The annual TV upfronts — held each May and marking the unofficial start of the broader upfronts season, which typically runs from mid-May through August — are essential in shaping advertising strategies and setting the tone for ad spending in the upcoming year.

This year’s hosts included NBCUniversal, Fox, Disney, Warner Bros. Discovery, Netflix, YouTube, and Amazon, a relative newcomer, now in its second year of presenting.

Across the board, presentations made one thing clear: the dynamics of ad spending are shifting—driven by changing viewing habits, rapid innovation in emerging technologies, and the rising dominance of ad-supported streaming models.

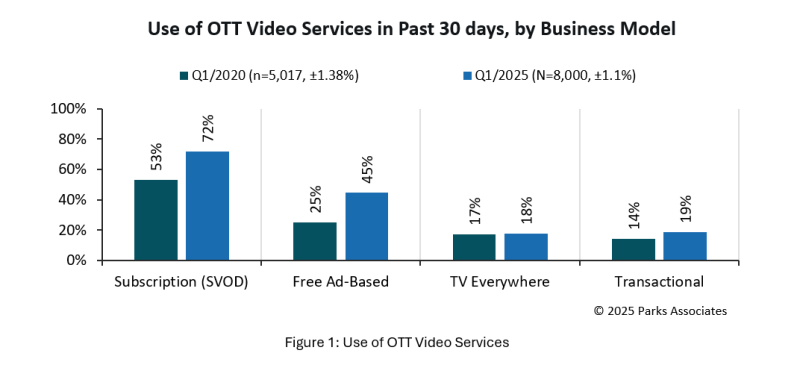

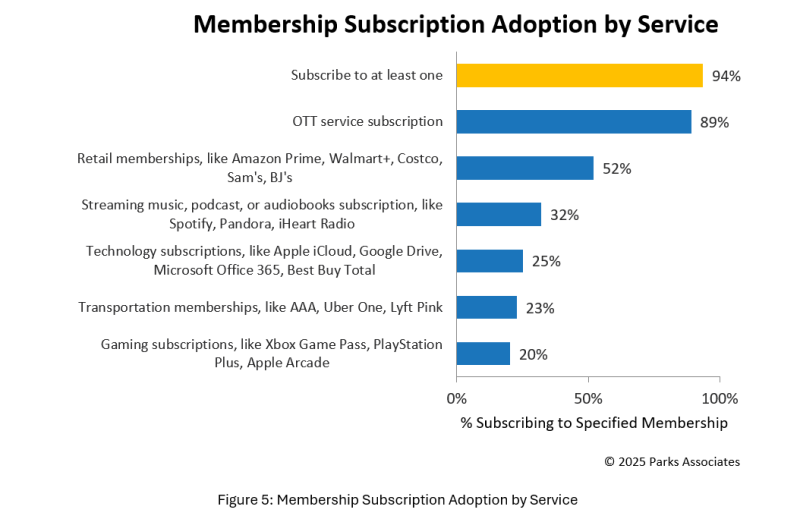

Parks Associates research shows that the streaming stack has been flat for several years, with streaming video subscription plateauing at 89% of US households and each streaming household subscribing to ~5.7 paid streaming services. Consumers are facing rising cost of living across all categories. This has led to are cutting higher priced services, typically pay TV, and moving to cheaper ad-supported plans to afford multiple SVOD services. The use of FAST and AVOD services grew by 6 points YoY, reaching 47% of US households in Q1 2025, as the number of these services available to consumers expands.

Growing Appeal of Ad-Supported Streaming

Ad-supported streaming is now a key component of the growth strategy for nearly every major platform. Netflix, Amazon, Disney, NBC, Fox, and more hosted high energy events featuring entertainment, data, and sneak peeks at fall and spring programming introduced by celebrities, media personalities, and well-known sports executives, all in hopes of winning over advertisers and media buyers. The services spotlighted the growing impact of their ad-based tiers — not just as budget-friendly alternatives for consumers, but as core revenue drivers.

- Netflix: Over 40% of new sign-ups in markets with an ad tier are choosing the ad-supported plan, double the percentage from a year ago.

- Disney: Disney+ gained a 65% year-over-year increase in ad-tier subscribers, and 90% of Hulu’s 50M+ subscribers are on an ad-supported plan.

