The NFL regular season kicks off this Thursday and separate reports from iSpot and EDO show that game coverage of the professional football league continues to be a dominate play for TV advertisers – including brands aligning with streaming-exclusive games.

Before getting to streaming, let’s take a look at some key findings from iSpot’s new Q3 NFL Sports Report and EDO’s 2025 NFL TV Outcomes Report that show just how big (and effective) NFL advertising was across television for the prior season.

Per iSpot, in 2024, the NFL programming was No. 1 across all types by ad impressions, delivering 3.28% of all household TV ad impressions. Looking at the Big 4 broadcast networks, during the 2024-25 regular season and playoffs the NFL accounted for 23.22% of all ad impressions across ABC, CBS, Fox and NBC – more than 2x the next-best program.

And it rakes in ad spending to capture those impressions, with NFL games accounting for an estimated $6.76 billion in national linear ad spend across the Big 4 broadcast networks, totaling more than 11,000 ad minutes and close to 30,000 ad airings.

EDO, meanwhile, estimates the NFL generates $5.2 billion per year in national TV advertising. The 2024 regular season had a total of 550 advertisers, with an estimated spend of $3.9 billion, delivering an estimated 186 billion impressions.

And advertisers spend on what’s seen as TV’s most premium ad inventory, the league delivers when it comes to driving impact and engagement, such as branded search to site visits.

Illustrating the effectiveness, EDO proclaimed “the NFL remains convergent TV’s crown jewel” as it found advertisers would need to air about 23 ads on broadcast and cable TV to generate the same impact as one ad run during the 2024 regular NFL season.

Per EDO, during last year’s regular season, ads run against NFL games were 19% more effective than the primetime TV average, increasing to 63% more effective for those aired during the first three rounds of 2025 playoffs (propelling the number of ads a brand would have air against typical TV programming to get the equivalent to 109), and soaring to 243% more effective during the Super Bowl (which skyrockets the number of regular TV program ads needed to achieve an equivalent impact to 1,056).

Exclusive streaming games drive ad engagement

Last season saw streaming-exclusive NFL games, where ads run scored points for consumer engagement.

Per EDO, streaming-exclusive NFL games delivered 66% stronger ad effectiveness than the broadcast and cable TV average.

Some exclusive games seen last year include Amazon’s Black Friday game, Peacock’s Week 1 Brazil broadcast and Netflix’s exclusive Christmas Day game live streams – all of which over performed.

Specifically, ads that aired during the Peacock-exclusive live game last season were 116% more effective at driving consumer engagement than those during the average broadcast and cable primetime program. Aired September 7, 2024, from Brazil with a matchup between the Green Bay Packers and Philadelphia Eagles, the live streamed game’s ads were 78% more likely to generate consumer engagement than those during the average NFL broadcast.

Peacock has another exclusive game teed up this season in Week 17 and will have plenty of other football action as the SVOD this year offers simulcasts (or simulstreams) of all NFL games on NBC – including the NFL regular season Kickoff this Thursday, September 4 between the Cowboys and Eagles, and Super Bowl LX in February.

Separately, iSpot data shows that ads aired against NFL games have proven particularly effective for food delivery services. It’s a finding that could bode well for Peacock user feature and ad options that it introduced in recent years – namely Virtual Concessions. It’s a feature aimed at QSR brands and other advertisers, like last-mile delivery services, to serve up interactive ad units that prompt users with QR codes so viewers can order food and beverages as they settle in for a big game. First introduced ahead of the 2024 Olympics, Virtual Concessions expanded on Peacock last year for live sports and other tentpole programming around the Thanksgiving holiday.

While not streaming-focused, iSpot’s report showed that ads aired on Fox delivered a 30% average seven-day brand lift for food delivery services, noting that can translate to immediate sales, “with many viewers using food delivery services while watching football action each week.”

Netflix’s first Christmas Day NFL games, meanwhile, delivered for brands in the Entertainment and Pharma categories, according to EDO. Ads run against those games were 84% and 70% more effective, respectively, than the same categories’ ads during competitive 2024 NFL games, EDO’s report found.

And we can’t forget about Amazon Prime Video, which last year streamed its second exclusive Black Friday game. Per EDO, ads during the Black Friday matchup were 51% more effective than the average ad during Thanksgiving NFL games. Amazon also previously disclosed internal data that it said pointed to a 10% uptick with interactive ads on its Black Friday NFL game compared to 2023’s debut edition.

