After launching a renewed focus and rebrand for its FAST service roughly a year ago, smart TV leader Samsung aims to offer a free ad-supported TV experience with device scale and content breadth that delivers the right programming to the right person and keeps them coming back day after day.

Last August Samsung said it would be bolstering its free ad-supported streaming TV (FAST) service Samsung TV Plus (STVP), originally launched in 2015, with a particular focus on bringing in more premium partners, news and on-demand content. It’s one of the smart TV makers playing in the FAST space, alongside competitors Vizio and LG, media-owned FASTs like Paramount’s Pluto TV and Fox’s Tubi, Xumo, as well as platform players like Roku and ad-supported live TV experiences on Amazon Fire TV and Google TV devices.

Samsung is looking to leverage its large and leading device footprint (with Samsung TV Plus now available on over 500 million devices, including mobile, across 24 countries), which brings its own well of unique viewing data across services, to serve as the entry point for TV and entertainment experiences. StreamTV Insider sat down virtually with Takashi Nakano, content & business development lead for Samsung TV Plus, who shared what’s resonating, where there’s room for more, and expectations from partners, as the consumer appetite for free ad-supported streaming TV appears unabated.

’Massive engagement’

As the traditional cable model continues to see declines and viewing shifts to streaming, Samsung sees opportunity, with Nakano citing the relaunch as somewhat symbolic of turning a corner to for the service on becoming “more and more like people’s everyday television.”

“We’re seeing massive engagement around our content and our growth has been exponential since the relaunch,” Nakano told StreamTV Insider.

Samsung declined to share specific data points on engagement or growth, but he said it’s exciting to see, adding, “we see no signs of shrinking appetite of people engaging in content on television that’s in the home.”

STVP is integrated into its smart TV interface and hardware, with presence on a home screen that’s often the jumping off point for TV viewing. And recent data from TiVo’s latest Video Trends report shows smart TV users are brand loyal. Out of respondents that have three or more smart TVs in the home, only 1.6% have sets from different manufacturers – with Samsung leading the pack by far for brand loyalty. And a quarter of North American respondents are gearing up to buy new smart TVs within the next six months.

Time spent is a key metric Samsung tracks for engagement on its FAST, but Nakano emphasized expansion through a user’s lifecycle. For example, a user that watches for hours and hours one day a month but doesn’t come back isn’t a healthy one.

“We want people to come back day after day…for hours and hours, so how do we ultimately drive that,” he said.

Samsung TV Plus currently offers 300 linear channels in the U.S. and 2,200 globally, along with a library of on-demand TV shows and films. Most recently it added content from FilmRise, bringing 600 more hours of ad-supported content to the platform.

Here’s what Nakano had to say about various categories for the FAST.

News:

Perhaps unsurprisingly, news continues to do well, according to Nakano.

“It’s a high engagement vehicle for news programming, so FAST is definitely a place where people get their news,” he said.

News has both a national and local story, he said, with STVP seeing engagement around both flavors. On the local side, he sees STVP in a bit of a unique position, where it is striking deals with local broadcast stations to offer news based on where users are. Meaning viewers in Los Angeles don’t need to flip through thousands of local stations but are automatically served their local feed, while DC viewers see their local hosts, weather and newscasters that viewers care most about.

“We’ve got deals with the local broadcast stations here to deliver an LA-centric local news experience, and we’ve seen just an exponential growth curve against that type of content,” he noted.

Local news has exploded in the sense local stations have a place for storytelling about nearby happenings and interests 24/7, something he believes is exciting for broadcasters. He said to expect more broadcasters to “be lit up across all of our DMAs.”

Samsung isn’t the only one focusing on local news as The Roku Channel, Fire TV and others have brought local news to their offerings, while smaller players like LocalNow target news programming by location And a new report from TVREV shows younger viewers are still watching local news, many on streaming. Data from TiVo’s Q2 report also found that of all time spent watching video 22.6% was spent on different types of local content.

On the flip side, national news still has a place with stories that continue to have “massive interest,” Nakano said. Samsung TV Plus has deals with CBS, NBC, ABC and Fox to bring a local slant to national news stories. Weather is also driving engagement, particularly around major events like hurricanes.

“We’re seeing these definite spikes in news, but we think that the way we’re delivering both local news, national news, and weather on a DMA by DMA basis, specifically targeting the user makes for a better consumption experience for the end user,” he said.

Nakano also cited an appetite for general entertainment be it procedurals, documentaries or movies, saying programming that people have grown to love on traditional TV “works on [Samsung] TV Plus.”

Single-series IP/binge channels:

Single series IP or what STVP calls “binge channels” are a linear FAST channel that plays episodes from a single (often long-running) TV series all day, in part with the the idea that users don’t need to pick a specific episode to tune in. Several FAST platforms and services utilize them, but are people actually watching?

According to Nakano, for STVP the answer is yes: “Single IP channels, they work great,” he said.

He declined to share specific data or name names in terms of where STVP sees the most engagement, but noted Samsung was one of the first to launch a single IP channel with "Baywatch" in 2019.

“I’m shocked. But these are great shows that were created years and years ago,” he said, noting many series are largely unknown to younger generations, who might tune and discover earlier hit shows like “Modern Family” or “Grey’s Anatomy.”

“This is our way of bringing back great programming to the masses, to either find a new home for something that was lost or potentially missed out on and revitalize,” he said.

Still, it doesn’t mean they stick around forever, as the content lead noted this form of content tends to see increased engagement right at the beginning but then slowly tapers off.

But while Samsung won’t keep a binge channel going indefinitely, as the audience adapts and changes, the channels can come back at a certain point in the future - possibly surfaced in a different manner such as within what STVP calls compilation channels.

