People are getting more out of their Smart TVs than just TV as the technology becomes more widely adopted and its features more commonly understood, according to new insights from Hub Entertainment Research.

In recent years, big players have continued to invest in non-TV capabilities — from Amazon creating an Ambient Experience on in-house-built smart TVs offering curated art collections and customizable widgets for calendars and sticky notes to Vizio's Viziogram, letting users share photos and videos from its mobile app directly to its smart TVs. Roku even launched a Smart TV-connected home security system.

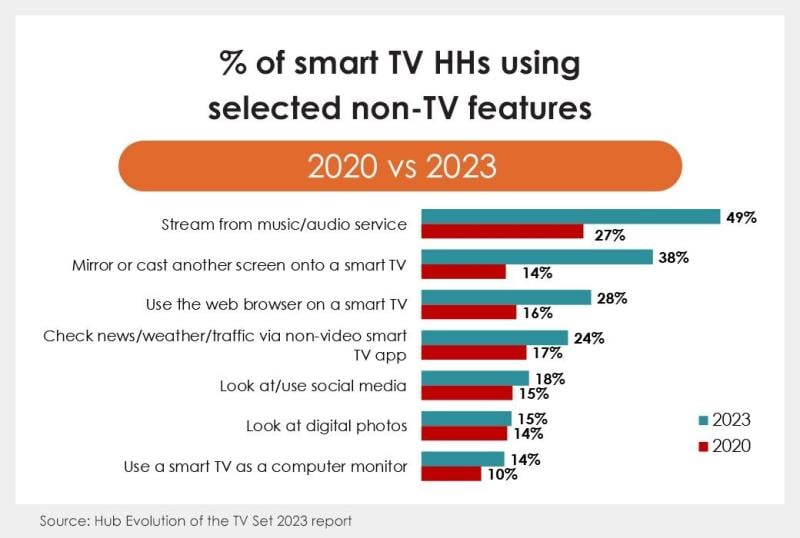

Hub Entertainment Research has been tracking entertainment behaviors and interests for the last decade, and its most recent report, “Evolution of the TV Set 2023,” revealed that while most people don’t yet think of security systems when it comes to their TV, people are embracing non-TV uses. Since 2020 the use of smart TVs for non-TV features rose from 63% to 77%, according to the report. The top non-TV features used were for streaming music and audio, rising from 27% to 49%, and casting another screen onto a TV — which nearly tripled from 14% to 38%.

Even the non-TV uses that had less usage — including web browsing, checking the news, browsing social media, looking at photos, and using it as a computer monitor — all individually grew from 2020 to 2023 (an average of 5.4%).

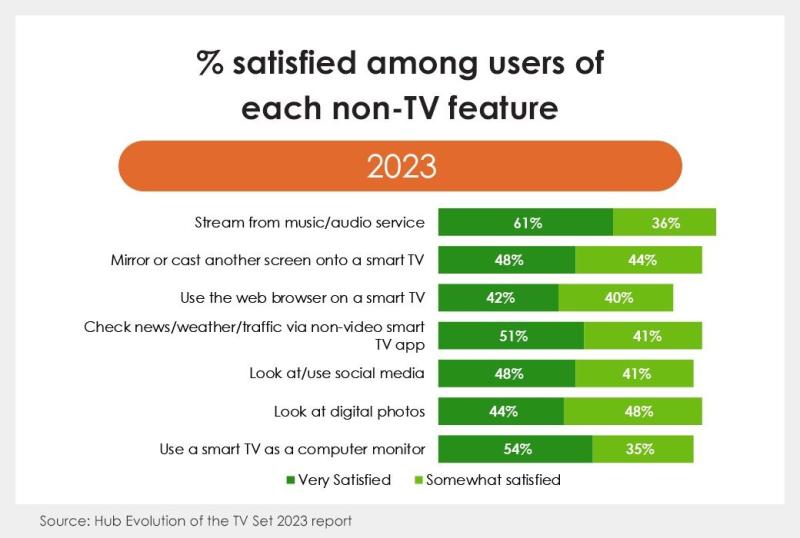

Additionally, the report found that over 80% of users of each non-TV feature were either very or somewhat satisfied with its performance. The firm sees this increasing awareness and majority satisfaction presenting the possibility that smart TVs may become the “hub” of home technology.

Hub Entertainment senior consultant and author of the report David Tice told StreamTV Insider that Smart TVs' particular growth shows long-term promise as a technological focal point in the home — where, for a while, Tice’s team observed a smart speaker craze.

“Tablets grew very rapidly, and the people who had them loved him. But then they got to 40% of homes, and that's sort of where they've stayed for the last 10 years,” he said. Smart speakers are showing a similar burn-bright-fade-fast trajectory. Hub Entertainment’s report shows that a spike found between 2019 and 2021 in users linking smart speakers to their smart TVs (19% to 35%) is steadily plateauing (33% in 2022 and 30% in 2023). It found the same pattern in smart speaker ownership, though by smaller margins.

Tice likens the growth of Smart TVs to that of cell phones, “for better or worse,” which are now used for everything. And part of the “worse” means software-dependent lifespans. “At some point, they don't get supported and so you have to get a new set just because of software issues [more] than anything else.”

Because the future of smart TVs is software-centric, he believes that smaller players — and even more sizable ones like Vizio — that use their own software and aren’t tapped into larger ecosystems of connected devices will need to evaluate: “How long can they last” against giants like Roku, Amazon and Apple, and “does it make sense when the purpose of these [smart TVs] is to make money via advertising and tracking, viewing and using that data?”

From Tice’s point of view these smaller players may want to “join up” with companies who can tap into wider pools of people, especially when consumers often push for consolidation.

“That's why we ended up with TVs that had VCRs and DVDs, right? Because people don't want the extra box sitting around,” he commented