After doing away with Peacock’s free tier earlier this year, NBCUniversal is the latest streamer to implement a price hike – its first-ever since the SVOD launched in 2020.

Announced Monday, the price of Peacock Premium is increasing by $1 to $5.99 per month, while Premium Plus is going up by $2 to $11.99 per month. The price hikes go into effect August 17 for existing customers and immediately for new subscribers. Peacock’s Premium Plus plan offers a mostly commercial-free experience with the ability to download episodes along with live and local NBC channels.

In announcing the price raise NBCU said the change will allow it to continue to invest in the product’s user experience and content, while also remaining competitive in the streaming market. NBCU also pointed to earlier content investments, noting that since 2020 the platform has added more than 80,000 hours of content (and expects to expand to reach nearly 100,000 over the coming year), including Pay 1 movies from Universal Pictures, next-day content from NBC and Bravo, as well as streaming channels from Hallmark and Reelz and morning news programming form CNBC and MSNBC. Peacock also touts 5,000 hours of live sports including Women’s World Cup, Sunday Night Football, an NFL Wild Card Playoff Game, Premiere League, and Big 10, among others.

The price increase comes as NBCUniversal, like other major streamers across the industry, focuses greater attention on profitability versus just subscriber growth for its streaming service. Earlier this year Peacock, which has amassed 22 million subscribers, did away with a free tier. Comcast in May started offering a free Peacock Premium subscription with its new Now TV video package for Xfinity Internet customers.

Peacock losses in Q1 amounted to $704 million, as the company funneled over $1 billion into programming and production and around $350 million into marketing. NBCU anticipates this to be the year of peak losses for Peacock, expected to total around $3 billion in 2023.

It’s the latest streaming service to up prices and most recently follows an increase by Paramount in June. Detailed earlier this year, Paramount integrated Showtime with its Paramount+ app (now called Paramount+ with Showtime) – raising the price by $2 to $11.99 per month. The Paramount+ essential plan rose by $1 to $5.99 per month. Warner Bros. Discovery’s HBO Max increased by $1 to $15.99 per month in January, but WBD isn’t charging more since introducing the revamped Max service in May. That follows a price bump for Disney+, which increased the price of its ad-free plan by $3 per month to $10.99 in December when it launched an ad-supported tier priced at $7.99 per month. During first quarter earnings Disney executives said the company plans to further increase the price of Disney+ later this year, aiming to drive more subscription revenue while citing minimal subscriber losses after the December increase. Lionsgate also this year raised Starz prices by $1 and Apple TV+ last year rose to $6.99 per month. Netflix in early 2022 bumped monthly plan prices for U.S. subscribers. *Update Netflix this week stopped offering its Basic plan - its cheapest plan without ads, regularly priced at $9.99 per month in the U.S. - for new or rejoining members in the U.S. and U.K. Existing subscribers get to keep the plan until they change plans or cancel their Netflix account.

And SVODs aren’t the only ones looking to generate more revenue from subscriptions, with virtual MVPDs that offer a cable-like streaming service including YouTube TV, Sling TV and Fubo all upping prices within the last year.

However, streaming companies looking to extract more revenue from subscriptions comes at a time when recent data indicates consumers are reaching their limits, both for the number of TV sources they use and the amount they pay for SVODs.

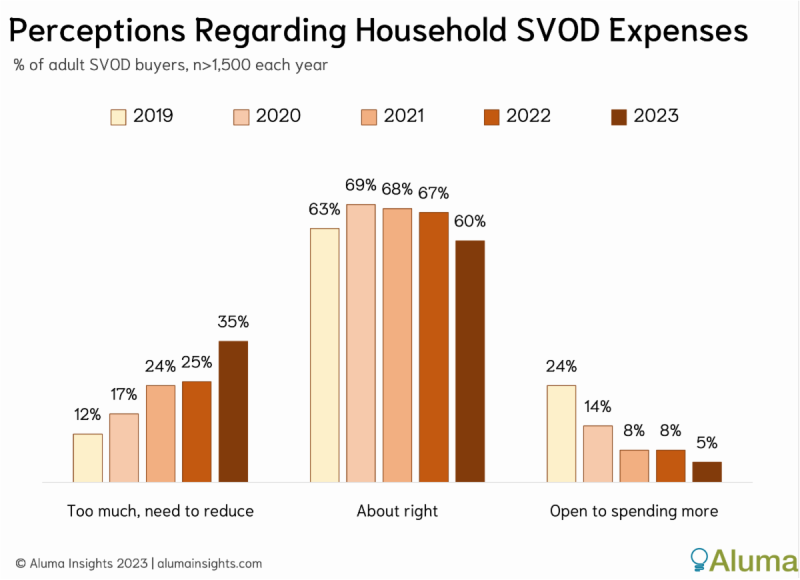

New research from Aluma Insights found 35% of SVOD customers are looking to cut back their spending on streaming services – reflecting a whopping 40% increase over 2022 and three-fold compared to 2019. While 60% feel their household SVOD expenses are about right, only 5% are interested in spending more on SVOD service – a 38% decrease from 2022.

"That only one-in-twenty SVOD buyers are open to adding a new subscription service is the latest indicator that US demand for such services is largely exhausted," said Michael Greeson, founder and principal analyst at Aluma Insights. "This does not mean mature SVOD providers will not add subscribers, only that such additions will be fewer, require more aggressive discounts, and be zero-sum purchases—that is, for every new service added, another must be cancelled."

Greeson’s comments align with separate data from Hub Entertainment Research that found subscription stacking declined for the first time in five years, marking a trend reversal as consumers look to shed instead of add more services.

Aluma Insights' report also anticipates that consumers’ frustration with continually increasing streaming expenses will only get worse – and the ongoing dual writers and actors strike could likely mean lower quality programming even as streamers seek higher fees.

“With most SVOD providers still bleeding cash, growing subscriptions has taken a backseat to optimizing revenue via higher prices, layoffs, and decreased content spending, among other measures,” wrote Aluma Insights. “Add to this the ongoing strike of writers and actors, and it is all but certain the quality of content will decline even as prices increase.”