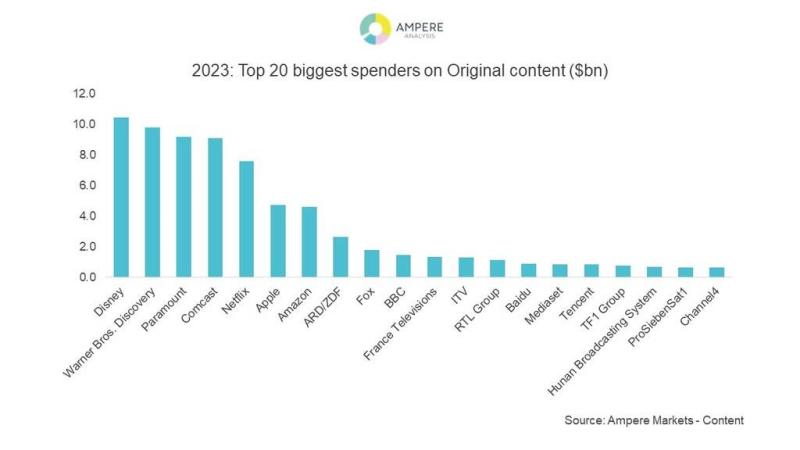

Disney and Warner Bros. Discovery are expected to lead the content spending race in 2023, even though the streaming industry at large is expected to cut back due to economic pressures, according to Ampere Analysis.

The research firm anticipates Disney will reach $10.5 billion in original content spend this year, while WBD’s content investment will exceed $9.5 billion. But even with those companies making investments, Ampere anticipates global content expenditure to increase by just 2% year-on-year in 2023 – compared to a 6% growth rate last year.

Meaning this year will likely see the slowest content spend growth in a decade – excluding the pandemic-driven content slump in 2020, said Ampere. The firm added global economic headwinds will curb household spending and advertising investment, which in turn will lead media companies to implement more cost-saving measures.

Both Disney and WBD are in the midst of refreshing their streaming strategy. Disney+ in December launched its first ad-supported tier, which comes with the same content catalog that’s offered on the premium plan. Content ranges from Disney classic movies to series franchises like “Star Wars” and “Marvel Cinematic Universe,” and Disney scored another content acquisition win in October with BBC’s “Doctor Who” series.

Whereas WBD is gearing up to combine its HBO Max and Discovery+ streaming services into one app, expected to launch this spring. In anticipation of the combined service, the company has been trimming down premium content on HBO Max. Last year, WBD halted production of some European-produced originals and subsequently cancelled a number of domestic HBO shows, such as “The Nevers” and “Westworld.”

Within spend on SVOD content alone, Ampere predicts Netflix will make up over a quarter of subscription-based original content worldwide in 2023. Netflix is particularly leaning into more international content to gain a wider distribution of viewers. For instance, the streamer is currently developing a reality game show based on its hit Korean drama “Squid Game.”

Ampere Analysis Research Manager Hannah Walsh predicted SVOD services will see an 8% year-on-year increase in total content investment, but it will lag the 25% growth rate seen in 2022.

“Services will continue to focus on original content to compete in a crowded, cost-sensitive market, but we are already seeing a shift in content commissioning to incorporate a greater volume of cheaper unscripted formats,” Walsh stated.

One area where that kind of content is gaining traction is via free ad-supported streaming TV (FAST) services. FAST channels not only build up content such as news and lifestyle, but they can also house a single series IP to get more engaged viewers, as executives from Vizio, Filmrise and Tastemade highlighted at NATPE Streaming Plus last year.

Additionally, last year saw FASTs bolster overall streaming consumption. Nonpaid services accounted for over one-third (32%) of a user’s average number of streaming apps in Q2 2022, per data from TiVo. The Roku Channel, Pluto TV, Tubi were ranked as some of most popular FAST services.