Fox’s Tubi made its debut on Nielsen’s The Gauge snapshot, reaching the 1% threshold for total TV viewing time in February to break out of the “other” streaming category and make it the most-watched free ad-supported streaming TV (FAST) service last month.

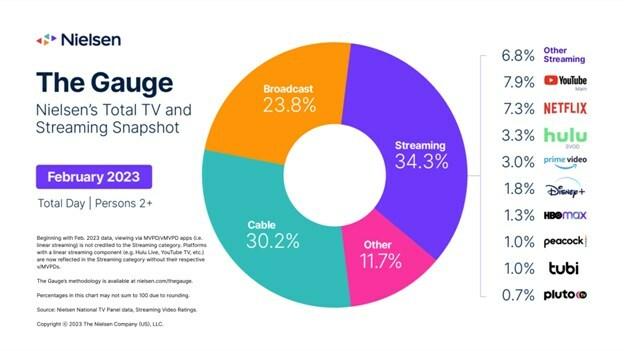

Tubi hit the 1% threshold as overall time spent watching TV declined 5.1% from January to February, which Nielsen said was in line with a year ago and typical seasonality trends. Streaming felt the least impact, with TV time in the category declining less than 1% from the month prior. Viewing on cable declined 5.7% while broadcast was down 9.2% from January.

With less impact, streaming was the only category to show any growth, increasing 1.5 percentage points to capture a 34.3% share of TV viewing time. This month Nielsen is no longer including results from virtual MVPDs such as YouTube TV or Hulu with Live TV in the streaming category, instead counting them for cable.

While Tubi broke out of the “other streaming” category this month, Pluto has the distinction of being the first FAST to do so last September. Still, Fox’s Tubi outpaced Pluto for viewing time in February, with the latter snagging a 0.7% share. NBCUniversal’s Peacock in December also reached the 1% mark, a percentage it maintained in February – although the service recently dropped its free tier. Earlier this year Tubi reached 64 million active monthly users, up from the 25 million it had when Fox purchased it roughly three years ago.

“Reaching 1% of total viewing minutes is a huge milestone for us because it validates we are driving massive viewership and our data-informed personalization and recommendations get the right content in front of the right people," said Mark Rotblat, Chief Revenue Officer at Tubi, in a statement.

Rotblat also pointed to the advertising experience as ready to handle shifting ad dollars.

"Advertisers can feel confident that our light ad loads, addressability and tools for cross-screen planning and measurement are built with their success in mind and they can shift a significant portion of their video investment dollars to a 100% addressable audience on Tubi," Rotblat continued.

In a study earlier this year Tubi found less than 1 in 5 viewers were unsatisfied with the length of ad breaks on Tubi’s platform, but still prefer lighter ad loads compared to traditional TV. Tubi cited 6 minutes or less of ads per hour as a target, a length that the study found less than 17% of the FAST platform’s users are dissatisfied with.

In 2022 Tubi’s total viewing time on its own platform was up 44% over the year before, with users streaming more than 5 billion hours over the year. Ad revenue for Tubi in the December quarter also continued to climb, growing 25% year over year.

Alongside increased viewership and ad revenue, Tubi has continued to build out its content slate, including a recent deal with Warner Bros. Discovery that added 14 linear FAST channels and over 2,000 hours of on-demand content.