What’s old may be new again. It looks like shifts in consumer sentiments and streamers’ priorities are aligning to bring bundled video offers — as old-school cable companies did for decades — back into vogue for streaming.

Enter the super bundle. The idea is an aggregated bundle of distinct services that users can access, manage — and importantly, pay for — through a single provider or touchpoint. Along with greater ease, super bundles would offer discounts on price compared to the services individually, potentially alongside longer subscription term periods.

But as John Buffone, VP and industry advisor for Media Entertainment & Connected Intelligence at Circana, pointed out, the concept of bundling top content from various providers, with one entity controlling the billing relationship, isn’t new. It’s something traditional pay TV operators have done for years.

Where it is new is streaming, sort of.

The concept of bundling isn’t exactly new to streaming either. One example is the Disney+/Hulu/ESPN+ bundle. A super bundle differs in that it brings together multiple subscription services from various, sometimes competing, companies into one single-billed discounted offer, rather than a bundled offer of assets owned by a single entity. It’s also been called an inter-network bundle by Aluma Insights analysts.

“Content owners that have long battled head to head in the SVOD space are about to engage in strategic bundling with competitors,” said Aluma Insights founder and principal analyst Michael Greeson, in a July blog post. “This is not some kumbaya moment for the streaming industry, but a strategic necessity for SVOD operators, much as joining cable TV was for over-the-air broadcasters in the 1970s. It’s about survival in an increasingly competitive marketplace.”

Super bundles have potential benefits, not only for consumers, but also for streamers looking to grow and reduce churn in the face of saturation. For a look at why consumers could be primed for streaming bundles read here.

Who is best positioned?

So who is best positioned to offer these so-called super bundles?

Telcos are one cohort interested to complement their service offerings while platform players like Amazon, Apple, Google, and Roku, which have premium video offerings, could also be in play.

In a recent Horowitz Research survey, when asked which providers users would consider for a streaming subscription bundle “consumers overwhelmingly preferred” going through an internet or MVPD provider, with the firm also citing Amazon as “a major contender.”

Telcos

Recent data from Bango found high interest from telcos globally in offering super bundles.

In a survey of 115 U.S. and U.K. telco leaders, Bango found the need to create new revenue streams as the number one priority and 68% citing it as “high priority.” To that end 82% said they believe super bundling will now be “vital” to their customer acquisition and retention strategies.

Verizon in the U.S. and Optus in Australia with Subhub are already pursuing this path. Verizon’s +play subscription aggregator platform features more than 30 services, including Netflix, Max, and Disney+, among other subscriptions such as music and lifestyle. Bango’s tech platform, which it likens to a subscription vending machine, powers Verizon’s +play behind the scenes.

Verizon in June started promoting a +play bundle of Netflix’s ad-free Premium plan paired with Paramount+ with Showtime, marking the first time the SVODs were offered together.

Speaking to StreamTV Insider, Bango CMO and co-founder Anil Malhotra laid out the two main benefits to streaming services from telcos offering super bundles: One, access to a larger base (Verizon has over 143 million customers in the U.S.). Two, a pre-existing billing relationship with all subscribers on its network.

“That kind of friction, that sort of problem area for consumers is dealt with by telcos,” he explained, meaning less roadblocks for streaming services.

Malhotra also cited ancillary benefits, saying telcos will sometimes bring a piece of their large marketing and subscriber acquisition budgets to the table, which ultimately helps streamers’ bottom line.

“I think there’s an increasing recognition of the power of these kind of bundles and offering incentives,” Malhotra said.

Still, Buffone cautioned there could be risks if providers don’t handle super bundles in a consumer-friendly manner that deliver flexibility and choice.

“The risk here is that these bundles, if not managed in a thoughtful way by these providers, could turn back into the legacy cable TV business where the consumer gets frustrated that they have to subscribe to a lot of things that they don’t use or don’t use too often,” he said. “That’s where the big risk lies.”

Platform players

Aluma’s Greeson has been touting the concept of what he dubs Pay TV 3.0 for several years and believes platform players are best positioned to offer so-called inter-network bundles.

In a July post, the analyst named large tech-media companies with their own aggregation platforms as the most viable players, including Alphabet, Amazon, Apple, Comcast and Roku.