“Great programming is still great programming,” he commented. The point is to bring content people might not know about or had forgotten about, while helping owners monetize their own libraries. And Samsung works closely with rights holders to window properly, he added.

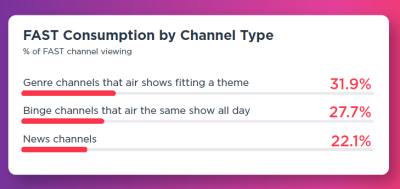

TiVo’s data also shows viewers are taking notice of genre, binge, and news channels on FASTs. TiVo noted binge channels that air the same show all day saw an increase in Q2, now capturing nearly 28% of total viewing time on linear FAST services.

Sports:

As far as genres, he called out sports specifically, saying the ecosystem has been turned on its head but that it will be exciting to see how everything shakes out.

“I believe that sports has a place on FAST,” Nakano said.

How that actually plays out remains to be seen, but he pointed to major and minor sporting events and leagues all struggling with reach to garner the largest number of viewers as the pay TV model continues to lose subscribers.

And Samsung isn’t just looking in the U.S.

“We believe that we do have a mechanism, not just domestically but internationally as well. With the push of a button we can deliver a game, a channel, a VOD experience to 24 countries, over 500 million devices, nearly instantly,” he said. “So that’s an exciting proposition for the future.”

On STVP’s FIFA+ channel, launched in August, viewers in Brazil and Italy could already catch full live matches of the FIFA Women’s World Cup.

Linear vs VOD:

As Samsung TV Plus thinks about programming, it also considers what environment it is best suited for, be it linear or on-demand.

In Nakano’s view, news is best consumed in a linear “stream of television consciousness” environment. “You’re not necessarily hunting and pecking for stories that you may want to watch.”

Whereas more serialized shows with story arcs and multiple episodes are more suited for on-demand.

The approach at STVP is to look at content, think about where it fits best and how to expose it, “and not necessarily shoehorn it into something that it wasn’t designed for,” he said.

FAST linear also becomes a way for viewers to sample content, say from a binge channel that piques a user’s interest, which then helps drive viewership into the VOD realm where they can deep dive after a small exposure on linear to something they weren’t originally seeking.

“We see that type of engagement, where people then go to VOD to say I’m addicted to this and I want to watch more,” he said. “That’s the type of flywheel effect that we’re interested in creating.”

And he indicated there could be an intermingling of linear and VOD environments on STVP.

Surfacing content to those who want it, filling content gaps

To Nakano, every piece of content has an audience and someone that loves it, and a benefit of FAST is it’s not constrained by time like broadcasters looking to fill an 8 pm hour. So a key aim is to make different IP available to different users that may be interested, no matter the time of day.

“We have the flexibility to really deliver interesting content to users throughout our ecosystem 24 hours a day. And people watch it all hours of the day, all hours of the night, different types of programming.”

Nakano acknowledged that STVP does have content gaps it could be shoring up, and some will be filled through on-demand.

“You’ll see is a concerted effort in driving more on-demand consumption, usage, discovery on our platform, we think it’s a huge opportunity,” he said, as up until now STVP has been more linear focused. And expect an evolution to a more “360-degree content consumption mechanism.”

He also questioned what kind of new content will be created for FAST over the next decade or two. “I think that’s what’s really exciting. How do you take a fully addressable, fully measurable, two-way experience with an end user and how do you bring content that’s for the masses.”

Going back to a 360-degree mechanism, he said that could be through linear, VOD or “a mashing of the two.”

As for STVP’s programming priorities, attention is mostly focused on broadening its content offerings.

“We are always on the hunt,” Nakano said, while it adding it doesn't make sense to keep stale content that isn't performing on the platform.

However, Samsung isn’t necessarily interested in exclusive content. The viewership pattern of users isn’t to leave the platform if they can find content elsewhere, he explained. Instead, the first things the company looks for is differentiated and tailored programming as content owners seek distribution.

“It’s really, how do we create a bespoke unique experience on Samsung TV Plus to drive engagement,” as that’s what both STVP, content owners and users are looking for.

While at the end of the day Samsung wants enough programming volume to satisfy any user, Nakano said it’s not about the number of VOD assets or the right number of linear channels.

“It really comes down to how do you bring that one piece of IP to that one user that’s going to be very much interested in and drive engagement that way. And there’s a lot of art and science that goes into this,” he said. Samsung’s device information plays into the understanding of what people might be interested in and he said the company is moving in a direction where it can deliver content in a unique way.

Brand safe environment, high bar for quality of experience

A key aspect as STVP builds out the platform and programming is a brand and advertiser safe environment, where it offers an experience with content that’s friendly for the entire family to view.

“We're very stringent on this idea of … if it’s safe for broadcast it’s safe for TVPlus,” he said, adding that it’s not always easy to do and some partners push back.

But ultimately, he said, the company believes the way STVP is integrated into its device hardware, that advertisers prefer a brand safe environment, as do users, to know there’s not going to be profanity or nudity within the experience – guardrails it’s “highly focused on.”

In its expectations from partners Samsung also is very focused on the engagement experience – particularly if a channel isn’t created with care – as Nakano said STVP is “ultra-sensitive when it comes to quality of experience.”

That means it expects ad breaks where they’re supposed to be and not in random spots or the middle of dialogue, proper aspect ratios that aren’t stretched disproportionally, and anomaly-free programming with good video quality and quick startup and playback, mirroring an experience of traditional TV.

“A lot of partners can’t meet these standards,” he said.

Quality of experience is key as the TV landscape continues to shift, and Samsung sees big opportunity to bring a breadth of content to users on the 65-inch+ living room screen.

“We've become a place where people come to find content that they weren't really looking for and people find themselves watching at longer, longer clips…every week, every month every and all parts of the year,” Nakano said.