The start of the NFL and college football seasons is always a volatile period for the American video business. And if anything this fall, we’ve seen that disruption accentuated, with both Disney/ESPN and Fox launching direct-to-consumer services that take the games over the top and out of the pay TV ecosystem.

We’ll know a lot more about the launch performances of these two major streaming services in October, when the major media companies report third-quarter earnings. For now, research company Antenna collected some signup data on covering the first 10 days after launch of Fox One and ESPN Ultimate.

The top line: Measuring transactions like credit-card purchases, Antenna detected approximately 1 million signups to either ESPN or Fox One from August 21-31. Importantly, these are mostly new signups and don’t include existing pay TV activations.

In a blog post highlighting its findings, Antenna concedes the data collection period was a bit early, with many enlistments to both services coming in the ensuing few weeks as gridiron action got underway in earnest.

But there are some learnings here worth paying attention to.

As expected, the Disney Bundle remains a highly effective sales driver for whatever Disney puts into it. Four of five enlistments for ESPN Ultimate came when it was combined with Disney+ and Hulu.

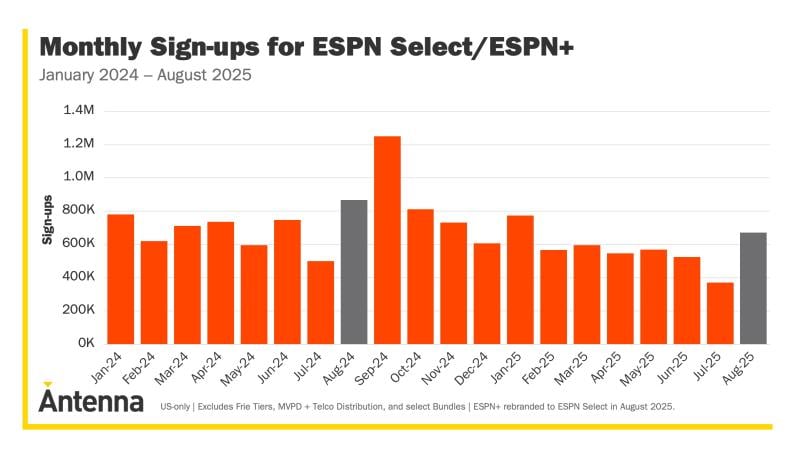

This next factoid, however, is more of a surprise: It was generally assumed that signups for the leaned-out, game-bereft version of streaming ESPN, formerly known as ESPN+ and rebranded as ESPN Select, would fall off a cliff. But Antenna found sign-ups off only 25% YoY.

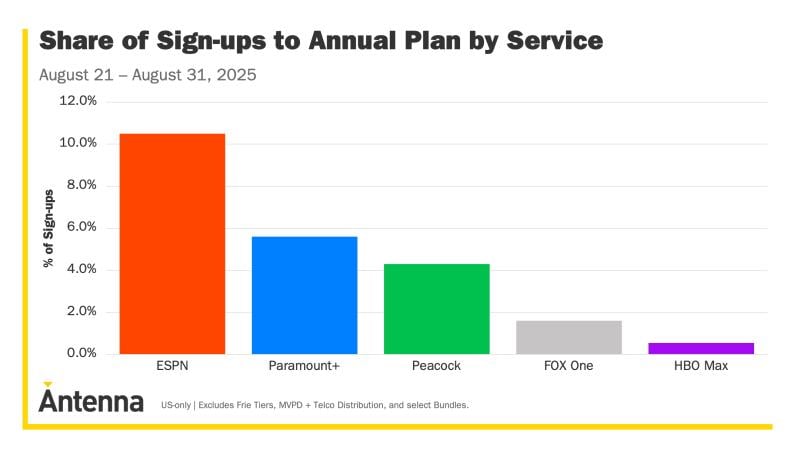

While signups for ESPN Ultimate were strong via the Disney Bundle, over 10% of enlistments were for annual plans. That’s a much higher indexing than what is typical for subscription streaming. Certainly, it’s much higher than Fox One, which saw less than 2% of its signups come in for annual plans.

“This suggests that ESPN’s early streaming customers aren’t just testing the waters, they’re ready to commit,” Antenna said in its blog post.

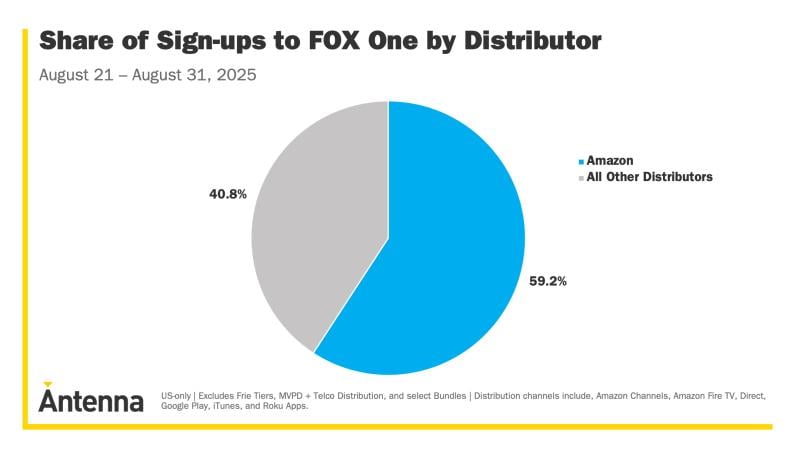

Notably, much of Fox One’s early traction seems to be coming via the Amazon Prime Video Channels marketplace. According to Antenna, nearly 60% of Fox One’s customers have come through that portal, which requires Fox to share revenue with Amazon.