- Amazon: Ad-supported monthly reach in the US has expanded to an audience of over 300 million across its owned and operated platforms, including Prime Video, Twitch, and Amazon Music, up from the 200M reported during Amazon’s inaugural 2024 upfronts. Also, 115 million global Prime Video viewers are now watching ad-supported content, following the rollout of its ads initiative earlier this year.

- Peacock: Ad-supported users now account for the majority of total viewing time.

- Paramount+: 60% of its new US subscribers in Q1 2025 chose the ad-supported Essential tier.

- Warner Bros. Discovery's Max: Its ad-supported tier now represents nearly half of its domestic subscriber base.

As the new economic reality of a higher cost of living settles in, consumers are constantly looking for ways to cut costs across every category. Parks Associates finds that 61% of households who churned from a streaming service in the past year said they were spending too much on streaming. With subscriber growth plateauing and pay-TV viewing declining, ad-supported business models allow platforms to attract price-sensitive viewers while unlocking new monetization streams — for themselves and for advertisers. For advertisers, this means access to engaging, broadcast-style environments combined with the targeting precision of digital.

That’s why this year’s upfronts felt both significant and urgent for streaming services. The market is saturated. Competition is intense. The economic future is uncertain. But executives and key stakeholders communicated a clear sense of determination through a mix of briefings, showcases, and presentations. Each one aimed at demonstrating how their streaming platforms can grow, innovate, and drive profitability — even in these challenging conditions.

Upfronts Themes and Takeaways

Content Is Still King

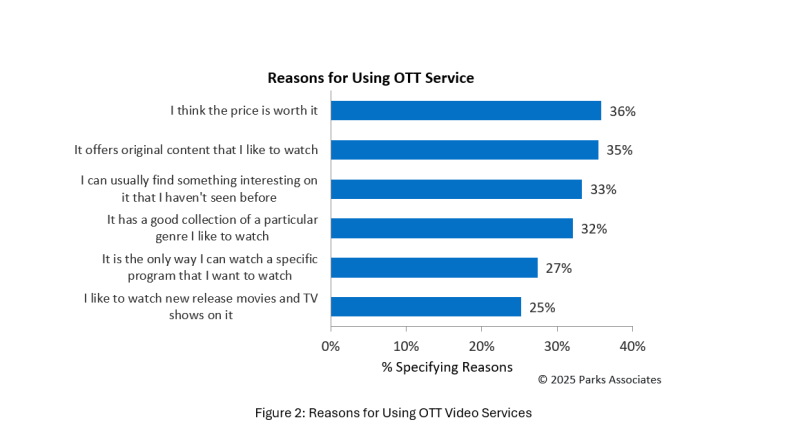

Even with the excitement of AI innovation, ad tech advancements, and platform expansions, one thing was clear at this year’s upfronts: content is the heart of video services. It’s what attracts subscribers, holds their attention, and ultimately drives the kind of engagement advertisers are willing to pay for. At 36% and 35% respectively, price and original content remain the top factors consumers consider when deciding whether to use or keep a streaming service.

Streaming services continually reminded upfronts audiences that they don’t just offer a wide range of content, but that their programming is premium and highly appealing.

Streaming Leaders’ Content Highlights:

- Netflix highlighted its expanding library of originals, including additional seasons of Bridgerton and a new comedy from Dan Levy.

- Amazon leaned into successes like Fallout and the upcoming Marvel-inspired Spider-Noir.

- Max (now “HBO Max” again) announced upcoming seasons of The White Lotus and The Last of Us.

- Disney and Hulu spotlighted the continued growth of the Marvel and FX universes.

- Peacock emphasized its mix of original storytelling and major live event coverage, including Sunday Night Football and 50 NBA games exclusive to Peacock.

Across the board, a key takeaway was that content isn’t just what fuels the platform. It’s ultimately the main feature that sells it.

It was also clear that star power, both on screen and on the upfronts stage, continues to be a key part of that content strategy. From Dan Levy and Laurie Metcalf appearing for Netflix to Lizzo, Jason Momoa, and Dave Bautista opening Amazon's event, streaming services are leaning on popular personalities to attract both viewers and advertisers. Celebrities have proven their ability to make both programming and platforms more appealing to audiences and more valuable to advertisers.

Return to Franchises

A major thread running through the 2025 upfronts was the return to, and expansion of, familiar franchises and stories. Streamers are increasingly betting on established IP to maximize the return on their content investments. It’s a lower-risk, high-reward strategy. Marketing becomes an easier lift when a franchise has already done the hard work of building an audience; the focus can then shift toward maximizing monetization through merchandise, brand partnerships, and growing audience loyalty.

