In the words of high-profile equity analyst Craig Moffett, Charter Communications’ second-quarter results from its new SVOD-bundling strategy are “eye-popping.”

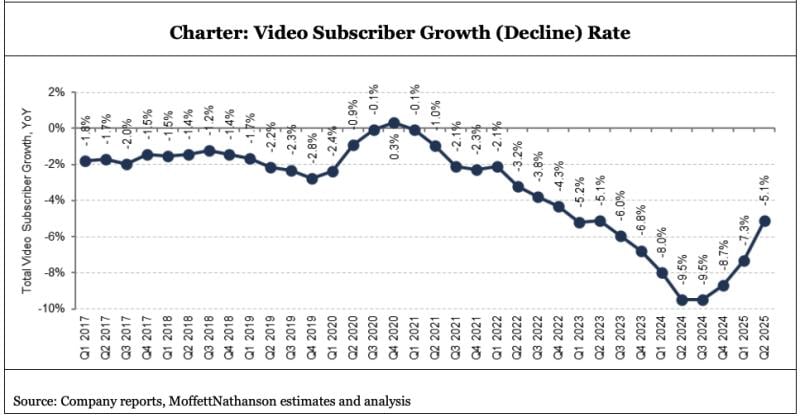

After losing 408,000 pay TV video customers in the three-month, second quarter period last year, Charter dropped just 80,000 pay TV subscribers in the most recent Q2. It was Charter’s best video customer performance quarter since 2021. Charter’s video customer numbers have been steadily improving since it began rolling out its streaming-centric strategy late last year, the result of refocused negotiations and carriage agreements with programmers.

The top U.S. pay TV provider started bundling ad-supported versions of popular subscription streaming services — Disney+, Hulu, HBO Max, Paramount+ and Peacock, among them — into its most popular programming tier, Spectrum Select. The soon-to-launch streaming version of ESPN will also be available at no additional customer charge on Spectrum Select, as will Fox’s new SVOD.

During Friday’s earnings call with equity analysts, Charter CEO Christopher Winfrey said the cable company is now delivering more than $100 worth of SVOD services to its video customers at no addition to their monthly bill.

Charter also started marketing video again in its primary service bundle, alongside high-speed internet and mobile.

Winfrey attributed the success of Charter’s reimagined video offering also to shifting the customer premises equipment to Xumo Stream Box, the OTT device platform jointly developed with Comcast.

Expanding the strategy further, Winfrey said Charter will begin “this month” marketing its partner studios’ streaming apps to “customers without traditional video packages, including broadband-onlys.”

Charter in the coming months will also launch a new online marketplace for video. “It’s a place where customers can discover, activate, migrate, upgrade and downgrade their streaming inclusion apps,” Winfrey said. “We'll also be a starting place for video-centric sales leads and a place to learn about and buy Spectrum TV video packages like TV Select and Stream and a-la-carte programmers' streaming applications.”

Notably, frequent Charter collaborator Comcast launched its StreamStore last week.

“Video has emerged as a significant opportunity” for Charter, analyst Moffett wrote, especially in the run-up to Charter’s proposed $34.5 billion merger with Cox Communications.

Unfortunately for the cable company, its core business, high-speed Internet, is still floundering. The 117,000 lost broadband customers in Q2 was a YoY improvement verses 149,000 lost in the year-ago quarter, but way above the 74,000 forecast by analysts.

That result spurred investors to crater Charter’s stock more than 18% Friday.