Fox Corp. today, Thursday, launches Fox One, a new direct-to-consumer streaming service that’s meant to serve as a digital one-stop-shop for the company’s news, sports and entertainment programming - with a major emphasis on live content.

It features a full lineup of all Fox’s linear pay TV channels across news, sports, entertainment and local. Some of those include Fox Sports, FS1, FS2, Fox Deportes, the Big Ten Network, Fox Broadcast Network, Fox News and Fox Business, among others.

Ahead of the launch, Fox held press events to preview the product and hear more from leadership about the strategy and user features.

Attracting cord-cutters and cord-nevers, appetite for Fox content on social

Fox’s new streaming service brings together existing assets, leveraging earlier content investments in its main areas of news and sports, as well as entertainment, that until now had primarily stayed within the traditional pay TV ecosystem.

That model has suited Fox well and as such it hasn’t been as quick as other media companies to dive head first into direct-to-consumer streaming. And with Fox One it isn’t looking to cannibalize existing linear audiences but instead tap into cord-cutters and cord-nevers.

Fox previously had plans in the works to bring its linear sports channels outside of pay TV into a streaming offer through the Venu Sports joint venture with Disney and Warner Bros. Discovery, but that effort was dissolved in January after settling an antitrust lawsuit against the JV brought on by Fubo.

Now instead Fox is bringing together its own sports channels alongside the company’s news, entertainment and local broadcast channels on one platform in an effort to reach those outside of pay TV, where there’s an apparent appetite for Fox content, including news.

Pete Distad, the former head of defunct Venu Sports who joined as CEO of Fox One in February, echoed the cord-cutter, cord-never audience approach during the press briefing, saying that Fox news content generated over 1.5 billion video views on YouTube and 3.7 billion social video views in the last quarter alone.

“This demonstrates our extensive reach outside of linear television and really shows we’ve got this untapped audience that is viewing this content, and it’s ripe for a platform like Fox One,” said Distad, who also spent 10 years at Apple leading sports and video for Apple TV+ and was part of the Hulu launch team.

“We know there’s a growing audience outside of cable,” he continued, citing a stat of about roughly 65 million U.S. households that don’t have pay TV services and that Fox One could potentially reach. “And we need to give those cord cutters and cord-nevers access to our incredible content.”

Pricing, bundling with Fox Nation

At launch the Fox One streamer is offering a 7-day free trial and then charging $19.99 per month or $199.99 per year.

Those that already pay for Fox through a traditional pay TV subscription will be able to access Fox One at no extra cost through authenticated pay TV login credentials.

The company is also offering a bundle of Fox One and its Fox Nation streamer, priced at $24.99 per month or $239.88 per year (equating to $19.99 per month for an annual plan).

Within the Fox One app, users can also subscribe to separate services of Fox Nation and B1G+ individually.

And as previously announced, with sports in particular posing a major challenge for consumers amid the shift to streaming and related fragmentation, Fox is hoping to make the offering more robust by teaming up with Disney – not through Venu – but on a bundle.

Fox One and Disney’s flagship DTC ESPN product (also launching today) can be purchased as a bundle starting in October for $39.99 per month, together providing access to NFL, NBA, MLB, NHL, college football and basketball and the FIFA World Cup.

More bundles could be part of the picture for Fox One going forward.

“You’ll see us continue to explore other bundle opportunities where we feel the content offering is complementary to what we offer our customers today,” Distad said.

To mitigate against any potential password sharing, execs said Fox intends to restrict out-of-home concurrent streams to around three (they’re looking to offer unlimited in-home concurrent streams).

The Fox One product: All about live and AI-driven personalization

In sharing a preview of the product Fox’s Amit Dudakia, SVP & Head of Product, said the platform’s first principle is simple: “Live is the center of everything.”

Live content is front-and-center when users enter the Fox One app and Dudakia emphasized that the company is hyper-focused on low-latency streaming “to deliver breaking news, live events and primetime content when it happens.”

Fox already flexed some chops in that department with its successful live stream of the Super Bowl on Tubi this year.

While Fox One was built from the ground up, the company was able to utilize some technology built for the Venu Sports platform, as well as foundational tech used for Tubi, executives noted.

Another emphasis is a unified experience, where Fox built the platform to handle multiple subscriptions and to allow users to easily move between different types of content.

