Despite a recent flurry that’s seen Disney’s full-fledged DTC version of ESPN, aggregation play Fox One, Roku budget ad-free streamer Howdy and CNN All Access join the subscription fray, the growth of the U.S. paid streaming subscriptions continues to slow, according to research company Antenna’s latest quarterly “State of Subscriptions” report.

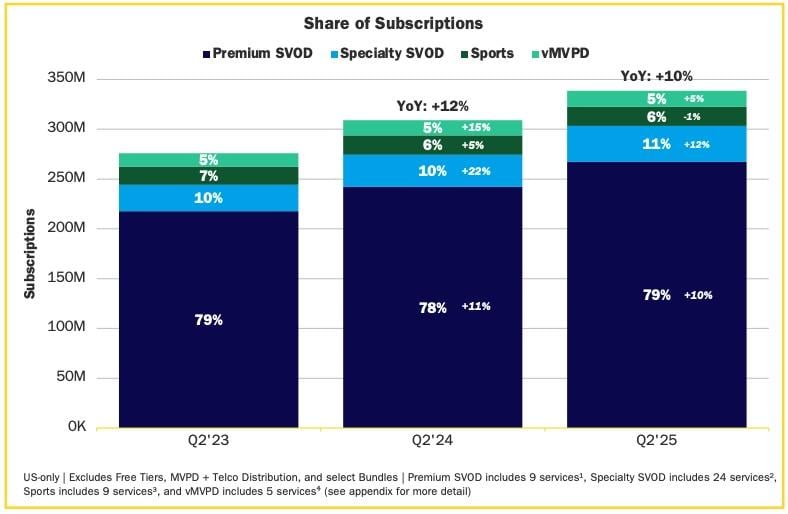

The impact of those recently launched services on streaming growth remains to be seen, but as for Q2, culling from a variety of sources, including consumer banking data, Antenna found that the subscriptions to paid streaming video services in the U.S. expanded by just 10% YoY in the second quarter, reaching 339 million customers. The rate of expansion was around 12% at the same point of 2024.

Notably, the subcategory known as “specialty SVOD” — a lower-priced niche grouping of paid services containing British content services like Acorn TV, the anime focused Crunchyroll and the horror-fixated Shudder—had been expanding at a 22% clip a year ago. But its growth rate decelerated to just 12% in Q2. Antenna’s report noted that while the growth remains strong, the slowing growth signals a maturation of the category.

The number of new consumers signing up for “non-premium” streaming services for the first time is also decelerating, Antenna noted. In the second quarter, 3.2 million users signed up for specialty SVODs, sports-oriented services and virtual MVPDs. That was down from 3.4 million in Q2 2024.

The non-premium grouping saw combined growth in the U.S. of 6% last year to 89 million subscribers, Antenna said.

Meanwhile, the sub-grouping of paid sports streamers — everything from ESPN+ to NBA League Pass to NFL Sunday Ticket — is now in narrow recession, declining 1% YoY in Q2.

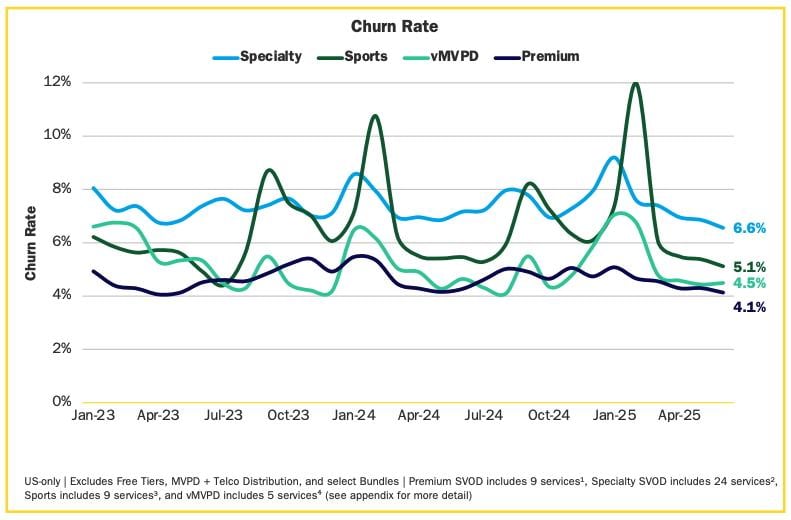

More happily, churn rates appear to be down across the board. Sports services remain driven by the cyclical nature of the NFL season, with levels spiking right after the campaign ends in early February. But after surpassing 8% in early 2024, churn for specialty SVOD dropped to 6.6%. Premium SVOD, which flirted with 6% churn not too long ago, was down to 4.1% in the second quarter, Antenna reports.

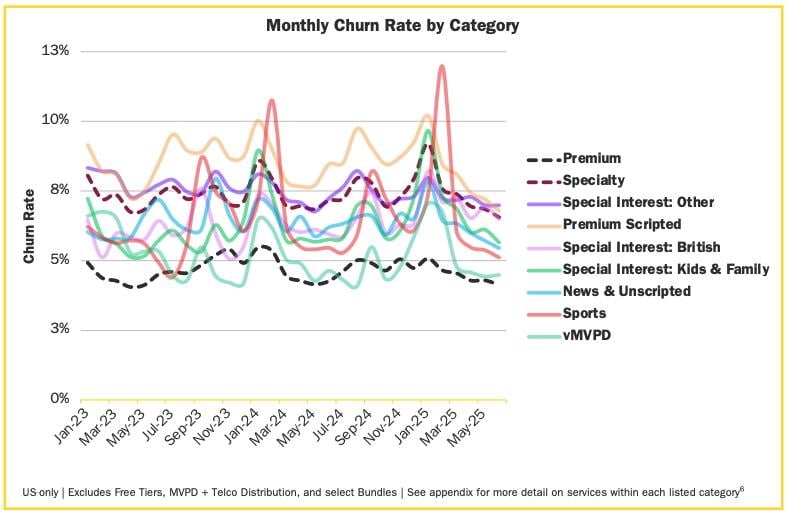

Getting even more granular on the issue of churn, it’s notable that “kids and family,” “news and unscripted” and “British” have lower churn rates than the rest of the broader specialty SVOD category.

“One might call this a moment of ‘un-consolidation’ in the media industry,” the Antenna report stated. “The launch of at least four significant streaming services: ESPN DTC, Fox One, CNN All Access, and Roku’s Howdy … demonstrates the sophistication and diversity of tastes among American subscribers. That broad range of preferences also supports the continued rise of specialty SVOD, which continues to outpace premium SVOD growth.”