The heated market for smart TV supremacy is heavy on propaganda from individual manufacturers, so any third-party, objective insight on this vital connected TV device category is useful.

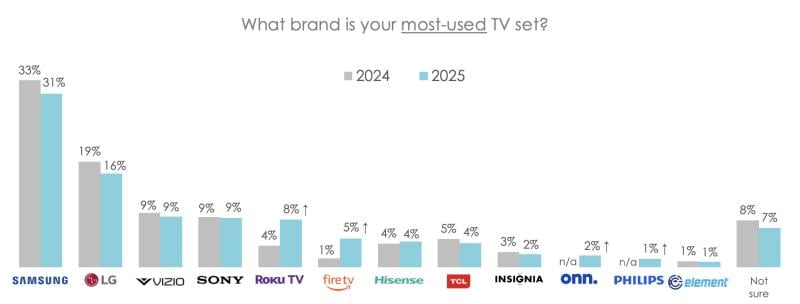

Polling 2,528 U.S. consumers in May as to which smart TV they use the most, Hub Entertainment Research’s “2025 Evolution of the TV Set” report doesn’t necessarily include any shockers — Samsung remains the top U.S. brand, followed by LG and Vizio. But this is interesting: Roku, which only debuted its own branded TVs in the spring of 2023, saw its U.S. share as the “most-used TV set” brand among consumers (according to Hub, at least) double in one year.

Amazon, which has been marketing its own sets since October 2021, saw a five-fold YoY increase in most-used TV brand share from 2024 - 2025.

It should be noted that this isn’t sales or shipping data — Hub is merely asking which TVs consumers use the most (and one household could have multiple TVs from different brands). And it’s focused on the manufacturing brand, not the TVOS powering smart TVs.

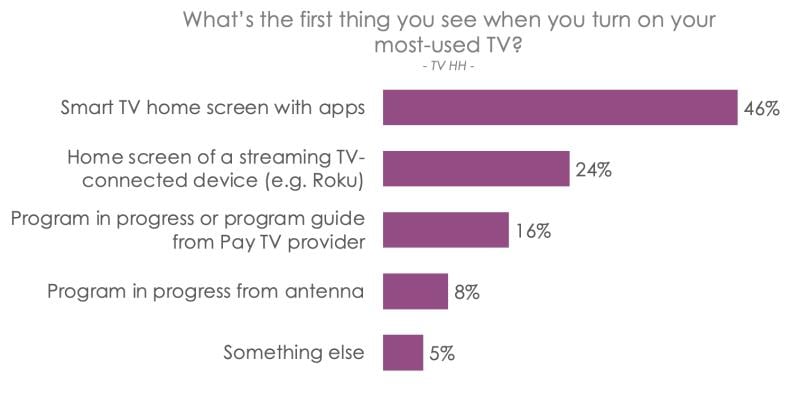

This is not to say that a TV’s native operating system isn’t more important than ever. Hub’s survey found that engaging with the built-in TVOS is the first thing 46% of users do when they turn on their set. That’s more than double the 24% who say their first act is to toggle over to the user interface of a connected TV device.

