In the words of one prominent analyst, it’s no longer a question of if Dish-parent EchoStar will liquidate, but when.

The company’s biggest revenue drivers, pay TV units Dish Network satellite TV and the Sling TV virtual MVPD, lost a combined 289,000 subscribers in the second quarter, which accounted for 3.9% of the entire EchoStar pay TV customer base going into the three-month period.

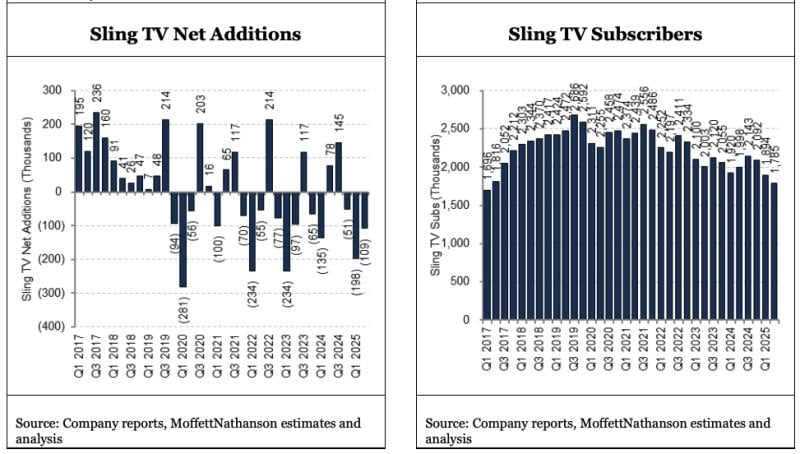

Losing 109,000 subscribers in the second quarter on its own, Sling TV’s base is now at 1.78 million — this is roughly where the seminal vMVPD stood eight years ago at the dawn of the virtual pay TV era.

Following the loss of 383,000 video customers in Q1, EchoStar had only 7.1 million remaining pay TV subscribers as of June 30. The telecom is raising its pay TV prices, but not enough to offset the steep 11.6% rate of customer declines — pay TV revenue slipped 8% in the second quarter to $2.5 billion.

The company needed the remains of linear pay TV’s day to underwrite the costly journey of building a nationwide 5G wireless network, and it’s now becoming abundantly clear that co-founder and chairman Charlie Ergen’s enterprise likely won’t get to the other side of the channel.

As equity analyst Craig Moffett noted, even though EchoStar’s capital spending declined by 15.6% in the second quarter to $293 million, its cash burn of $739 million was three times the expected amount of $245 million.

EchoStar entered earnings week by once again narrowly missing default on a debt payment. Then, the other show dropped, with the FCC reportedly pushing the company to sell some or all of its AWS-4 wireless spectrum. With this spectrum in short supply, and Dish failing to develop a network and a business that might use it, the government wants the spectrum freed up.

Friday’s earnings report only quickened the pace of EchoStar’s inevitable fate, Moffett wrote in a post-earnings report. “EchoStar’s quarterly results missed expectations on almost every important financial metric,” he added. “Revenues, EBITDA and free cash flow are all in free fall — and all badly missed consensus — and EchoStar’s leverage is now an absurd 15.6x EBITDA.”

In a Friday 10Q filing, EchoStar further highlighted its own peril: "We currently do not have the necessary cash on hand, projected future cash flows or committed financing to fund our obligations over the next twelve months, which raises substantial doubt about our ability to continue as a going concern,” the company stated.