Ad-supported CTV streaming is growing faster than non-ad-supported viewing, according to Comscore’s most recent “State of Streaming Report,” and that shift is hatching new opportunities for advertisers.

A total of 238 million people in the U.S. are streaming on CTVs (up 4 million from May of 2022), and CTV hours are up 20% from last year (9.6 billion in May 2022 to 11.5 billion in May 2023), according to the report. And while non-ad-supported streaming grew at a rate of 9% from May of 2021 to May of 2023, ad-supported services nearly doubled that figure at 17% growth.

Comscore Product Management VP James Muldrow told StreamTV Insider that within the streaming landscape, “there has been an overwhelming expectation that there’s going to be a growth path for advertisers,” and that is “finally coming to fruition with a lot of the largest streaming services like Disney+, Netflix and Max,” with all three now offering some version of an ad-supported tier.

Additionally, with top dogs like Netflix looking for new ways to monetize subscribers as growth slowed and more competing services in the game than ever, the report also showed that 75% of video hours growth came from outside the top six (Netflix, YouTube, Amazon Video, Hulu, Max, and Disney+). Yet despite slowed growth, these six continue to hold significant dominance in consumers’ total viewing hours.

“The economics of today lend themselves to consumers wanting to find alternatives to paid streaming that they may have had access to in the past, simply because there are too many services, and as a collective group, we can't afford them all at once,” Muldrow noted. “An ad-supported mentality is manifesting itself in [consumers’] decisions and what they watch.”

Finding ‘meaningful’ audience engagement

These newer services present a lot of opportunities for advertisers, and Muldrow feels it’s key to understand the difference between a large total audience and a “meaningful” audience.

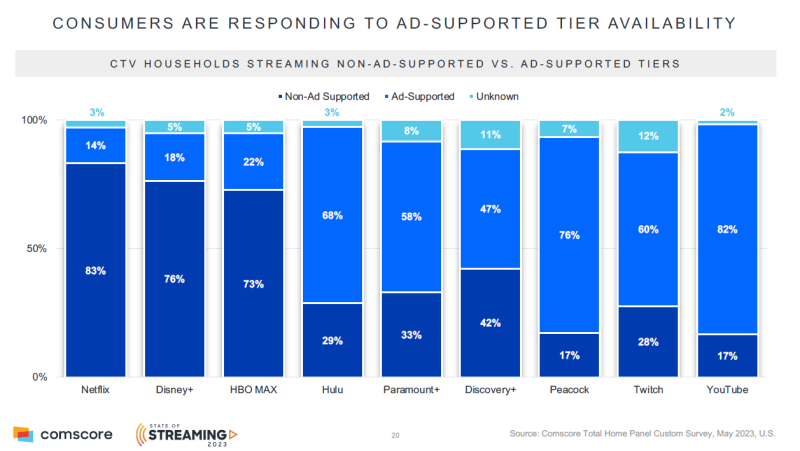

For example, the report finds only 14% of CTV households are using the ad-supported tier on Netflix as opposed to 76% of user households on Peacock. As of the second quarter of 2023, Peacock’s mere 24 million subscribers pales in comparison to Netflix’s 238 million users, but when factoring in Comscore’s percentages, that difference drops to only 15 million users.

“I think there's a challenge of trying to find the right optimal mix between those because there will be an expectation and some confusion in the market of how large the audience that [an advertiser] can actually reach [is] versus the audience that a service has,” he explained.

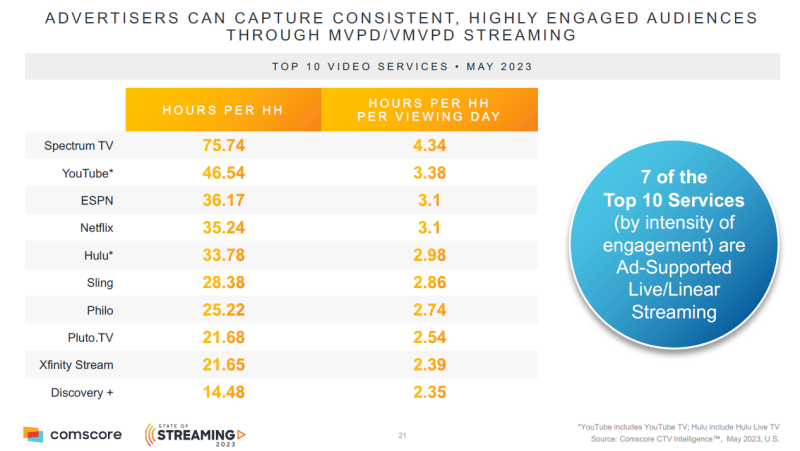

Muldrow also emphasized that advertisers should not sleep on linear TV apps. The report found that among the top 10 services measured for the intensity of engagement within households, seven were ad-supported live and linear streaming services. Spectrum TV ranked with the highest hours per household — even above YouTube and Netflix.

He elaborated that streaming continues to be a burgeoning area for advertisers, but because it is a more focused and selective form of viewing content, live TV — be it news or sports — presents more concentrated viewing hours per household. While “there is a gravitation for a cross-platform view of the world,” advertisers should not yet jump ship when it comes to linear audience segments, he noted. “They're still present and accounted for when it comes to advertising.”

Of course, what goes up must come down (or at least plateau within the world of streaming engagement), but Muldrow reasons that “we aren’t at the crest of the growth yet” for ad-supported streaming. “But we are approaching it for sure because nearly 90% of homes out there that are streaming are doing some kind of ad-supported streaming.”

That means the question will become less about whether or not consumers are using ad-supported streaming and more a measure of how much. That point will continue to fluctuate “for at least another year” under observations from firms like Comscore, according to Muldrow.

In this period of broad growth, he believes optimized targeted programming will be a key method for advertisers to distill audience engagement data into effective content.