Some advertisers are still wary of high prices associated with addressable TV, according to Ampere Analysis, but the firm found that those who already employ the method see addressable advertising as very cost effective, and its latest report forecasts significant sector growth over the next few years.

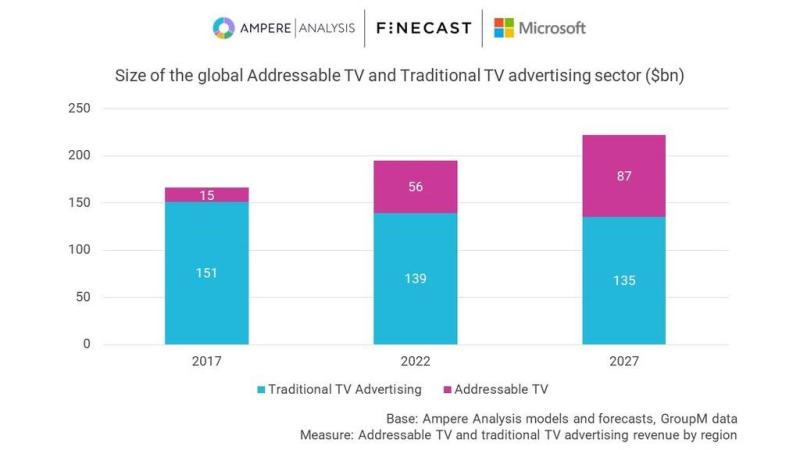

As of 2022 addressable TV advertising accounted for one-sixth (17%), or $56 billion, of global TV ad revenue – compared to $139 billion that traditional TV ad revenue generated. Worldwide, addressable TV revenue is expected to climb to $87 billion in 2027, with the method capturing one-fifth of global video ad buying.

Ampere’s report, commissioned in partnership with GroupM’s addressable TV product Finecast and Microsoft Advertising, outlines the potential and best practices for the medium, and defines addressable TV as encompassing an array of platforms and technologies (including video on-demand, AVOD, FAST, SVOD, linear, smart TVs and so on), which allow advertisers to buy TV inventory in a targeted way.

In the mature North American market, addressable TV drove a greater share, generating more revenue than the rest of the world combined in 2022 at $35 billion, with North American revenues forecast to grow to $52 billion by 2027. Comparatively, addressable TV is projected to deliver $18 billion in revenues in Europe and $15 billion in APAC by the end of the forecast period.

Ampere's report outlined core drivers for the larger addressable market, such as broader awareness of the format among buyers, alongside more comfort with the capabilities and effectiveness, as well as greater population reach and higher volumes of inventory thanks to more consumption on existing services. In addition, Ampere said the market will be bolstered by services moving into the addressable TV realm for the first time, such as hybrid SVOD/AVOD players that open up new pools of inventory. New ad formats and additional screens were also cited as drivers of addressable TV growth.

Addressable TV reach in in North America is 85% as a percentage of homes, according to Ampere, which noted that the reach is fragmented across platforms. In April, DirecTV and Dish Media teamed up with new products aimed at simplifying workflows for programmers by removing the need for custom integrations for addressable linear TV, cutting time and effort required across different and multiple distributors.

While aggregating inventory is one way to make it easier to buy across platforms, the report questioned if the industry is in need of tools to de-duplicate audiences split amongst platforms.

As for top reasons advertiser are leveraging addressable TV, according to Ampere they include: incremental reach – particularly for younger viewers who are tough to find through other methods; creative optimization, targeting audience segments with creative-specific messages; brand awareness plus performance marketing provided by addressable TV; cost savings, with the method up to 50% more cost-effective than traditional formats; and for a holistic viewer journey that maps from contact to purchase via cleanrooms.

In addition to conducting interviews with 100 companies across brands, agencies and streamers, Ampere performed a consumer-facing study of 8,000 internet users and found targeting through addressable TV has the opportunity to increase engagement, while also allowing advertisers to change their campaign depending on viewer response via AB tests and improve effectiveness.

According to Ampere, the vast majority of consumers admit to being distracted during ad breaks, with 37% saying they often leave the room and 34% talking to other people they’re watching TV with. And nearly half fast forward through commercials if they have the option. That said, addressable could help bring eyeballs back to the screen. Nearly 70% of viewers 18-34 said they were interested in seeing ads tailored to them. In the U.S. in particular there’s also a sizable interest in new formats or having ads displayed on companion apps while viewing and the ability to find out more about a product on a they see on TV on a second device. The report found that in the U.S. 61% of consumers were interested in ads on companion apps, 56% were interested in QR codes and 48% were interested in pause ads.

Embedded QR code-based ads help close sales attribution loops, but aren’t always a good fit, according to the report, particularly in emerging markets where a higher proportion of TV viewing is done on mobile apps rather than TV sets. In the U.S. players like Roku have been experimenting with QR codes including with partners DoorDash, and data sharing for ad targeting with Instacart and Best Buy.

And when it comes to challenges for addressable TV, Ampere found attribution and effectiveness were top of mind.

“A core challenge that addressable TV faces is simply that is often used by advertisers as a supplementary channel, supporting and complementing cross-media campaigns. As such, many brands find it challenging to precisely determine the impact that addressable TV brings,” wrote the report authors.

The report also found a “notable division” among brands and advertisers who were using addressable vs those that weren’t in terms of their perception of the cost of the method.

“Simply put, those experienced in the sector saw addressable TV as highly cost-effective, even ‘cheap’, compared to traditional TV advertising,” Ampere wrote. “Those that had merely dabbled judged based on headline CPMs.

While advertisers noted CPMs in North America for addressable TV were generally higher in than traditional TV, the report said for cost per result many advertisers thought addressable TV was highly cost effective and an important and growing part of their overall media mix as they tend to see clear and measurable ROI once leveraging the method.

“The extent to which addressable TV advertising is now being used by non-traditional TV advertisers, including smaller companies and B2B brands, is illustrative of how the medium can support TV service providers in their push to reach beyond traditional broadcast TV budgets and to open entirely new revenue streams,” said Richard Broughton, executive director at Ampere Analysis, in a statement. “But it’s clear that there is still work to be done by the industry in challenging entrenched opinions and in countering common misconceptions.”