“Each of the five offer branded hardware and their own SVOD service or TV network, a combination that conferred strong competitive advantage,” wrote Greeson, noting they have a presence at each link of the video chain including content, platform, devices, and services. “That doesn’t mean other aggregation schemes (e.g., Verizon’s +Play) won’t work, only that it will be more challenging for those without the breadth of ownership that large tech-media companies enjoy.”

Buffone agreed that platform players such as Apple, Amazon, Roku and Google are in a strong position to start offering these types of bundles. Factors he sees in favor of those companies include large-scale operating systems and their own premium video services that can be part of the bundles. The other aspect goes back to the billing relationship.

“For the consumer, a large part of the benefit isn’t just the bundle at a discounted price, it’s the single billing relationship,” he said, noting many already have that with providers such as telcos and Amazon. The same can’t be said for TV OEMs like Vizio, the analyst explained, which while boasting a TV platform and free streaming product via WatchFree+, doesn’t have that existing payment relationship beyond purchasing hardware.

Circana’s March TV Switching Study survey of people who said they’re likely to add an SVOD in the coming six months also hints how integrated billing plays into subscriber acquisition. Asked about their preferred streaming sign-up method, be it internet provider, app, Roku Channels or other, 24% said they opted for a particular route because of a pre-existing billing relationship with the provider, while 36% cited good customer service.

Addressing streaming’s churn issue

Streaming services don’t always want to play nice with competitors, but the two main goals of participating in a super or inter-network bundle together, according to Buffone, are to acquire subscribers and to reduce churn.

“I think the vast majority of these strategies are going to be based on trying to achieve one or both of these endpoints,” he said.

One of the things that makes streaming services appealing — the easy ability to sign up or cancel — has also resulted in a churn issue as some viewers will simply subscribe to a service just to watch certain content or for a short period of time before hopping to a different one.

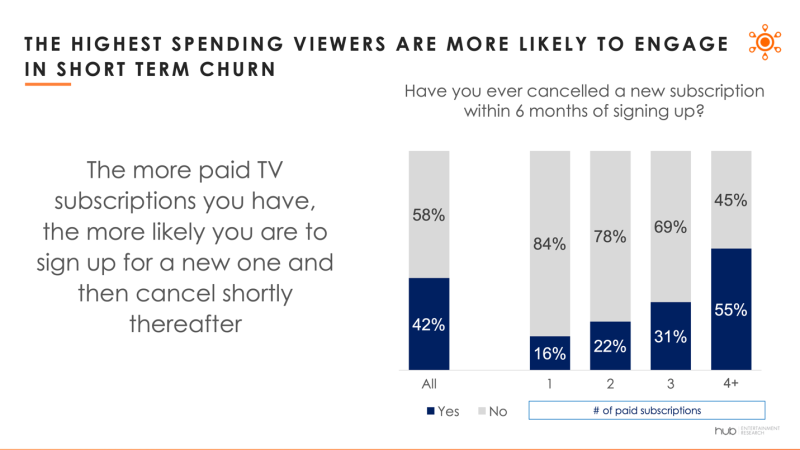

Hub Entertainment recently found that 40% of consumers say they’ve signed up for a subscription to watch just one show, while 42% say they’ve signed up for a new service and dropped it within the first six months. Younger viewers and those that spend the most on TV are also more likely to drop a subscription soon after signing up — with almost 60% of Gen Z viewers doing so and 55% of those who have four or more paid TV subscriptions.

Over the past three or four years the industry has seen companies bundling their own streaming assets. This can be successful, Buffone said, as one service in the bundle might keep a viewer engaged if the other doesn’t have any current programming they want to watch and vice versa, noting it sounds a lot like the cable TV bundle that was developed decades ago.

But bundling with other services could gain traction since streamers are reaching saturation and need new approaches to grow and keep customers from leaving.

“What we're finally beginning to see examples of is streaming companies hitting subscriber growth maturity, and hitting that maturity, oftentimes a year or two earlier than their initial forecasts were because of the pandemic fueled viewing that occurred and the increases in subscriber bases,” Buffone noted.

These companies are looking for new product packaging approaches via bundling that will continue to grow their subscriber base, and possibly most importantly – to minimize churn, he said. “So it’s not surprising that at time when we’re seeing subscriber maturity hit for a lot of the major services that you’re also starting to talk about concepts like the super bundle or bundling your service with a competitor."

He pointed to Amazon’s February move to bundle MGM+, formerly Epix, with Lionsgate’s Starz at a discount via Prime Video, saying they had basically been two competing premium TV networks.