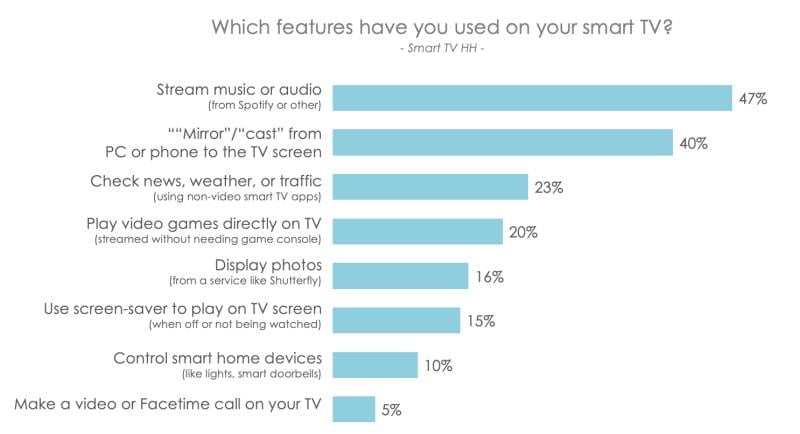

Meanwhile, set makers including Roku and Amazon have tried to evolve their smart TVs into hubs of the connected home, controlling things like lights, thermostats, security cameras and doorbells. But according to Hub’s survey, only 10% of U.S. smart TV owners are using their sets for that purpose. Notably, plenty (47%) are using their TVs to stream music and to mirror the display of their phone or personal computer (40%).

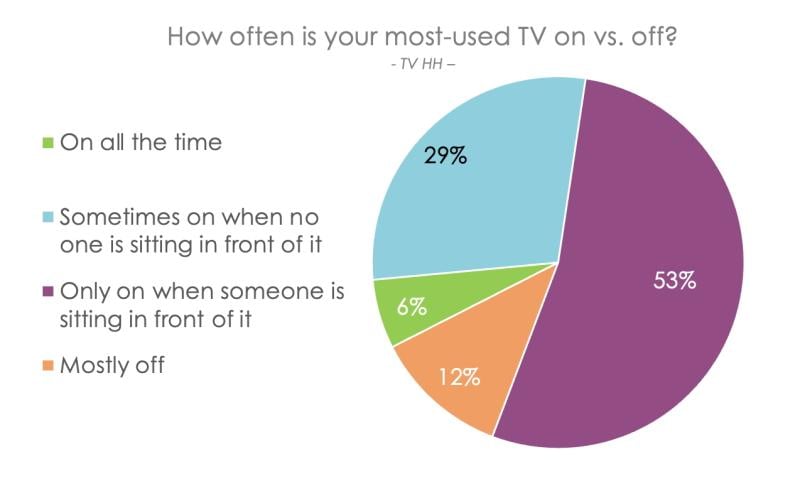

And while smart TV makers have tried to bill their devices as energy-efficient, always-on, center-of-home gadgets, only 6% of survey respondents told Hub they leave their set on 24/7. Most (53%) said they only keep their TV one when someone is watching it.

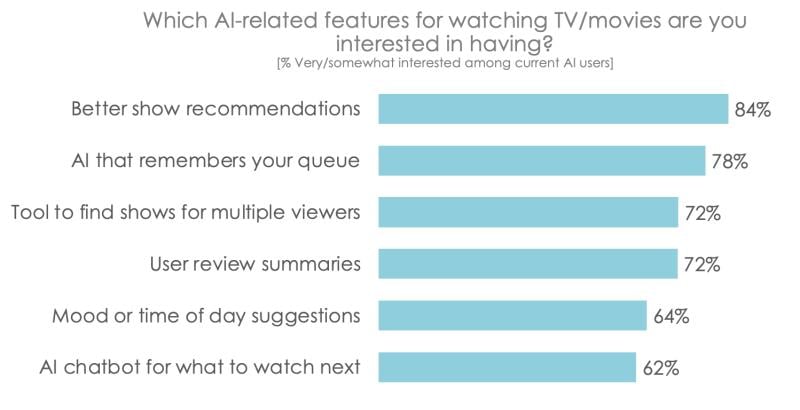

Finally, integration of AI features promises to improve the performance of things like search and recommendation, features that have in the recent past disappointed smart TV owners. Hub’s survey shows keen consumer interest in potential AI feature improvements almost across the board.

"Without a single TV operating system dominating the market, each [TV maker] has the opportunity to better promote streaming services and AI-viewing enhancements to make things easier for viewers," said Jason Platt Zolov, senior consultant at Hub, in a statement. "The challenge of finding a good show to watch is not just about too many services to choose from; it’s about finding a TV operating system that simplifies those choices in a way that works.”