TelevisaUnivision’s ViX is poised for rapid growth in the Americas this year according to a new forecast from Ampere Analysis. The firm predicts the Spanish-language streamer will grow its subscriber base by 18% in 2025 to reach 10.5 million paid customers in the region.

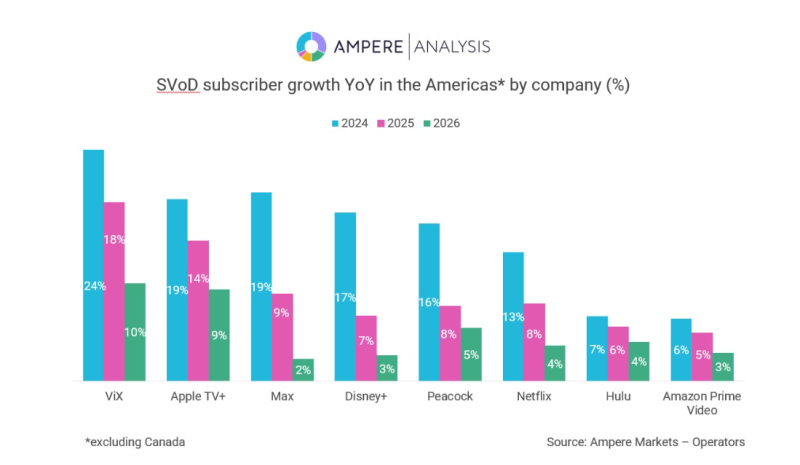

That growth rate is expected to make it the fastest-growing major subscription streaming service (major meaning those with more than 2 million subscribers) in the Americas, excluding Canada, outpacing anticipated increases for Apple TV+ (14%) and Max (9%) this year. The remaining global streamers are all expected to have lower growth rates.

Ampere cited ViX’s tiered pricing structure as one of the factors helping to capture audiences and drive growth.

ViX debuted three years ago and has expanded to include a completely free tier alongside both ad-free and ad-supported subscription models. During that time TelevisaUnivision grew the ViX subscriber base by 70%, per Ampere. A lot of that growth came early, as TVU reported 7 million paid subscribers on the ad-free SVOD tier at the end of 2023. ViX’s ad-supported subscription plan only debuted in May 2024 and at that time ViX disclosed 50 million monthly active users globally (though note, MAUs is a different metric than paid subscribers).

Speaking to StreamTV Insider this May, Rafael Urbina, president of Streaming and Digital at TelevisaUnivision said, to-date, ViX is delivering incremental audiences, reaching 28 million US video viewers across its tiers and growing streaming hours per user by over 70% versus the prior year.

And ViX has already achieved profitability, which continued in Q1 despite a revenue dip for the larger TelevisaUnivision.

“As most streamers shift focus from chasing subscriber growth to achieving profitability, ViX entered the market with a clear strategy, offering tiered options from the outset,” said Deborah Polanco, analyst at Ampere, in a statement. “While competitors are catching up with ad tiers and implementing password-sharing crackdowns, ViX has already become the third global streamer to reach profitability, and in record time.”

Also propelling ViX’s quick expansion is key strategic partnerships with major telcos in the US for hard bundles, including last year’s deal with Charter, which now offers ViX as part of its Spectrum pay TV packages at no extra cost to consumers. Per Ampere, the Charter agreement will add 900,000 new ad-tier subscribers for ViX from 2024 and into 2026.

Retail partnerships in Mexico are also providing a boost, the firm said, including with OXXO and Mercado Libre, alongside a new bundle deal in the country with Disney+.

Content catalog key to growth

In addition to strategic partnerships, ViX’s extensive content catalog and focus on culture to resonate with Spanish-speaking audiences has been key.

According to Ampere’s data over 40% of US ViX subscribers cite a wide choice of movies and TV as a main driver for choosing a subscription platform. Since launching in 2022, ViX has doubled the size of its SVOD library, adding more than 2,500 distinct titles – expanding its lead “as the largest Spanish-language content streamer in the world.”

As it bolsters viewing options for consumers, the streamer has brought new formats and genres into the mix. At this year’s Upfront TelevisaUnivision announced content expansions of vertical video original microdramas, always-on 24/7 reality formats and new music offerings, among other additions.

But older content also continues to be a draw, thanks to TelevisaUnivision’s large catalog of legacy content in two key genres that keep resonating in Latin America. That includes the crime & thriller genre, which is 20% of TVU’s catalog and was the most commissioned main genre in Latin America in the second half of 2024, per Ampere. Second is the romance genre (18% of the TVU catalog), which the firm said reflects Latin America’s “enduring telenovela culture.”

And it’s not just subscribers.

The firm said ViX also takes pole position in streaming advertising growth, helped by its unique “freemium” business model with varied pricing tiers that “has helped it capture the Hispanic/Latino audience across the US and Latin America.”

TVU’s Urbina told STV Insider last month that the fastest-growing segment of the ViX audience is tuning into the Premium with Ads subscription tier, which provides expanded content access with a limited ad load. Live sports events like Copa America and UEFA Euro helped drive viewership spikes, the exec noted.

In 2025, Ampere forecasts that 60% of ViX revenue will come from advertising on both free and premium ad-supported tiers, with an additional 36% of revenue contributed by the ad-free subscription tier.

“ViX has maximized viewer demand for Spanish-language content. Its unique hybrid business model offers a variety of subscription tiers and a vast catalogue, appealing to all audience types. Its stronghold in the Americas and deep understanding of Spanish-speaking audiences have allowed it to effectively monetize through advertising, which now drives the majority of its revenue,” said Natalie Cruz, analyst at Ampere, in a statement. “With these advantages, ViX is well-positioned to continue outpacing competitors in both subscriber growth and revenue expansion, particularly through advertising.”