Disney is raising the price of its ad-free Disney+ and Hulu plans in the U.S., as it looks to drive uptake of its ad-supported plans.

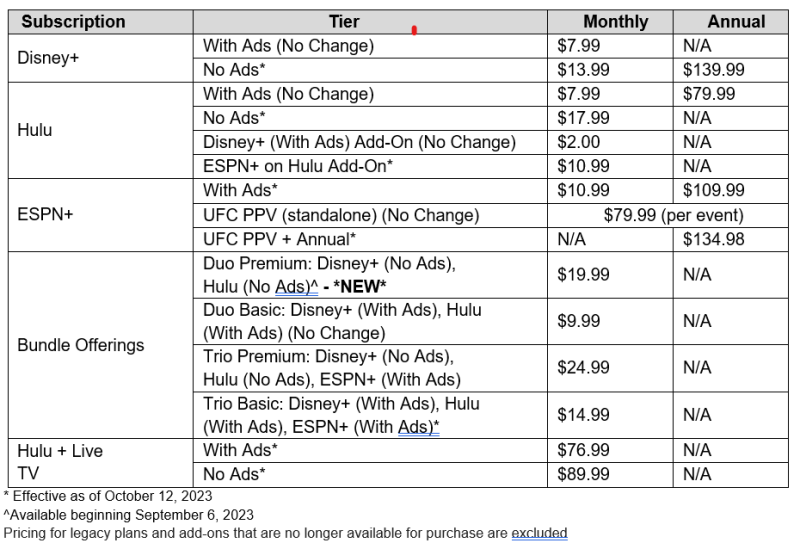

The move raises the price of ad-free Disney+ by $3 per month to $13.99 per month. It follows an earlier increase in December that coincided with the launch of the ad-supported tier of Disney+. The price of Hulu SVOD without ads is also going up by $3 to $17.99 per month. Disney is also raising prices on certain bundles and Hulu + Live TV. Pricing changes in the U.S. start October 12.

They come alongside plans to introduce of a new higher-priced ad-free Hulu and Disney+ bundle, launching in the U.S. September 6 for $19.99 per month. Prices for standalone Hulu and ad-supported Disney+ in the U.S. will remain the same.

Here's a breakdown of the new prices and plans:

In addition to domestic price changes, a Disney+ ad-supported tier will rollout in Canada and select European markets November 1, starting at £4.99/€5.99 month in EMEA and $7.99 per month in Canada. Already this year the company increased Disney+ prices in nearly 50 countries.

Disney announced prices changes as it released fiscal year 2023 third quarter earnings Wednesday, where the media company slashed streaming losses but saw some domestic subscriber declines. Disney reported losing 300,000 domestic (U.S./Canada) Disney+ subscribers in the three-month period, leaving its home market base at 46 million. It’s the same number it lost in the first three months of calendar 2023. Disney+ added 1.1 million international subscribers, increasing 2% over last quarter to 59.7 million. The total core Disney+ base (which excludes Hotstar subscribers in India) stands around 105.7 million. As for Disney+ Hotstar subscribers, Disney lost a whopping 12.5 million since the prior quarter, ending June with 40.4 million subscribers, down 24% from what it had as of April 1.

Disney expects core Disney+ subscribers to rebound to growth next quarter both domestically and internationally.

Hulu, meanwhile, added 300,000 subscribers for its SVOD-only service for a total of 44 million, while the virtual MVPD Hulu + Live TV lost 100,000 subscribers for a total base of 4.3 million. ESPN stayed relatively flat, ticking down by 100,000, for a base of 25.2 million.

In Disney’s fiscal year 2023 third quarter, direct-to-consumer revenue climbed 9% to $5.5 billion. Its streaming businesses recorded a $500 million operating loss, marking an approximately $150 million improvement compared to the previous quarter and $550 million improvement from the $1.5 billion loss a year ago. Disney is targeting profitability for its direct-to-consumer streaming businesses by the end of fiscal year 2024.

Disney reported higher average revenue per user (ARPU) for both domestic Disney+, which rose to $7.31, and Hulu SVOD, which rose to $12.39 – both thanks to higher per-subscriber advertising revenue.

On Wednesday’s earnings call Disney CEO Robert Iger said the company is very optimistic on the long-term advertising opportunity for streaming and acknowledged the price hike is intended to encourage subscribers to opt for the plan with ads.

“The advertising marketplace for streaming is picking up, it’s more healthy than the advertising marketplace for linear television,” Iger said. “We believe in the future of advertising on our streaming platforms, both Disney Plus and Hulu, and we’re obviously trying with our pricing strategy to migrate more subs to the advertiser supported tier.”

Asked by investment analysts whether Disney thinks it can hold its customer base as it raises prices, Iger pointed to the December increases, after which he noted there wasn’t significant churn or loss of subscribers as a result. He also noted a substantial percentage of new subs signing up for the ad-supported tier, suggesting it’s at a good price point, and won’t be changing.

As of the end of the quarter Disney has had 3.3 million subscribers sign up for its ad-supported Disney+ option, Iger said. And since launching last December, 40% of new Disney+ subscribers are choosing and ad-supported product.

“We grew this business really fast. Really before we even understood what our pricing strategy should be or could be,” he said, adding that only in the last six months has Disney gotten at a pricing strategy aimed an allowing it to improve financials and ultimately turn streaming into a growth business and as part of that grow subscribers.

Password sharing crackdown a priority for 2024

Disney is also actively exploring how to address account sharing, Iger said.

It plans to update subscriber agreements later this year with additional terms and sharing policies, and the chief executive citing password sharing as a priority issue to tackle in calendar year 2024, though acknowledged the work may not completed in that timeframe. He didn’t give a specific number of how many users are sharing accounts “except to say that it’s significant,” while noting the company already has the technical capability to monitor much of that activity.

What’s unknown is how many existing password sharers will be converted to paid subscribers, with management declining to speculate, though expecting some conversions.

Netflix has been the most notable streamer to take aim at password sharing, with a crackdown and paid sharing effort that rolled out in the U.S. in Q2. Analysts previously noted that Netflix’s extra member charge for paid sharing and plan price strategy was also designed to drive more subscribers to its ad-supported plan option.

As for Disney, while the company reported growth in DTC revenue, its linear networks saw declines, where quarterly revenue dropped 7% year over year to $6.69 billion. Content sales and licensing were down 1% to $2.1 billion. However its parks and experiences business saw revenue climb 13% year over year to $8.3 billion. Total revenues reached $22.3 billion, up 4% year over year.