A new Nielsen study highlights the reality of content choice fatigue, finding viewers on average are spending more than 10 minutes to sift through an increasing array of options, sometimes without success. The sea of choices is so vast that 20% of viewers, or 1 in 5, say they weren’t sure what to watch and couldn’t find something from browsing, so opted to ditch their viewing session altogether and do something other than watch TV instead.

In Nielsen’s 2023 State of Play report, using data from its content metadata arm Gracenote, the research finds viewers on average spend 10.5 minutes searching for something to watch. That’s better than the over 11 minutes spent in October 2022 but still significantly longer than the 7 minutes 24 seconds averaged in 2019.

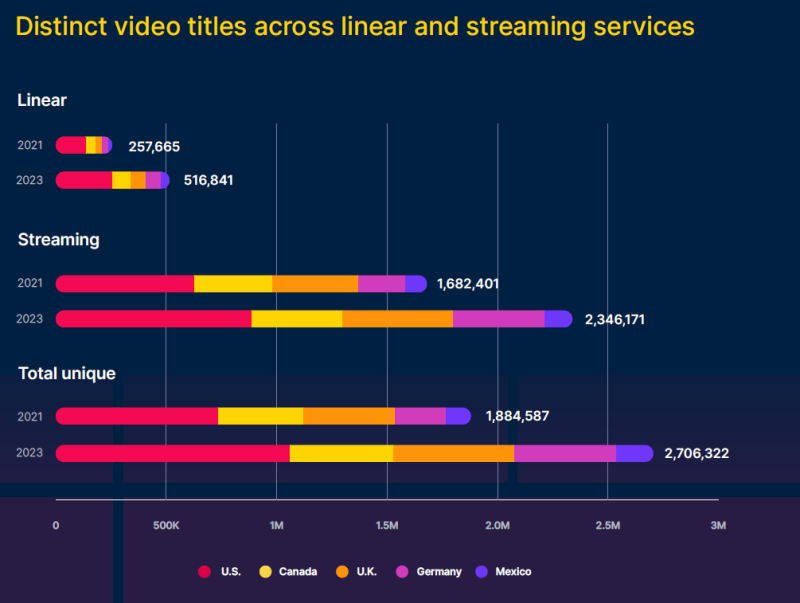

And they are browsing through a growing abundance of titles. Across the U.S., U.K., Canada, Mexico and Germany, Gracenote found the number of unique titles across cable and streaming has ballooned from 1.88 million in 2021 to over 2.7 million in 2023 – with over 87% of those available on streaming.

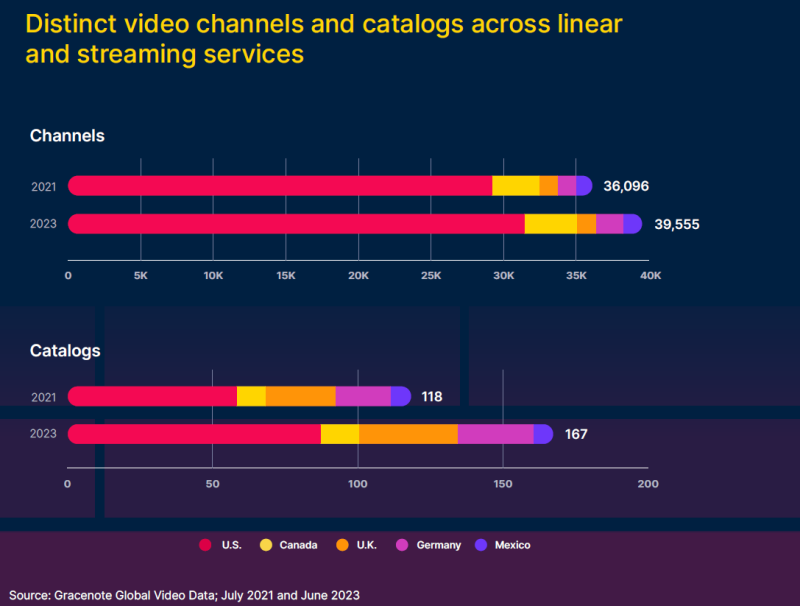

It’s not just the number of titles available that’s causing friction, but also the mountain of streaming sources and channels for where to find content. Looking at distinct channels where consumers can find content across FAST, streaming providers and aggregators, the report found the channel number across regions is approaching 40,000. These represent unique channels, such as ABC or a FAST channel on Paramount Global’s Pluto TV like Flicks of Fury. The U.S. accounts for nearly 80% of all channels.

When it comes to just free ad-supported streaming TV (FAST) channels specifically, Gracenote’s Video Data recorded 1,434 individual FAST channels in its database as of June 2023, with 1,073 of them available in the U.S. And the industry isn’t showing signs of abating just yet. Newly joining the FAST ecosystem last week was TV-maker TCL, which debuted a new streaming service in the U.S. including on Google TV and Roku, called TCLtv+.

“As individual FAST services increase their channels—many of which include several hundred—success will hinge on their ability to quickly connect viewers with content they’re looking for,” wrote Nielsen in the report. “That point, which is critical across all streaming services, becomes even more critical when you consider that many channels and programs are not exclusive to individual services.”

While SVODs have previously spent heavily on original programming, the report also highlighted time viewers spend with older TV shows and a shift towards non-exclusive and licensed content as media companies look to expanded distribution as a way to monetize content.

Per the report, in the U.S. 60% of time spent streaming in May 2023 was on programming that first aired on linear channels, or acquired content, reflecting a 5.2% bump from October 2022. Of the top 25 most-watched streaming titles in the U.S. for women aged 18-34 in 2022, 18 were older TV titles, with “Grey’s Anatomy” and “Gilmore Girls” clinching the top spots. These older TV shows accounted for 73% of the time spent viewing for all 25 top titles by that demo. And 60% of the time men in the U.S. age 18-34 spent watching the top 25 streaming programs in 2022 was dedicated to acquired titles, representing nearly 43 billion minutes.

The trend of acquired programming can be seen with media companies hopping into the FAST game, including NBCUniversal, which brought nearly 50 FAST channels to Amazon’s Freevee and Xumo Play . More recently it added additional channels to The Roku Channel and Google TV and Android TV. Platform players themselves are expanding free content, such as Google TV’s live channel experience featuring more than 800 channels from various FAST providers. Warner Bros. Discovery also inked FAST deals for linear-style and on-demand titles to Tubi and Roku. And in a shift away from keeping premium content for its own platform, WBD licensed popular HBO titles to rival Netflix.

With shifts in content and the proliferation of services, Nielsen’s Gracenote believes personalization and the ability to surface relevant content – both for viewers and advertisers that want to align with specific programming or genres, will be key to success.

“Right now, there are tons of experiences, but very little personalization,” says Filiz Bahmanpour, VP of product at Gracenote. “Many say that FAST services will need exclusive content, original programming and marketing to succeed, but I think user experience and personalization will be the real differentiators. FAST services need to get the right piece of content and ads to the right user through merchandising, curation and algorithms.”

Gracenote touted its own solutions, with content IDs and content metadata including a library of around 15,000 Gracenote Video Descriptors. Nielsen pointed to content metadata as providing deeper views for categorizing content and context around why viewers might like it, such as mood, theme, setting and scenario - helping platforms with content discovery. In addition to assisting platforms with viewers’ choice fatigue via personalization and recommendations, it can help advertisers that are seeking transparency around the content their advertising against or contextual opportunities around network and genre to improve targeting and monetization.