Apple TV+ and Amazon Prime Video were most deft in June at “merchandising” their digital wares across a myriad of platforms and territories, while recession-leery consumers are shifting dollars into ad-supported streaming tiers. Those are some of the major takeaways from three compelling research reports focused on the U.S. streaming market and simultaneously published at the top of this week.

We’ll start with Looper Insights, a London-based SaaS analytics provider that specializes in helping streaming companies keep track of and optimally position their movies and shows around the world. Two decades ago, studios would hire consultants to help them keep track of where physical media (like DVDs and Blu-rays) were being merchandised in locations including far-flung big-box stores. For example, if a Hollywood supplier negotiated prominent “end-cap” shelf space at Tesco in the UK, it would need someone to audit that product placement and make sure the distributor received what it paid for.

Looper, which works with all the major Hollywood studios, is trying to do the same thing in the streaming era, essentially helping clients answer the question, “Where’s my stuff?”

The company has come up with a proprietary metric that attempts to measure the marketing value of how content titles and the apps they live in are positioned not only on the UXs of the various TVOS platforms, pay TV services, digital stores and other online gateways, but also the vast array of territories in which they are distributed. Looper calls this metric the “dollar media placement value,” or $MPV for short. The larger the $MPV, the more value the title or streaming service is getting in terms of its virtual prominence, visibility and impressions.

Looper Insights recently rebranded its monthly ranker (it was previously called the “Merchandiser of the Month”) to “Streamer of the Month.” In its most recent ranking for June, the firm, using its $MPV formula, determined that three of the top four titles getting the most bang for the buck in terms of placement visibility and value came from Apple TV+ — Major League Soccer, MLB’s Friday Night Baseball package and the new Owen Wilson comedy Stick.

Meanwhile, Amazon Prime Video, which had six titles rank in the top 10, was the top streaming app overall in terms of placement prominence.

This week Hub Entertainment Research and Antenna also each released separate reports that were somewhat complementary, revealing increasingly dollar-conscious consumers steadily migrating to ad-supported services.

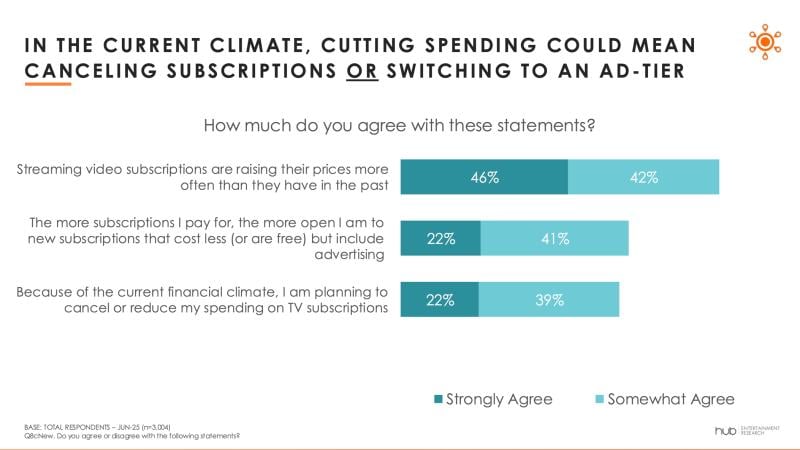

In the latest iteration of its "TV Advertising: Fact or Fiction" report, Hub sets a backdrop of a consumer market that is, amid factors including the president’s tariff war, growingly concerned about the global economy. While 39% of the 3,000 U.S. adults Hub polled said they had concerns about a recession just before the election last November, 49% said they were worried about it in May.

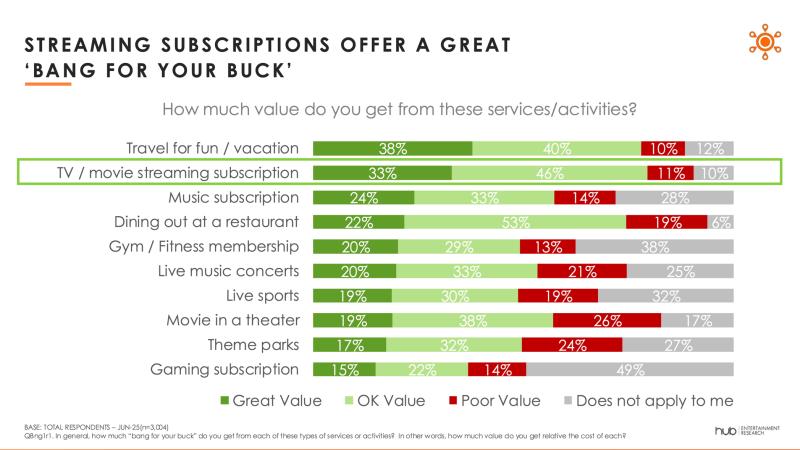

Still, subscription streaming has maintained high value for consumers — nearly 80% of Hub survey respondents said streaming video subscriptions deliver “great” or “OK” value for their recreational dollar, second only to vacation travel.

Nonetheless, survey respondents also indicated a willingness to trim their subscription streaming budgets.

