Changing consumer sentiments and continued frustrations over streaming could mean viewers want to consolidate their video services and opt for bundled offerings.

In recent months separate reports have come out showing that consumers are reaching their limits on how many TV services they want to use and pay for, are frustrated by the crowded video app marketplace and also have interest in signing up for a bundled streaming offer from one provider if they could.

Streaming was riding a high from Covid-19 pandemic-related lockdowns, but alongside subscriber saturation, the height of consumers adding an ever-growing number of TV video sources to the household roster looks to have plateaued. Hub Entertainment Research’s Best Bundle survey, released in May, showed a trend reversal, as video stacking recently declined for the first time in five years, with an average of seven being the sweet spot. The firm also found consumers are still stacking the top five SVODs — Netflix, Hulu, Amazon, HBO Max and Disney+ — but not as many as they used to. In 2022 around half of consumers used three or more of the big five, but in 2023 that decreased to 43%.

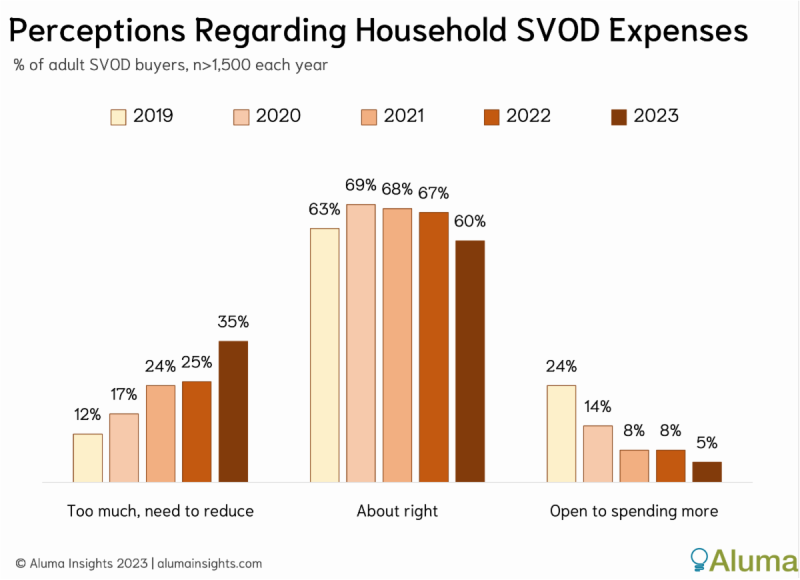

Meanwhile, survey data from Aluma Insights released this month showed consumers are tightening their wallets on streaming. Aluma’s latest research found only 5% of consumers are willing to spend more than they are currently on SVOD streaming services (down 38% from 2022), and 35% want to decrease spending on SVODs – a 40% increase from those who planned to cut back a year ago. And more consumers are looking to cut back at a time when many streaming services have or are looking to increase prices.

But as streamers look for new avenues to grow and viewers seek to curb spending and reduce the number of subscriptions they manage, many consumers are interested in bundles that aggregate a variety of streaming services. A survey from Horowitz Research found that six in 10 (61%) of streamers would be likely to switch to a bundle of subscription streaming services from one provider if that option was available. Per Horowitz U.S. streamers currently use an average of 6.4 services in a month, including an average of 3.8 paid and 2.6 free.

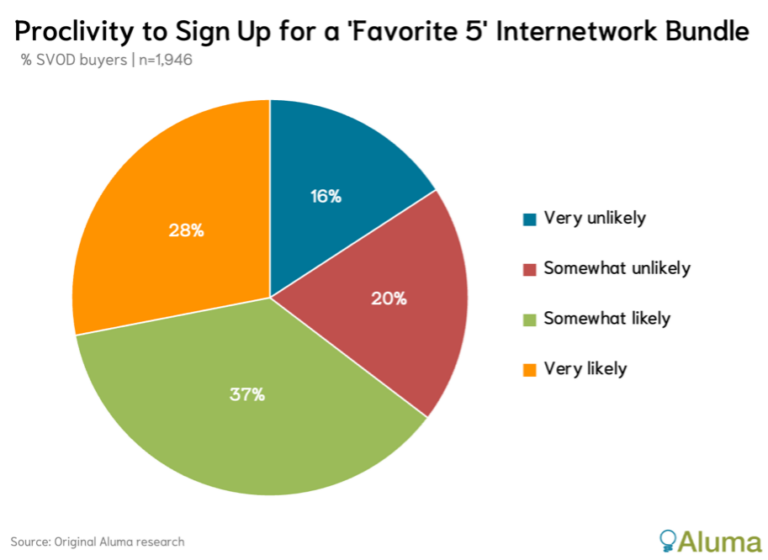

And subscription fatigue and frustration of using too many apps is evident in Aluma’s July analysis that contends now is the time for inter-network bundles, finding two-thirds of adult SVOD users are unhappy with their favorite shows scattered across too many apps, and nearly half are frustrated by having to switch between apps. The firm found that if consumers were offered a $50 per month bundle of five of their favorite streaming services, even with a one-year contract required, 28% were very likely to sign up, and 37% somewhat likely.

Asked what five services consumers would want to include in a bundle, perhaps it was unsurprising to it was the top five SVODs — with Netflix by far leading the way at 81%, followed by Prime Video (60%), Hulu (55%), Disney+ (50%) and Max (47%).

Verizon is one telco that’s been pursuing a super bundling strategy to complement its service provider offerings through its +play subscription aggregation platform. That includes a recent discounted offer for Netflix Premium bundled with Paramount+ with Showtime. And just this week Google disclosed plans for a YouTube TV offer that would bundle its NFL Sunday Ticket package with Max, though no pricing or go-to-market has been disclosed.

And consumer sentiment could be shifting back in favor of bundles at a good time for streaming services that are seeking new ways to grow and reduce churn. Check back on StreamTV Insider for an upcoming deeper dive into why super bundles may be the next strategic move for streamers, the benefits and drawbacks, and who could be best positioned to offer them.