If Vizio did not have an ad-supported, connected TV platform, the company might be in trouble.

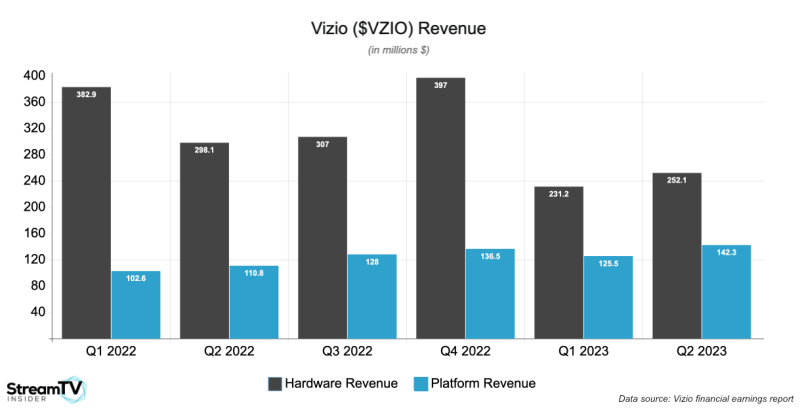

This week, Vizio revealed sales of its smart TV sets dipped to $252 million during its second financial quarter of the year on shipments of around 1 million devices. The figure marked a 15% decline compared to the same period last year, when Vizio took in $298 million. Shipments fell 11% on a year-over basis.

Vizio has reported fewer sales of its smart TV sets over the last few consecutive quarters as the company increasingly turns its attention toward its connected TV (CTV) operating system, called Platform Plus, which powers its newer-model smart TV sets.

The platform offers native access to popular streaming apps like Netflix, Prime Video, Disney+ and others, along with nearly 300 linear content streams offered through Vizio's WatchFree+ service. Both are supported by advertisements, which continues to be a bigger part of the company's business: During the quarter, Vizio earned $142.3 million in Platform Plus revenue — a 28% year-over increase — after growing its Platform Plus user base to 17.6 million active accounts.

Total gross profit for the quarter clocked in at $86 million — nearly all of which was attributed to Vizio's ad-based products. Device profit was a miniscule $300,000 for the three-month period that ended June 30.

On a conference call with investors on Tuesday, Vizio CEO William Wang said the company's innovative connected TV products helped insulate it from the effects of a sluggish advertising market that has impacted other media companies and operators in the space.

"Unlike the challenges many are facing in the advertising marketplace, our ad business is firing on all cylinders and our team delivered 35% growth in revenue during the quarter," Wang said while delivering prepared statements at the start of the call. "This is even on the back of a 24% increase in results in Q1. Through our growing presence with ad agencies, brands and content services, we are creating demand for CTV and continue to gain share within the fastest-growing part of the advertising marketplace."

Executives pointed to a number of unique offerings on Vizio smart TVs, including the ability to learn what users are watching and target them with personalized search results and advertising that draws them toward streaming channels, products and services that might interest them. Those features are baked into a new home screen experience that started rolling out during the quarter, one that offers streamers a better user experience and advertisers the ability to target audiences on a granular basis.

Mike O'Donnell, Vizio's chief revenue officer, said the home screen offered advertisers a way to reach streamers with "better personalized options, larger ad units (and) more video."

"We are already seeing increased demand as well as increase in CPMs for the units that we have there," O'Donnell said.

Users appear taken with the new experience, too, with Wang saying streamers were 20% more engaged with content there compared with the older experience.

"Our advertisers love it," Wang affirmed.

Vizio also forged a number of partnerships during the quarter — to include the launch of a "preview experience" in partnership with Comcast's NBCUniversal that allowed streamers to watch a handful of shows and movies from Peacock, and an agreement with Qurate Retail Group to bring their channels HSN and QVC to WatchFree+ — that helped boost ad spend among media and entertainment buyers. Overall ad revenue grew by 35% during Q2 compared to the previous quarter, Vizio's Chief Financial Officer Adam Townsend said.

"We remain very enthusiastic about our opportunity heading into the second half," Townsend remarked, though he cautioned that spending among media and entertainment companies could slow as the writers strike — which has ground television and film production to a halt — continues into the fall.

That said, Townsend affirmed Vizio was not putting all of its eggs in the media basket. He acknowledged the company is also courting advertisers from other industries, including automotive, pharmaceutical, quick-service restaurants (QSR) and consumer packaged goods (CPG). Historically, these have been among traditional television's largest ad buyers, and Townsend revealed they are increasingly spending money against Vizio's ad products, too.

"With strong demand for our advertising inventory, driving user engagements specifically within our ad-supported content such as our own WatchFree+ app remains a key lever in our growth opportunity," Townsend said.

So far, the strategy appears to be working. Total hours streamed on Platform Plus — which also goes by the consumer name SmartCast — climbed 16% on a year-over basis to 4.952 million hours for the quarter (the figure excludes streaming on third-party devices like a Roku or Amazon Fire TV, which might be plugged into a Vizio TV set). The amount of time spent streaming content natively through Vizio's connected TV operating system helped boost the company's average revenue per user to $30.55, an 18% increase compared to Q2 2022.

WatchFree+ is becoming a bigger part of that equation, as budget-conscious consumers turn toward free, ad-supported offerings. Increasingly, more are turning toward so-called "lean back" experiences that replicate the cable television experience by delivering content in a linear, time-scheduled fashion.

But Townsend said WatchFree+ is better than cable, because the company doesn't have to pay carriage fees in order to offer programming to its users (there is currently a fight at the FCC over this, which involves streaming services that offer actual cable TV channels).

"This is a revenue share structure model," Townsend said. "As we source content and bring it in, if people watch it, and we’re able to drive engagement, we make money and the partners make money. So, it's a different dynamic than running a cable service...it's actually the reverse of that, in a much more economically-beneficial structure."