In fact, a majority of consumers (61%) indicated that they’re doing some level of planning on either cancelling subscriptions or downgrading to an ad-supported tier. Fortunately for the video business, the latter option seems to be a favored one.

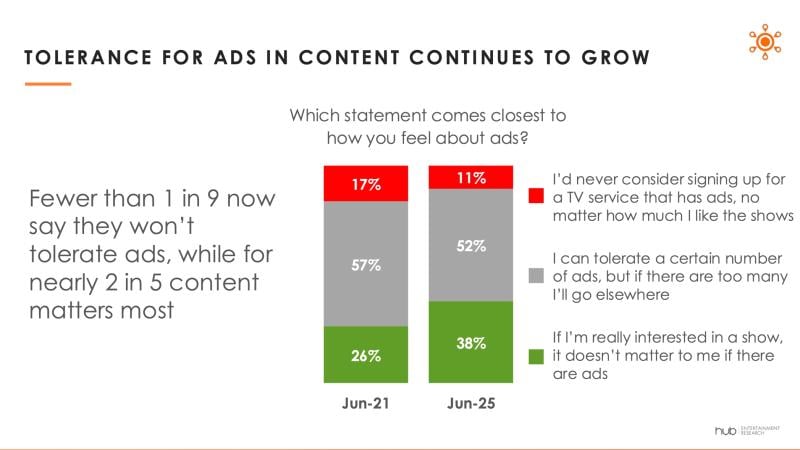

Hub found that fewer than one in nine survey respondents said they won’t tolerate ads in content.

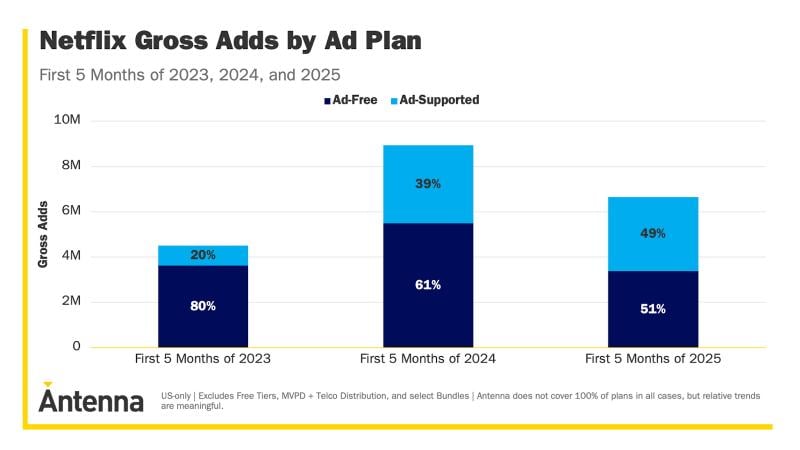

As consumers have become less resistant to advertising, Netflix’s subscription tier with ads now accounts for an increasingly large portion of the leading streaming company’s subscriber signups or gross adds. This is according to separate data published in Antenna’s latest “Insights Blog,” titled “A Whole New Netflix."

Introduced less than three years ago, Netflix’s cheaper ad-supported tier accounted for 49% of signups in the first five months of this year, Antenna said.

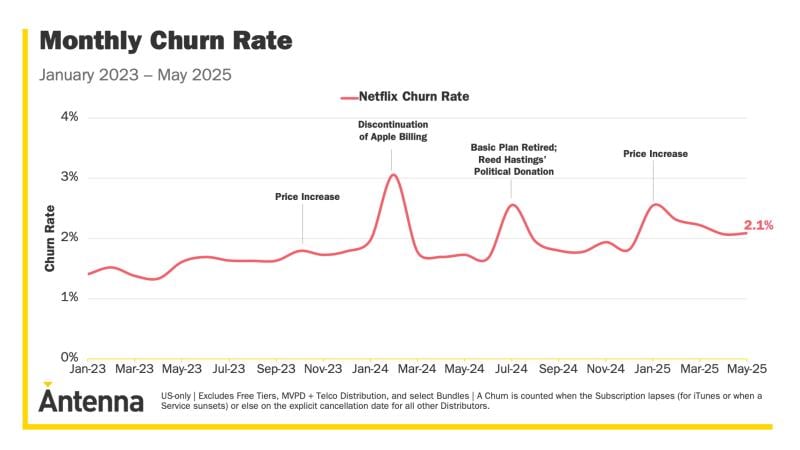

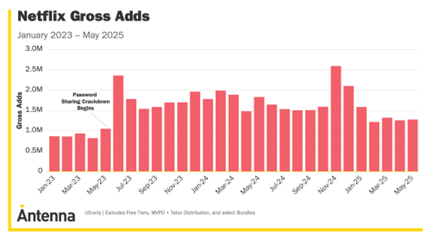

Meanwhile, examining other aspects of Netflix’s business, Antenna took note of the streaming company’s sudden gross subscriber adds uptick in mid-2023 as it began pushing off password-sharers, converting “longtime users” into “first-time subscribers.” As the graphic below indicates, that surge might be moderating for Netflix.

Antenna also examined Netflix churn (which is the best in the streaming business, coming in at 2.1% monthly).