But of course Prime Video has more than one exclusive game. In 2025 the streamer added a Wild Card Playoff game in addition to previously secured rights for Thursday Night Football.

Prime Video-only NFL advertisers

Interesting, while plenty of advertisers appeared during NFL games across traditional linear TV and streaming broadcasts last season, iSpot’s report shows some brands kept it strictly streaming – and on Prime Video only to be specific.

Per iSpot, 62 NFL advertisers only appeared during Amazon Prime Video games during the 2024-25 regular season, although some later expanded from Amazon-only to playoff and Super Bowl spots as well.

Amazon-owned brands like Amazon Music, Fire TV and others, were, perhaps surprisingly, among those that kept ads to Prime Video, but several big unaffiliated brands also tapped the platform for NFL game spots.

According to iSpot, brands that leveraged Prime Video-only for NFL used the platform in multiple ways, such as local targeting or zeroing in on younger-skewing demographics. Additionally, some used Amazon mix of ad and retail capabilities to create direct calls to action – and more specifically purchase – via QR codes and other interactive elements.

“Amazon also provided opportunities for potentially smaller brands that wouldn’t otherwise be able to appear during NFL games,” iSpot’s report stated.

Here’s a snapshot of the Prime Video-only NFL brand advertisers for the 2024-25 regular season.

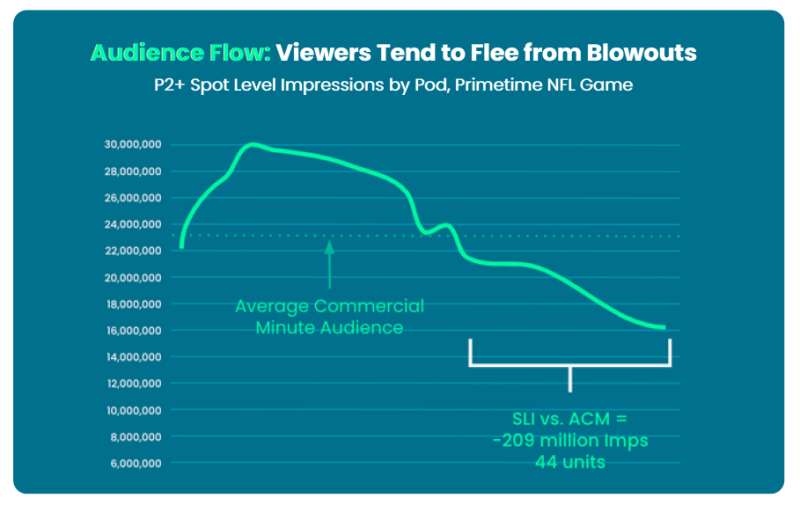

Competitive gameplay matters as viewers tune out to NFL blowouts and late-game ads

One thing to keep in mind, no matter where the game is airing, how competitive the action is crucial to audience as viewers tend to tune out to game coverage (and late-game ads) if the matchup is a blowout.

iSpot used one primetime game as an example, during which 18 brands only rans ads from pod 14 through the final whistle – and ads that appeared during those pods saw impressions fall “dramatically short of the game’s Average Commercial Minute Audience” – by an aggregate of 209 million impressions.

Given the huge delta between spot-level impressions and Average Commercial Minute Audience of the NFL’s 2nd most active advertiser, iSpot examined drivers at play and determined “pod placement was unequivocally the primary issue driving the difference” between the two metrics.

“While there’s a chance audiences grow during a close and exciting game late, there’s also significant risk in blowouts shedding audience (and reducing reach, despite what you pay for upfront),” iSpot wrote in its report. Reduced exposure can also reduce the opportunity for outcomes, – which the measurement provider said is particularly problematic during NFL games as they have high conversion rates and more scale than other programming.

Still, the pro sports league continues to deliver for advertisers.

"In conversations with CMOs and media directors, I've arrived at an undeniable conclusion: the NFL remains the ultimate platform for brand engagement at scale,” said Laura Grover, SVP, Head of Client Solutions, EDO, in a statement. “For brands seeking measurable TV outcomes, no other media property comes close.”

And with even more key NFL coverage poised to be available on streaming this season with both Fox and Disney’s ESPN debuting new respective direct-to-consumer services, it’s game on for platforms and advertisers alike.