American advertisers across six major sectors are losing out on $141 billion of ROI collectively because of inefficient harmonization of their linear and connected TV budgets.

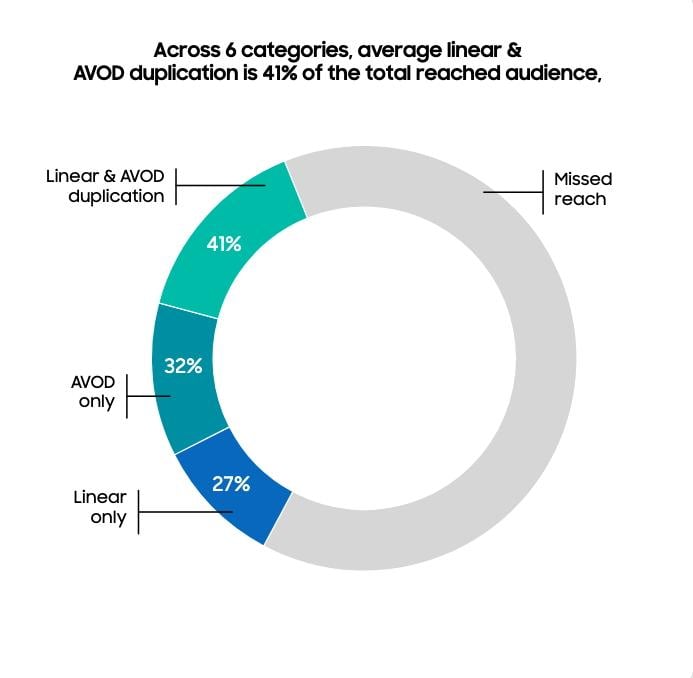

That’s the conclusion of Samsung Ads, which collected ACR data across 18 advertising campaigns spanning automotive, telecom, pharmaceuticals, financial services, retail and quick-service restaurants (QSR). The Korean electronics giants ad division determined that 41% of advertising impressions were duplicated across CTV and linear platforms.

Samsung Ads places the value of that duplicated ad time at around $9.3 billion. If that money were to be reinvested in more efficient way — with an average return of $15.16 per ad dollar — it could deliver as much as $141 billion in additional sales across the six economic sectors, Samsung said in its “Missed reach, found revenue” report.

Presenting this data at the StreamTV Show in Denver last month, Samsung Ads thought leadership chief Justin Fromm also offered about the report to StreamTV Insider.

“We have line of sight across all these ad campaigns that run on linear and streaming [platforms] through our first-party data. And we're able to identify the portions of those campaigns that are reached to streaming-only viewers, linear-only viewers, and then viewers who are actually reached with those ads both on streaming and linear. It turns out that 41% of campaign reach,” Fromm said.

Meanwhile, measuring duplication across specific linear networks and apps, Samsung Ads found that there was a striking 34% redundancy across NBC and YouTube.

In terms of sectors, the company also found that telecom had the highest duplication — 58% — followed by retail (54%). Financial services had the least, 22%.

Samsung and Fromm are, of course, pitching something here — in this case, it’s peddling its Optimal Reach solution, which the company claims helps improve cross-platform advertising efficiency through improved insights, targeting and reporting. The company says that users of the solution can improve incremental cross-platform reach by as much as 47%.

“If you can shift some of that 41% [duplication] to new audiences, reach a larger proportion of your target audience, the potential revenue based on return on ad spend is that Carl Sagan billions and billions over,” Fromm said.