“Today people are tired of bouncing between apps or juggling logins,” Dudakia noted.

It’s also leaning on AI for user-driven personalization and content discovery and partnered with genAI company Perplexity for certain search features and summaries. After some light onboarding for new users, Dudakia said the experience becomes more personalized as viewers interact with the platform.

“When you open the app you’re not just seeing what’s live, you’re seeing what’s relevant for you based on your viewing habits,” he commented to reporters.

Distinct sports highlights feature

In the demo, the Fox One home page featured distinct tiles for Fox Sports, Fox News, Fox Nation, B1G+, and Tubi, for example.

On the main screen, the first thing surfaced is a carousel of live content based on what’s relevant to the viewer – including live games that can show the current score without clicking in (scores can be toggled off for those that might come late and want to catch up before seeing the live action).

It's also got sports-focused user features with on-screen options to rewatch full streams of a live game, see a condensed version (say around 5 minutes-worth of an hour-long game, for example), or catch up on just highlights.

And Fox One has a ‘Shorts’ mobile experience, which Dudakia described as its “engagement and discovery engine” which uses genAI to package and surface the biggest live sports moments alongside commentary and various takes on gameplay.

While sports highlights and catch ups aren’t unique to Fox One, Dudakia said it feels strongly about getting users into the live action as quickly as possible and believes the platform’s sports highlights feature stands out from others.

“Rather than having 20 to 30 different key plays, we’re actually taking the work out for the users and we are dynamically creating a new clip that captures all the most important moments that would have contributed to the story arc,” he explained.

Highlight catchups are always 90 seconds or less and give users the option to immediately jump into the live stream.

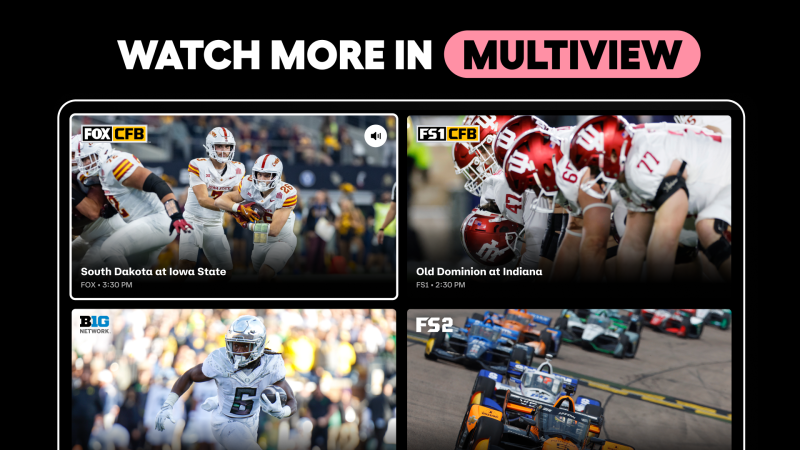

Editorially curated Multiview is also available for Fox One on select devices at launch.

Flexibility for recorded live content, built for multiple subscriptions

Flexibility around recording live content is another focus for Fox One, which offers unlimited DVR storage with a 9-month storage window.

Recorded content can be viewed in full, condensed versions, or via highlights. Users also have multiple options to record and can opt to schedule recordings of all NFL football games, for example, or only matchups from a specific team or league.

The platform’s UI features a “Latest for You” content rail based on personalized recommendations, including recorded content.

An “Upcoming” content carousel, meanwhile, helps users plan and know what events are coming up based on personalized suggestions and multiple options to record, as well as data overlays like displaying game odds for sporting events.

There are also curated hubs that allow users to go deeper – such as league-specific, that collocate not only live games but also playlists of news, analysis and commentary around that week’s match-up.

In addition, there is a row for content from other Fox subscriptions within the platform like a “Trending on Nation” rail featuring programming from the existing Fox Nation streamer. Part of that is future looking, as Dudakia said it’s “a platform that’s meant to house multiple subscriptions.”

“The idea around this was that we wanted to build a platform that can scale to house a content library that’s on the order of 1,000s but also be able to create a UI which can also be much more streamlined and focused on a live-first experience, such as B1G10+,” he explained.

Fox One also has a live guide that follows a traditional EPG style where users can browse programming up to 14 days in advance.

