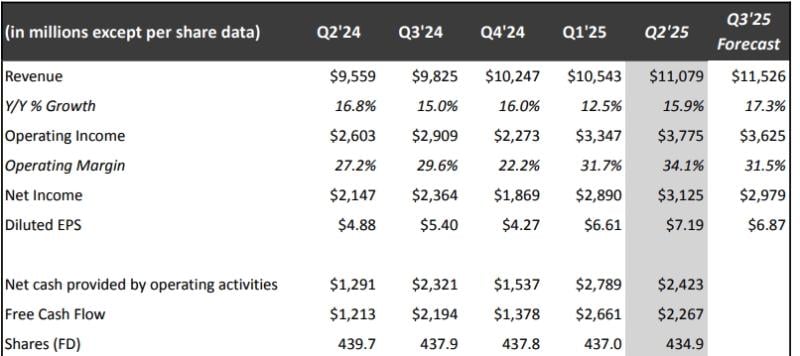

Netflix once again outpaced consensus forecasts, delivering 15.9% revenue growth to reach $11.08 billion in the second quarter, while growing net income by 45% year-over-year to $3.13 billion.

With the better-than-expected revenue, Netflix updated its full-year revenue forecast, expecting revenue to come in between $44.8 billion - $45.2 billion — up from a range of $43.5 billion - $44.5 billion. (Here’s Netflix’s Q2 shareholder letter.)

But while equity analysts were treated to another big revenue quarter, it’s what could be down the road for Netflix that was perhaps more interesting to them.

Three weeks ago, Wells Fargo analyst Steven Cahall suggested that Netflix could further fuel its revenue growth by transitioning more YouTube creators to subscription streaming. And during Thursday’s earnings call with Netflix, Cahall asked Netflix’s co-CEO’s if they saw an opportunity in shifting these creators over exclusively.

“We want to be in business with the best creatives on the planet, regardless of where they come from,” responded Netflix Co-CEO Ted Sarandos. “Some of them are here in Hollywood, others are in Korea, some are in India and some are creators distribute only on social media platforms and most of them have not yet been discovered. So for those creators doing great work, we have phenomenal distribution, desirable monetization, brilliant discovery in our UI and a hungry audience waiting to be entertained.

“I think I listened to you on a broadcast where you talked about our business model, I believe, on this very topic. And we largely agree with you and believe that working with a wide set of content creators makes a lot of sense for us, Sarandos added.

And while he acknowledged the analyst’s earlier comments that not everything on YouTube will be a fit for Netflix, which Sarandos said “we couldn’t agree with that more,” the co-CEO said there are some creators on YouTube “that are a great fit.”

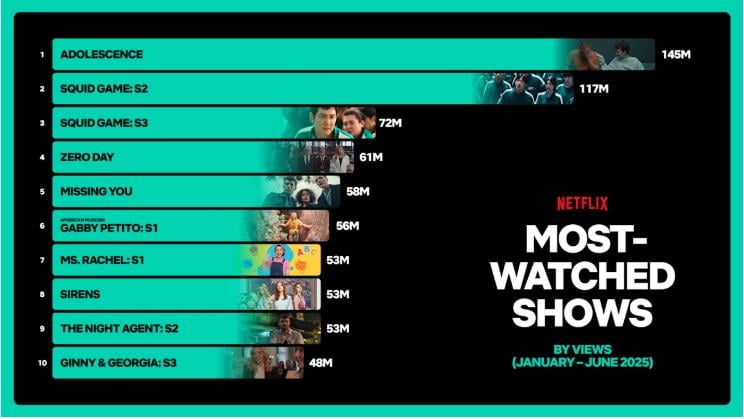

For those in that category, Sarandos cited the example of child educator Ms. Rachel, a YouTuber whose Netflix series generated 53 million views in the first half of 2025. (More on Netflix’s just released first-half-of-the-year viewing report further down.)

Sarandos also cited musical group Sideman and reality-romance-themed Pop the Balloon or Find Love as other YouTube creators who have already played well on Netflix.

For his part, Cahall sees the addition of shorts as a third leg to a growth triangle, alongside ads and live events, that will propel Netflix to a $1 trillion market capitalization by 2030. “Some of the bigger creators on YouTube have high production value content with huge, built-in audiences. Their annual viewing hours rival big Netflix originals,” the analyst said.

Meanwhile, released simultaneously with its Q2 earnings report, Netflix published its biannual “What We Watched” report on program viewing for the first half of 2025. UK-produced limited-series drama Adolescence, nominated for 13 Emmys earlier this week, was the most watched series on the platform, amassing 145 million views in the first six months of the year. With Seasons 2 and 3 of Korean hit Squid Game ranking second and third, the top three most watched shows on the platform were all produced overseas.

Meanwhile, comedy-spy-actioner Back in Action starring Cameron Diaz and Jamie Foxx was the No. 1 movie, amassing 165 million views.

Netflix also noted that nearly half of viewing on the platform from January through June was generated by titles that debuted in 2023 or earlier, with shows like Orange Is the New Black, Ozark and Money Heist each generating more than 100 million hours of watching.

Overall, viewing hours were up just 1% YoY, a fact that one analyst noted, represents a per-member viewing decrease, given that Netflix has significantly grown its subscriber base over the past year. (Netflix no longer divulges its subscriber metrics, but the company said it kept growing members in Q2.)

Greg Peters, the other half of Netflix’s CEO tandem, attributed the shortfall to the residual effects of weening off non-paying account sharers. He said a better metric is usage per paid household.

Sarandos, meanwhile, pointed to what he feels is a particularly strong slate for Netflix in the second half of 2025, with Season 2 of Wednesday and the Stranger Things finale highlighting series debuts, Adam Sandler’s Happy Gilmore 2, Kathryn Bigelow’s A House of Dynamite and Guillermo del Toro’s Frankenstein leading film releases, and the Canelo-Crawford boxing match among a number of anticipated live events.

Speaking of live events, while live-streamed programs including the twin Christmas Day NFL games on Netflix typically don’t show up in the top 10 of the platform’s “What We Watched” viewing reports, Sarandos noted they have an “outsized impact” on things like viewer retention and cultural influence.