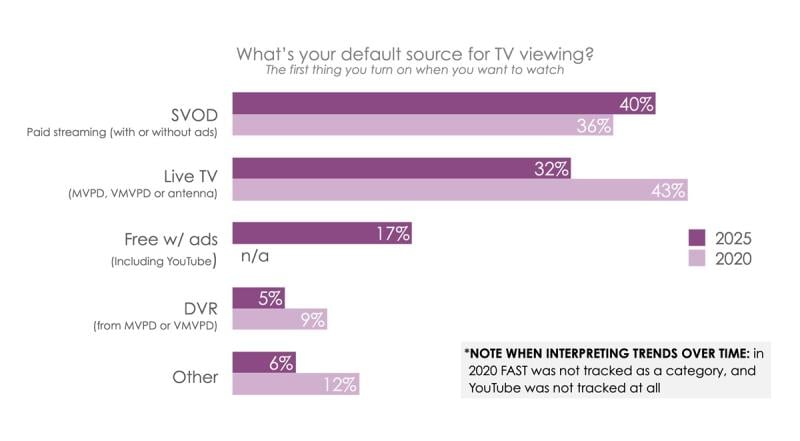

Subscription video on demand (SVOD) has become the programming source connected TV consumers in the U.S. turn to first when they turn on their TV set. Among the major premium SVODs, Netflix is far and away most often the first programming source.

Those are the conclusions of Hub Entertainment Research’s latest annual “Decoding the Default” report, in which the firm surveyed 1,600 U.S. consumers with broadband, a pulse and some indicators of ongoing metabolic activity, then asked them what their default TV content choices are.

Notably, SVOD has risen from 36% to 40% of respondents over the last five surveys, while more traditional “live TV” choices (MVPD, virtual MVPD and over-the-air antenna viewing) slipped from 43% to 32% over that 2020 to 2025 span.

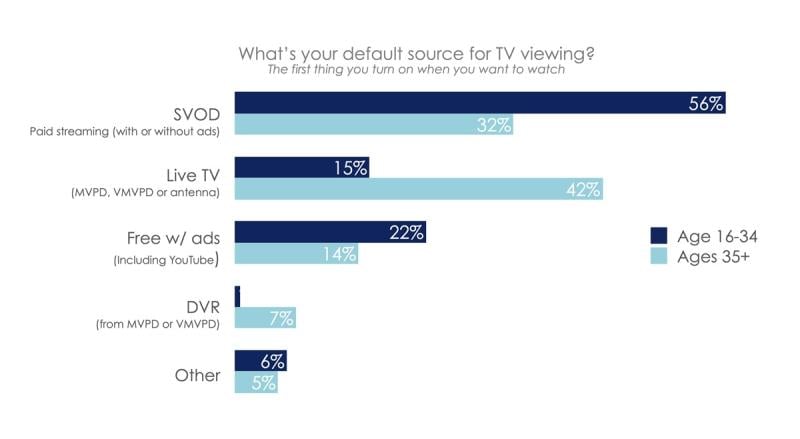

This sea change in TV consumption habits is far more pronounced among younger demographics. As the Hub graphic below reveals, TV watchers ages 35 and older still strongly prefer old-school pay TV and over-the-air antenna viewing.

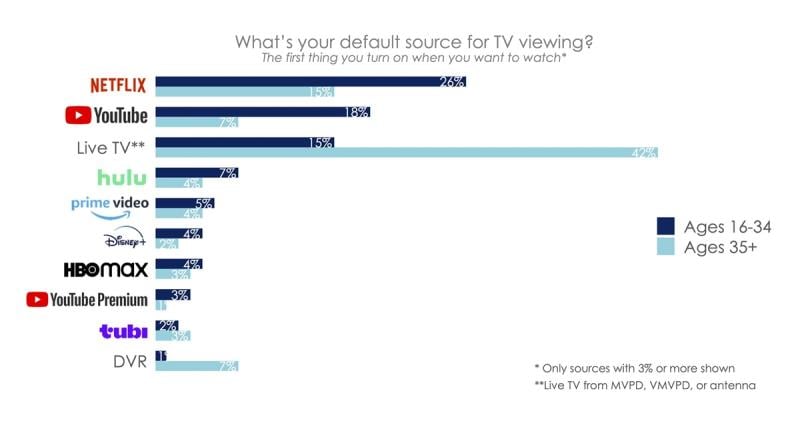

Drilling down even further, Netflix appears to be the top individual default viewing destination, surpassed among all viewers surveyed only by the collective heft of traditional “live TV.”

When asked, “What’s your default source for TV viewing,” 32% of the 1,600 survey respondents listed the broad category of pay TV and OTA antenna choices, but 18% specifically listed “Netflix.”

The answer became very different when respondents were sorted by age — Netflix was the overwhelming favorite (26%) among those ages 16-34. Among this age demographic, the Netflix preference was higher than surging YouTube (18%), or the entire collective of live TV sources.

Also worth noting: Digital video recorders are still the default source for 7% of those 35 years or older, but younger consumers barely show up on the radar of DVR usage.

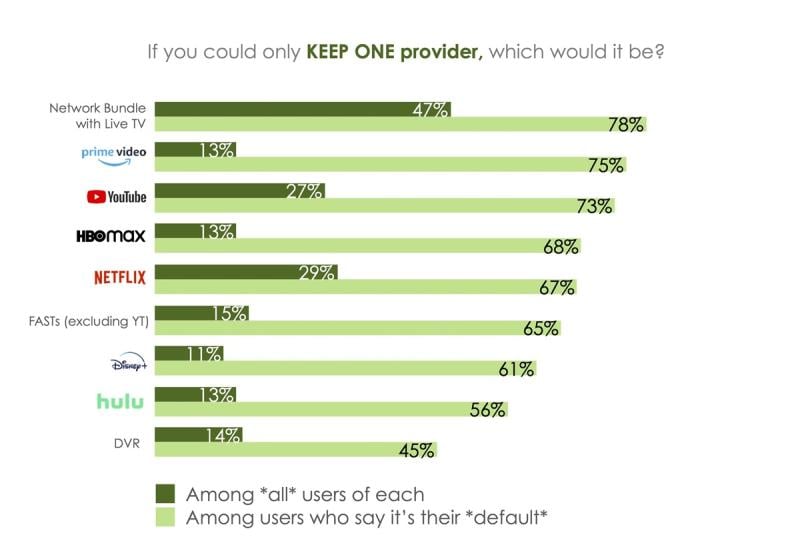

Being the default has advantages in an era dominated by heavy subscriber churn rates.

“The data is clear: being a viewer’s default dramatically increases the likelihood they’ll keep you,” said Christina Pisano, consultant at Hub and one of the study authors.

“First-stop status drives more sessions, more time spent, and higher retention. That’s why the battle for the TV home base is the most important fight in today’s entertainment landscape.”

To bear out the report’s conclusions, Hub asked consumers to pick the video service they would keep if they could only have one. There was, perhaps not surprisingly, a high correlation between services listed as “default” and those ranked No. 1 on a desert-island collection.