“Notably, now those two are bundled together in a discounted offering, something you wouldn’t’ necessarily expect to see,” he said.

It’s one example of how Buffone sees Amazon strategizing to use owned and operated assets like MGM+, while also leveraging its distribution platform like Amazon Channels, to ultimately grow the collective business of both Amazon-owned video assets and that of its streaming partners like Starz via bundled offers.

Drawbacks vs. benefits

Subscriber acquisition and churn reduction might incentivize streamers to be more open to bundles, but do they outweigh drawbacks of having a subscription relationship managed by a third party?

For years media companies have been trying to determine the benefit versus drawback of having a direct customer relationship versus outsourcing it to another party, according to Buffone. And favor may be tipping in the direction of the latter.

“It tends to take a very large amount of scale for retaining the customer relationship to be beneficial,” he explained, noting major players such as Disney might benefit. However, a direct relationship requires customer service mechanisms, staffing and infrastructure that in a third-party scenario someone else might handle for those less equipped.

In that sense, streaming service aren’t necessarily giving up a portion of their revenue by bundling, but rather paying a price to get a service in return, he said. The question then for streaming services is “does that financially make sense or not?”

The other big question for streaming providers, per Buffone, is around the control and potential loss of some data when a company is selling a service through a third party.

“As you see these companies reach subscriber maturity, it’s harder to acquire new subscribers, managing churn becomes more challenging,” he commented. “It’s more attractive to allow for a little less access to all of the data in order to be able to achieve that growth and minimize churn, where in the early days of their subscriber business, that didn’t make much sense.”

And in Greeson’s push for inter-network bundles, he summed up some pros and cons: “While service providers lose a bit of profit, they gain a guaranteed 12-month contract. And while consumers lose a bit of flexibility, they gain discount pricing and other benefits.”

The analyst suggested allowing subscribers to periodically change their five or so apps within a bundle during the contract period, such as at a six-month mark.

“While this would reduce subscription periods to six months versus one year, it would discourage app hopping,” Greeson wrote.

One aspect where streaming services will need to take a hard look is whether they’re pairing with a complementary or competitive service.

“That’s where I think we’re going to see some wins and losses,” Buffone said. For example, he could see combining the Hallmark channel with other lifestyle programming as a big win. There, he sees a complementary programming pairing, where a viewer is less likely to unsubscribe to one as the other service fills in a gap.

Where challenges could arise, he said, is if two services with very similar content were part of the same bundle.

“It’d be cannibalistic, the companies bundling that way,” Buffone said.

More willingness, experimentation

Taken together, changes in the industry could mean streaming services are more likely to consider super bundles and an upcoming period of product packaging experimentation.

“The focus in the industry is more on content monetization than it is subscriber growth right now. And I think that's going to drive more willingness to consider being in a bundle with a service that's not your own company’s service,” Buffone said.

Malhotra meanwhile noted that in Bango’s experience some top tier players are, as he characterized it, more engaged, in terms of what they want to offer, in which market, and with what partners. In that case, they’ll tend to negotiate deals themselves directly with partners they’ve picked and then deploy services through Bango’s tech. Others, meanwhile, “are actually happier to be offered alongside peers and indeed even competitors."

Some media companies have also weighed in on the outlook for super bundles. Speaking at an investor conference earlier this year Warner Bros. Discovery CEO David Zaslav pointed to potential for SVOD consolidation through bundling services.

“For me, it seems very clear that if we were to package this great product that we have with others, if you were to wake up tomorrow and in each market the number one, two, or three products for a specific price, it would probably reduce churn. If we don’t do it ourselves, I think it’ll be done for us,” Zaslav said in May (without commenting further on specifics of when that might happen or how it might look).

And it looks like experimentation is under way. Just this week, Google disclosed plans for a YouTube TV offering that will bundle the Max SVOD service with the NFL Sunday Ticket package on the virtual MVPD's base plan.

As streamers explore bundles, Buffone pegged product packaging experimentation as a key theme for the industry in the next two or three years. He expects streamers to test what’s working and what’s not to see what pairings are most effective, and ultimately measure the net positive impact on churn for having done so.

“The super bundle is no different than subscription tiers. It’s just product packaging strategy. And now that we’ve hit more maturity across a larger part of this industry, streaming, we’re going to see more mature product strategy surface,” he said.