Consumers continue to swap streaming services as they follow content and keep an eye on wallets, and new data from Samba TV suggests Disney+ and Netflix may be best positioned to keep customers from unsubscribing and cycling to another platform after they tune in for a specific program.

The report looked at subscription cycling, which is when a user picks up one streaming service to watch a specific show and then immediately drops it to sign up for another - a behavior that 29% of U.S. adults engaged in in the past six months. According to Samba, a whopping 69% of U.S.. adults plan to subscription cycle in the next six months.

For its new The State of TV Viewership report, Samba analyzed approximately 47 billion hours of linear and streaming in the second half of 2022, using automatic content recognition data (ACR) from tens of millions of opted-in TV sets across 24 smart TVs sold in more than 100 countries, alongside its panel of more than 3 million smart TVs balanced and weighted to U.S. Census data. It also leaned on survey results of 2,505 U.S. adults conducted by HarrisX from August 29-September 1, 2022.

The report pointed to continued declines in pay TV, with the total linear hours watched during 2H 2022 down 2% from the same period in 2021. It also highlighted streaming popularity, but with tightening budgets people limiting their consumption fewer services at a time. In the second half of 2022 over half (54%) of streaming households watched content across two or less services.

“With streamers like Netflix and Disney+ recently adopting AVOD models, it’s likely that consumer behavior will continue to shift in coming months as viewers customize their viewing experiences, cycling through paid streaming services while they supplement their content bundles with a variety of AVOD and FAST services,” Samba noted in the report.

According to Samba, content as key to subscription cycling, with viewers who are chasing hit series and film taking an a la carte approach to streaming.

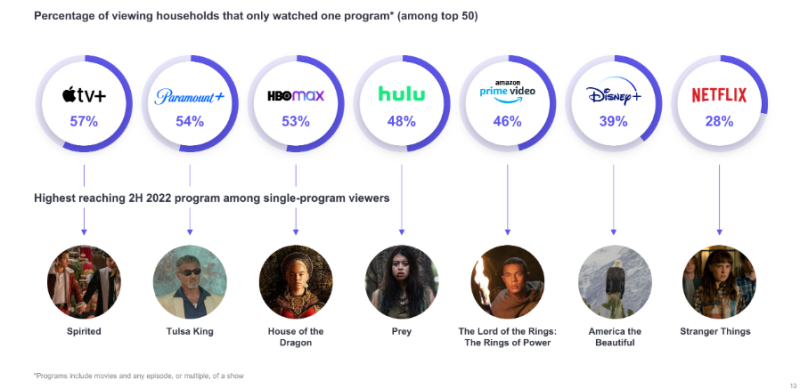

With that in mind, Netflix and Disney+ may be in a good position with content investments, as those services had the lowest percentage of consumers who watched only one of the top 50 titles on the respective platforms.

On Netflix, only 28% tuned into just one title among the top 50 in the second half of 2022 – marking the best performance among streamers. The SVOD giant was followed by Disney+, which had 39% of viewers tuning into only one program.

Perhaps the most in the line of fire for subscription cycling is Apple TV+, as Samba TV noted the overlap between how many viewers only watch one program on a platform and their propensity for cycling. Nearly 60% of viewers only watched one title on Apple TV+. Among those seeing more than half of users watch just one of the top 50 programs also include Paramount+ (53%) and HBO Max (53%). In the middle of the pack above 40% were Hulu (48%) and Amazon Prime Video (46%).

“With over two-thirds of adults, and three-quarters of millennials, planning to subscription cycle in the next six months streamers will need to adjust their strategies to elongate the viewership cycle and maintain their subscriber bases,” wrote Samba.

The company said Netflix showed a strong example of lengthening the viewing timeline with its release of Stranger Things 4.

“With the season split into two volumes that premiered a month apart, they actually drove higher viewership towards the volume two release than volume one,” Samba noted. According to Nielsen’s year-end rankings “Stranger Things” came out on top for both original and acquired content as the most-streamed TV show in 2022, accumulating 52 billion minutes viewed for a total of 34 episodes.

Aside from investing in strong content, Samba pointed to the challenge of content discovery as fueling the rise in subscription cycling. When viewers only watch one program, it makes it difficult for streamers to consistently reel them in week over week. The report found that during the second half of 2022 one in 10 viewers across top platforms including Hulu and HBO Max watched those services for only one month out of six.

“These viewers are likely in danger of cancelling their subscriptions (if they haven’t already) and, to retain them, streamers will need to optimize their content discovery to increase stickiness by serving up relevant content.”

To that end Samba said streaming services need new approaches for understanding what users want to watch using data that covers entire platforms.

For Netflix, Samba’s data found that viewers of the platform’s series “Ozark” are three times more likley to watch “The Gilded Age” on HBO than the average U.S. household.

“When Netflix has a historical drama on its slate (such as Bridgerton), this type of data on overlap audiences across platforms can help Netflix provide recommendations and ads to the most relevant audience possible,” concluded Samba.

In terms of viewers only tuning in for one month out of six, Netflix had the lowest percentage at just 1% - compared to Paramount+ the highest at 18%. Disney+ was at 9%, behind Netflix and Amazon Prime but ahead of Hulu, HBO Max, Apple TV+ and Paramount+.

Disney during the most recent financial quarter added around 200,000 domestic Disney+ subscribers, ending the period with 46.6 million in the U.S. and Canada. Disney CEO Bob Iger affirmed that its future is firmly rooted in streaming, but plans to cut content costs, alongside slashing 7,000 jobs globally, as it targets $5.5 billion in cost savings. Of that Disney hopes to realize $3 billion in annualized non-sports content cost savings over the next several years, though didn’t break out produced and licensed content spending.

Netflix, meanwhile, saw its domestic subscriber base grow by 909,000 in the fourth quarter to reach 74.2 million in the U.S. and Canada at the end of 2022. And the streaming service is ready to pull levers on monetization efforts this year with plans to implement paid sharing mechanisms more widely and continued iterations on its Basic with Ads plan.