With the start of the NFL regular season a little more than three weeks away, the U.S. subscription streaming business is about to embark on what has traditionally been a bit of a roller coaster ride with consumers signing up to watch the games live, then quitting services in the early spring when the season ends.

According to new research from Samsung Ads, 65% of signups for top subscription streaming services that showcase live NFL games end up churning at the end of the season, a rate that’s twice that of users who enlist before the season.

Samsung Ads also said that by March, a month after the Super Bowl, affected streaming apps drop 33% of their audience and see a 59% decline in platform usage.

So which services are impacted?

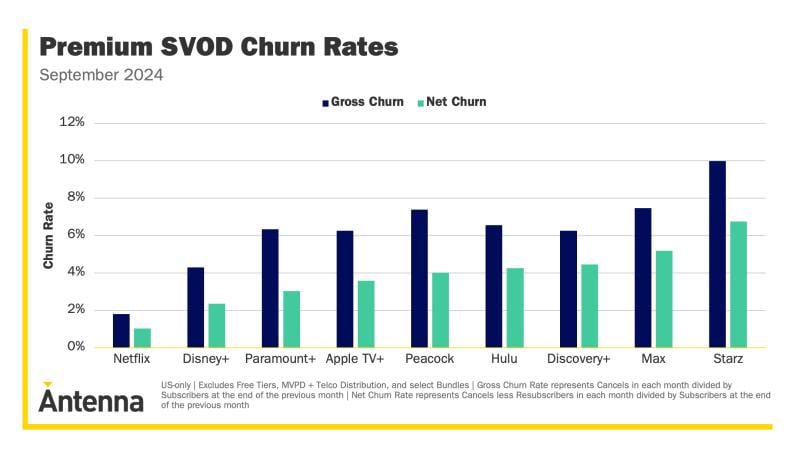

Samsung Ads, which measures consumer viewing habits with its massive network of smart TVs, cites these trends among what it describes as “the top three streaming apps that offered NFL games.” That presents a bit of confusion, since Samsung wouldn’t specify which apps it was talking about. The “top” subscription streaming service of them all, Netflix, now presents two live NFL regular-season games on Christmas Day, but it’s known to consistently enjoy industry-low churn amid a huge, global, diversified user base.

Likewise, the also-massive Amazon Prime Video, which now hosts the NFL’s Thursday Night Football games package, offers video in a diffuse member value proposition that also carries the very heavy weight of free shipping on goods.

Other research sources have corroborated that Paramount+ and Peacock — each tied to NFL-contracted broadcast networks — have some of the highest overall churn in the streaming business.

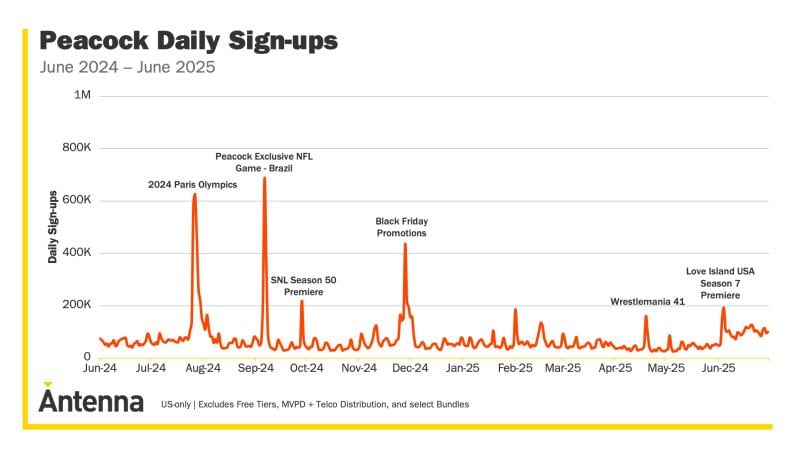

Research company Antenna also reveals that NFL live events can drive big signup spikes for subscription services, including an exclusive game last year on Peacock.

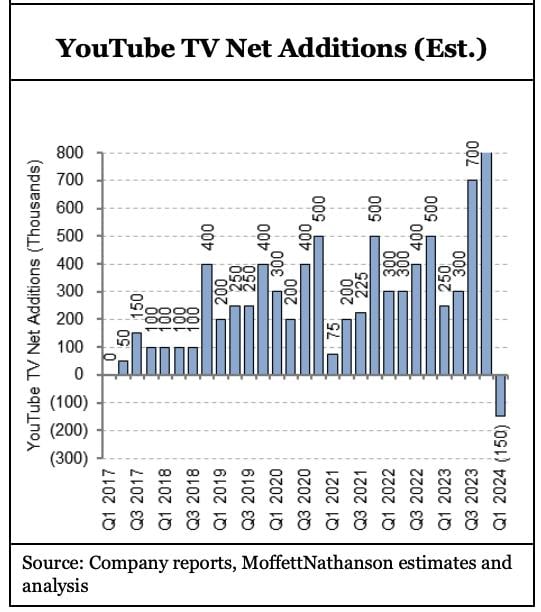

Meanwhile, as equity research company MoffettNathanson reveals, virtual pay TV providers heavily invested in sports, notably YouTube TV, also see big subscriber growth-trend shifts right around the first quarter, when football season finally ends.

For its part, Samsung Ads stresses the need for affected platforms to find some way to engage these more single-minded viewers. The more engaged with the platform overall they are, the more likely they are to stick around. Samsung found that users who didn’t churn from these services spent an average of 2.9x more time engaging with the platform.

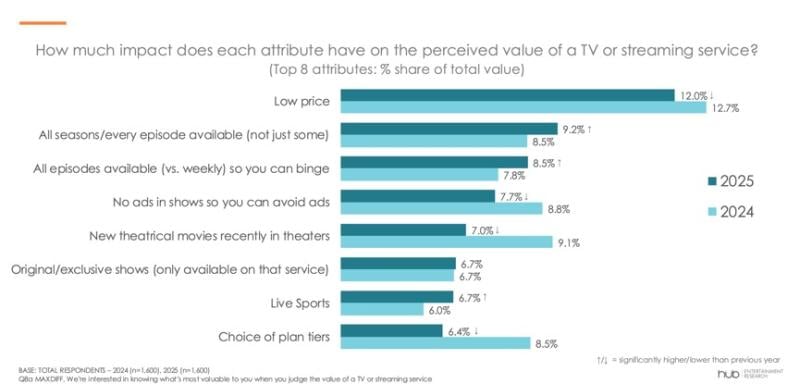

Another data firm, Hub Entertainment Research, discovered another possible customer retention formula — one tied to basic economic theory. Find a way to moderate pricing. Hub’s most recent survey of 1,600 U.S. consumers found that “low price” is the No. 1 factor in determining the perceived value for a streaming service.