Not the majestic mountains of Colorado, or the rivers, railroads, highways, and county lines that have been shaped by continental splits. The “Great Divide” we’re discussing here is the chasm that is changing the future of streaming video.

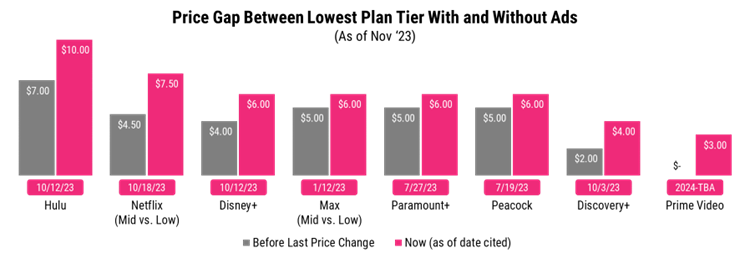

The landscape shift is occurring fast and furious as platforms lean into advertising-supported plan tiers to increase average revenue per membership (ARM), offset mounting programming costs, and deliver a profit to Wall Street. Indeed, Netflix, Disney, Warner Bros. Discovery, Paramount, Peacock, and Amazon are all widening the price gap between ad-supported and ad-free Subscription Video-On-Demand (SVOD) plans. As a result, viewers who want an ad-free experience must now spend an average of $6 more per month for each SVOD service. That’s an increase of 49% compared to just a few months ago. As such, consumers are being faced with the choice to pay more, cancel, or watch advertisements.

Why now?

Interest rates are high, consumer debt is mounting, and student loan repayment is returning. The average selling price for general merchandise products is up 26%, and food and beverage prices are 32% higher, compared to what U.S. consumers were paying pre-pandemic. Simply put, consumers are paying quite a lot more for everything, so why should TV be different? In Circana’s latest wave of research, The TV Switching Study, consumers reported a significantly greater propensity to cancel SVOD services because the cost was too high. This isn’t very surprising given the macro-economic factors highlighted above. High costs are now driving almost one-quarter (24%) of cancellations among the top 10 SVOD services and even more (27%) among targeted SVOD services. Price sensitivity is one of numerous challenges the industry is wrestling to the ground. The best tool to fight this battle is the (re)introduction of advertising to our TV viewing experience.

So far, it’s working.

Let’s take Netflix as an example. The company just reported that ad plan membership is up almost 70% quarter-over-quarter, and 30% of sign-ups in countries where ad-supported is available are, on average, to the ads plan. Notably, Circana research shows that over one-quarter (27%) of new subscribers on that ad-tier attribute sign-up to the plan being affordable. That’s a 13-percentage point increase over what subscribers reported just six months ago. And Netflix is not alone: the new Disney+ ad-tier demonstrates similar results. Given these developments, it’s unsurprising that Amazon announced Prime Video will contain ads next year, unless you are willing to pay $3 more per month to keep the premium ad-free offering.

It’s safe to say the bifurcation between basic and premium SVOD offerings will continue to grow. Further, advertising inclusion is merely one delineation to expect between tiers. We’re waiting on more programming distinctions, such as sports availability, which is expected to be positioned as an additional monthly fee.

But wait, there’s more.

Maybe you’ve noticed that everyone wants to offer you an SVOD bundle these days. With domestic subscriber growth plateauing for many services, customer acquisition has become more challenging and more expensive. Mature businesses need mature product strategies and that’s where pricing and packaging comes into play. In this case, the bundle.

Sounding familiar, and maybe even retro? While tiered offerings give consumers options, they don’t keep them from breaking up with their TV provider and cancelling the month after the series they signed up for ends. So here we are, back in the 1980s when cable TV channel bundles offered the consumer a way to save money and get mountains of programming. This is indeed the definition of opportunity and risk. That is, the opportunity to reduce subscriber acquisition cost and minimize churn – and the risk of over-bundling and recreating the cable TV environment that resulted in consumers feeling forced to pay for programming they didn’t want.

As of right now, most consumers see SVOD bundles as positive. More than half (51%) of those who bundle say it’s a good way to save money. Now think for a minute about the inflationary environment and you’ll quickly see the importance of this consumer messaging. Then there’s the fact that more than half (52%) of those who bundle want even more customizable bundles available. Don’t gloss over the detail there: customizable. The business opportunity is sizable, can reduce churn, and deliver consumers cost savings.

Avoid the pitfalls of the past.

There is a massive opportunity for streaming video providers to establish long-term meaningful customer relationships with subscribers who want their programming and need expense relief. Doing so in a manner that retains customization is key. Likewise, the streaming video advertising market is poised to ramp up as subscribers migrate onto more affordable, ad-supported tiers. Brands should be thinking about how to take advantage of this now before its proliferation drives up CPMs. Today’s TV business environment is like a trek through Colorado’s Great Divide. While the path can get treacherous, now is the time to set your sights on the summit.

John Buffone is a vice president and industry advisor at Circana (formerly The NPD Group). With over 20 years of experience in the consumer research and entertainment industries, John has advised many of the largest media and consumer technology brands in the industry.

He offers his industry expertise on trends that focus on how connected devices are rapidly changing the way consumers use technology at home and on the go. His research focuses on the confluence of digital content distribution and consumer electronics trends.

Industry Voices are opinion columns written by outside contributors—often industry experts or analysts—who are invited to the conversation by StreamTV Insider staff. They do not represent the opinions of StreamTV Insider.