Finally, there is a “My Stuff” section that houses users’ latest DVR recordings, in-progress content to continue watching, and content from favorited shows, teams and leagues.

Fox One mobile experience leans into short form content

The Fox One mobile app, meanwhile, maintains a consistent user experience by mirroring the same information hierarchy as the CTV app but is leaning more into short form content given the consumer appetite on mobile devices.

“We recognize that the consumption trends are rapidly changing for users in terms of how they’re getting their news and their sports content or even their entertainment content. And we believe that at Fox, our content is ripe for short-form content,” Dudakia said regarding the Shorts experience on mobile.

Per the exec, Fox One runs all of its sports, news and entertainment content through “a video content intelligence layer” that clips and clusters content and then deploys it into an “explore” feed to allow users to get a playlist of trending moments.

So for example, if a user tapped on a sports athlete’s playlist, it would surface all analysis and news commentary from Fox around the athlete that week.

Another aspect Dudakia said Fox believes differentiates the product is that users can not only add those playlists to their library and share with others, but also go into a full-length playback of the related assets from the Shorts experience.

On the app users can also search and an AI engine will expose relevant upcoming games, previous matches, as well as clips or short form content – across Fox news, sports or entertainment. And if users want to go deeper, they can tap an icon to get an AI-generated summary from Perplexity, which according to Dudakia, allows Fox One to be very topical.

Podcasts part of the picture

Podcasts are also part of the offering on Fox One.

“We will have podcasts available at launch because we think podcasts…both audio and video podcasts are quite interesting for this audience, so it is an area where we’ll keep investing,” Distad said during the press briefing.

And more podcasts could be teed up in the future, including through Fox’s acquisition of Red Seat Ventures in February.

Per Distad, Fox is working with Red Seat “to identify specific video or audio podcasts that would make sense for the audience,” adding “it wouldn’t surprise me at all if you start to see some Red Seat Venture stuff.”

And while expressing excitement, the executive said Fox One is just getting started.

“We’ve been primarily focused on building the foundation so that we can quickly build on top of it. We have a very robust and aggressive roadmap that the team’s working on,” Distad commented.

Audience and uptake to be seen, taking a distributor-friendly approach

Fox CEO Lachlan Murdoch had previously stated modest subscriber figure expectations for Fox One of single-digit millions over the next few years.

During a Q&A with press when asked by a reporter about who the target audience is and subscriber expectations for Fox One as it seeks not to cannibalize pay TV, Distad said he’s optimistic and more aggressive so “hopefully quicker than that” in terms of subscriber uptake, but also candidly acknowledged it’s a bit of a wait and see for who signs up.

“We don’t know,” Distad said, regarding the ultimate customer base for Fox One. “We’ve got a bunch of hypotheses on what the overlap will be” with pay TV viewers, he noted, but it remains to be seen exactly where subscriber numbers will land.

Still, with notable news content views on platforms like YouTube he said the company knows “there’s an appetite out there for cord cutters and cord nevers for our news product.”

“We do know that there’s a customer base out there, and we don’t know how many” which is why the company is being modest about publicly stated subscriber expectations, he explained.

But for Fox, the focus is not necessarily to build up a massive subscriber base or to spend big on content for Fox One. Instead, it’s looking to leverage existing content assets and investments and deliver or extend them to an audience Fox believes it’s not yet reaching through pay TV.

“We’re mostly focused on profitability. And how do we build a business that’s sustainable, profitability, without feeling the need to say that we have 100 million subscribers or 75 million subscribers” Distad said of Fox One.

As for pay TV distributors that like to have those key Fox sports channels in their TV lineups, Distad believes the company is going to market with a fairly “distributor fair and friendly approach,” in part by not undercutting price and having a significant amount of differentiated programming.

He also thinks it’s taking a consumer-friendly approach, with the view that the sports experience hasn’t yet been solved for those not in the pay TV ecosystem and that there’s plenty of potential to keep evolving the Fox One product down the line.

Distad said his focus, “is making sure we’re building a customer experience that makes sense for the cord cutter and cord-never, but we’re also not doing it at the cost of pay TV.”

But for now, it’s all about the launch and features to come.

“I’m incredibly proud of the work the team here has done, it’s cross-functional at Fox to pull this together and I’m really looking forward to the evolution of the product,” Distad said.