As consumers consider which streaming services they should subscribe to, more than half recognize apps like Netflix, Hulu and Disney as essential to their viewing experience, new data from Aluma Insights shows.

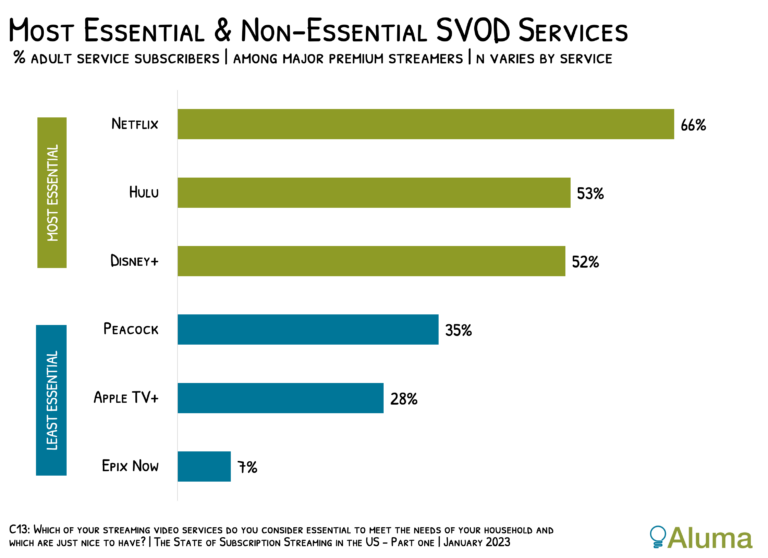

In a survey of nearly 2,000 U.S. heads of households, 66% of consumers flagged Netflix as the most essential SVOD service, while Hulu (53%) and Disney+ (52%) were also considered must-haves.

As for least essential services, only 35% of respondents said Peacock was essential to meet the needs of their households. Apple TV+ (28%) was ranked below Peacock, whereas Epix Now (now rebranded as MGM+) came in last with only 7% of consumers considering it essential.

The fact Netflix, Hulu and Disney+ topped the essentials list was unsurprising, Aluma noted. Given Disney reported minimal subscriber losses last quarter – despite raising prices on Disney+’s ad-free plan – Aluma predicts both Disney+ and Hulu standalone prices will increase by around 15% this year. Similarly, Disney CEO Bob Iger said the company is examining the Hulu business “very carefully.”

“This is a one way of comparing a service’s utility with that of its competitors,” said Aluma founder Michael Greeson in a statement. “It says to some owners you’ve a bit more latitude when it comes to revenue optimization measures, such as cracking down on freeloading or increasing retail prices. It says to others there is great risk in significantly altering prices or service terms.”

Netflix, which in Q4 added 7.6 million global subscribers, plans to reaccelerate revenue growth by charging users that are sharing an account with another household. The streamer in February rolled out password sharing restrictions in four countries and plans to eventually introduce those guidelines in the U.S.

Peacock and Apple TV+ being among the least-essential services was unexpected, Aluma pointed out. A recent survey from Hub Entertainment Research indicated consumers struggle to understand Apple TV+’s value proposition, but they better understand the value of services like Netflix and Disney+.

“Apple TV+ is recognized for high-quality original content that resonates well with its subscribers,” Aluma wrote. “Then again, it has little depth in terms of third-party content and subscribers rank its value poorly relative to competitors.”

As for Peacock, the service surpassed 20 million paid subscribers in Q4, though NBCUniversal has stopped offering the free tier to new customers. Comcast also plans to phase out complimentary Peacock Premium subscriptions for Xfinity subscribers.

As monthly SVOD spending winds down, Aluma noted less essential streaming services will likely be impacted. According to Aluma, households in 2022 spent on average $43.25 per month on SVOD services.

While that amount increased significantly from 2020, the percentage of buyers open to more SVOD spending declined from 14% to 8% in the two-year period.