Streaming services that serve a special interest or particular genre like anime may have fewer subscribers overall, but Crunchyroll and Funimation are among the most likely to be considered “must-have” services by fans, according to new survey by Hub Entertainment Research.

In a study exploring use of different entertainment services (across 10 different categories including traditional and streaming TV, gaming, music, podcasts and more) Crunchyroll and Funimation ranked alongside heavy hitters like Netflix for those users say their household couldn’t do without.

Across categories, the average household uses 12.5 different sources of entertainment, but only half, or about 6.2 are viewed as have-to-have, according to the Hub.

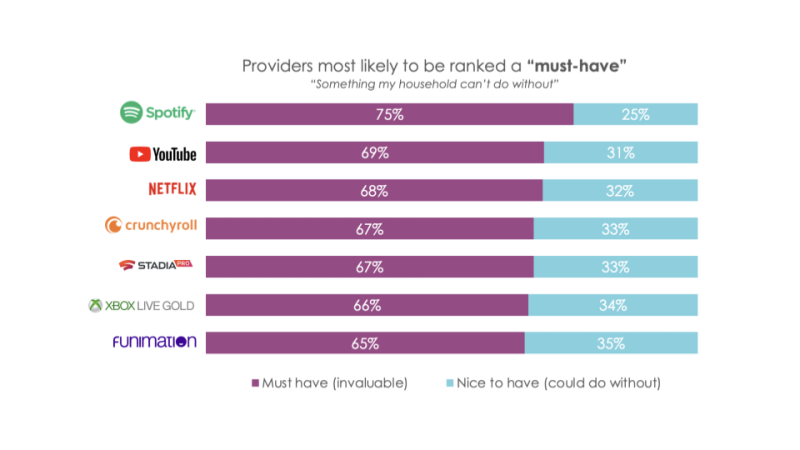

For Crunchyroll, 67% of users rank the platform as “must-have”, while 33% consider it a “nice to have” – 65% put Funimation in the must-have category, while 35% said while they’d miss it, they could do without.

The report concluded that more niche services like anime, where’s there’s no easy substitute for content, are more resilient.

“It’s exciting to see the loyalty that special interest or niche platforms engender,” said Mike Durange, senior consultant to Hub, also an author of the study. “While they don’t reach as many people as broader offerings, by providing something there’s no simple substitute for, they’re perceived as invaluable to their users.”

Despite losing subscribers in the first quarter, the survey found Netflix is still a must have by 68% - the highest of any premium video platform. On par with the streaming giant was YouTube, with 69% pegging it as a must-have. Faring even better than any video platform was Spotify, which only had 25% say it’s something their household could do without. Also in the top seven “must-haves” were Stadia (67%) and Xbox Live Gold (66%). Interestingly, less than half (45%) said Amazon Prime Video was on their need to have list, but that percentage increased to 64% when Prime Gaming and Amazon Music were also bundled.

Hub’s inaugural “Battle Royale” study surveyed 3,014 U.S. consumers age 16-74, with data collected in March.

As for anime’s Crunchyroll and Funimation, the services are coming together since Sony purchased Crunchyroll from AT&T for $ 1.17 billion in a deal that closed August 2021. At the time, Crunchyroll had passed a 5 million subscriber and 120 million registered user milestone.

After announcing in March that Funimation would unify under the Crunchyroll brand it’s been adding content and this week released a list of the latest Funimation titles coming the service in May including “Interviews with Monster Girls,” “Junji Ito Collection,” “Tsugumomo,” and “Tsukigakirei”.

In a crowded world of streaming services (and one Crunchyroll viewers subscribe to twice as many as non-anime viewers at an average of seven versus 3.5 according to research firm Interpret), consolidating with Funimation could take at least one subscription out of the equation.

“Crunchyroll likely expects to convert fans who previously paid for Funimation but watched Crunchyroll ad-supported into Crunchyroll subscribers,” wrote Interpret in an April blog. “The consolidation of the two services also exponentially increases the value proposition for Crunchyroll without seeing an accompanying price hike.”

In other recent Crunchyroll news, the leading anime subscription streaming service in April said it will tap Google as a strategic technology partner to help drive global growth. The multi-year partnership covers multiple facets, including CDN in the future, as the relationship kicks of long-term platform planning for Crunchyroll. Among those include advertising tools, supporting the services continued ad-supported service with more than 1,000 episodes available to sample.