With its “season” of original episodes exhausted until the fall, June has always been a fallow month for the major broadcast networks. But never like this.

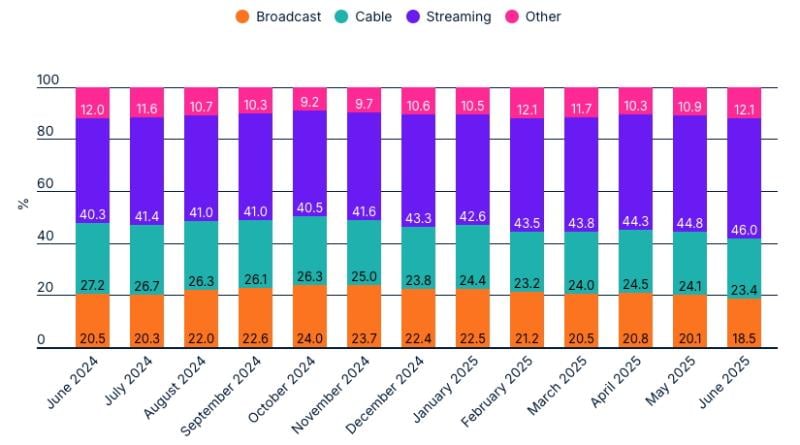

According to Nielsen’s monthly TV time tracking, broadcast TV’s share of total U.S. viewing for the month of June slipped below 20% for the first time ever, dipping to just 18.5% for the month. This is down from 23% for the month of Jun, 2021.

Meanwhile, Nielsen continued to show streaming gaining increasingly more audience share — up to 46% last month, a new record. YouTube maintained its connected TV dominance in June, accounting for 12.8% of viewership, while Netflix made up 8.3% of TV watching.

Notably, as the TV business — or “video” industry, or whatever we’re calling it these days — rethinks how it’s distributed and monetized, Nielsen recorded another new broadcast television conundrum for the key 18-49 demographic, the currency it predominantly uses for advertisers in prime time, as most of the payload now comes from streaming.

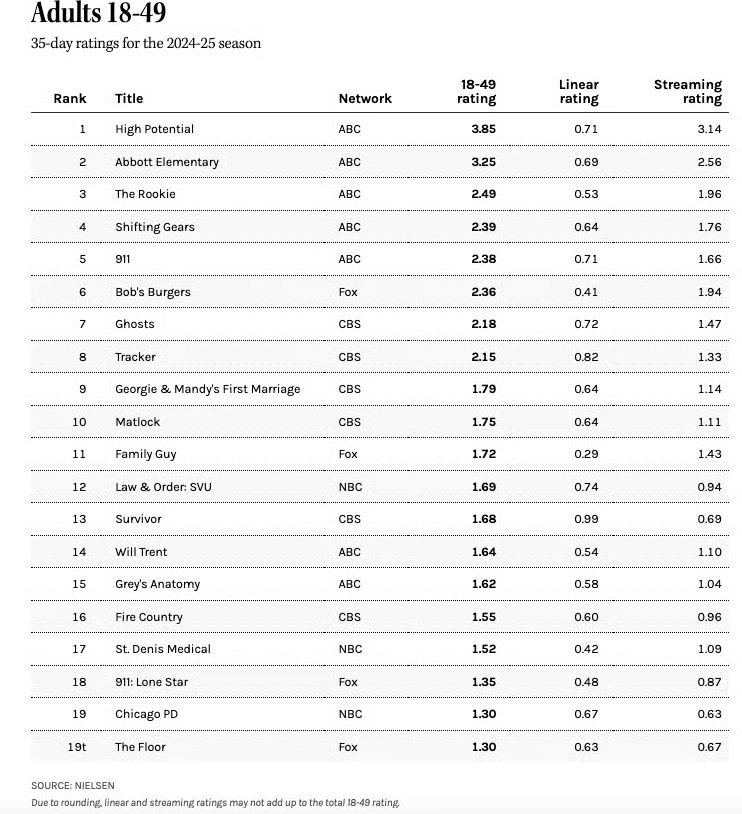

Crunching Nielsen data, The Hollywood Reporter found that only two of the top 20 performing shows in the 18-49 demo for the 2024-25 TV season — CBS’ Survivor and NBC’s Chicago PD — drew more audience in broadcast and subsequent DVR viewing vs. on-demand watching on respective streaming platforms including Paramount+ and Peacock.

Notably, the No. 1 ranked show in the demo, ABC’s High Potential, generated just 18.4% of its viewership airing on ABC, with the rest arriving via streaming outlets including Hulu. (For this metric, Nielsen averaged how each episode of a show did in its first 35 days after debut.)

Notably, the major broadcasters skew very old, so the story is a bit different when older demographics are factored in. In terms of total viewership, streaming’s share of viewership over five weeks dipped to a still-very-substantial 31%. For example, CBS’ Tracker, the most watched show on broadcast last season, generated 32% of its audience from streaming on Paramount+.

Meanwhile, High Potential — which ranked second in overall viewing — achieved nearly half of its total audience (49%) via streaming.

While primetime linear TV audiences are being effectively monetized by the major media conglomerates via subscription and ad-supported streaming, the same can’t be said for the late-night day part. While media pundits have accused CBS of pandering to FCC political pressure in its decision to cancel Late Night With Stephen Colbert, the network has vociferously argued through outlets including The New York Times that the move was made strictly for business reasons amid a challenging late-night backdrop.

Colbert’s average of 2.42 million viewers in the second quarter beat the network post-late-news competition at 11:35 p.m., besting both The Tonight Show Starring Jimmy Fallon on NBC and ABC’s Jimmy Kimmel Live!. Colbert was the only show during that time period to grow its audience from quarter to quarter. However, CBS execs said the show was losing “tens of millions of dollars” annually, with the most profitable 18-34 audience component choosing to watch its clips on social media, where they were harder to monetize.