The Paper, a new series set in The Office universe and premiering this fall, taps into existing fan nostalgia while introducing new characters to both keep longtime viewers engaged and attract a new generation of fans. HBO is expanding the Game of Thrones universe with projects like A Knight of the Seven Kingdoms, while Netflix is extending Stranger Things into both animated and prequel formats.

Next-Gen Ad Solutions Are Becoming Service Differentiators

Today’s advertisers want more and better metrics; they want interaction with customers through hyper personalization leading to revenue. Streaming platforms are competing using ad technologies and solutions as a way of delivering more measurable value.

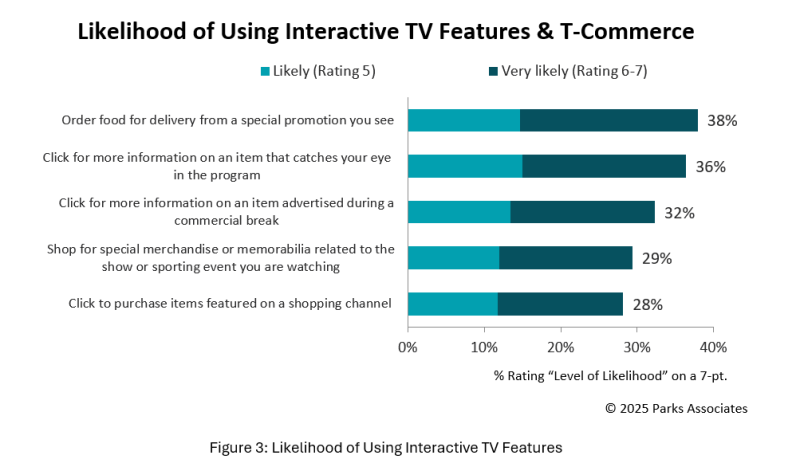

Interactive TV platforms are developing more robust ecommerce features, bridging the gap between brands and content. This shift will create new, dynamic experiences that are highly personalized, allowing viewers to shop directly from what they’re watching in real-time. AR/VR can take this even further, enhancing the ecommerce experience on interactive TV platforms. By incorporating augmented and virtual reality, viewers could virtually try on products, explore immersive brand experiences, or interact with 3D models of items—all while staying engaged with the content they're watching. This would add a whole new layer of interactivity and personalization, making shopping feel like part of the entertainment experience.

New ad formats are introducing dynamic, AI-powered experiences that integrate contextual data and real-time viewer behavior. These new experiences are designed to hold attention and prompt action in a way that traditional ad formats couldn’t achieve. Blending creative storytelling with smart ad tech enhances viewer engagement and also demonstrates an ability to deliver deeper value in real time.

Amazon Emphasizes the Entire Digital Experience

While big networks and streaming companies focused their presentations on upcoming content programming and ad innovations, Amazon executives positioned the company not just as streaming platforms, but as a powerhouse digital ecosystem. Their pitch wasn’t only about what consumers can watch, but also what they can shop, listen to, play, and buy without ever leaving the platform. With properties like Prime Video, Twitch, Amazon Music, and Wondery, the company aims to create a tightly connected entertainment and commerce cycle.

“No one else connects with these customers like we do,” said Tanner Elton, VP of U.S. Ad Sales at Amazon Ads. “From sunup to sundown — through the content they obsess over, the services that make their lives easier, and the products they want and need — these engagements are meaningful and represent unbelievable opportunities.”

Subscription services have redefined how consumers access music, games, health monitoring and care, delivery and transportation services, productivity tools, retail and shipping discounts, and a long tail of other consumer and business services. Few if any companies can combine the kinds of content assets that Amazon, Apple, and Google have in their portfolios.

This strategy is about more than scale. It’s about stickiness. Amazon isn’t just competing with Netflix, Disney+, or other streaming services. It’s competing to embed itself across the consumer’s entire digital lifestyle. YouTube, part of Alphabet/Google, emphasized its expansive cultural reach, short-form creator economy, and AI-powered ad tech, positioning itself as the most agile platform for multi-format advertising.

While Apple did not host an official upfronts presentation, the company continues to expand its tightly integrated ecosystem across Apple TV+, music, podcasts, fitness, and hardware—all seamlessly tied together through subscription bundling.

For advertisers, the ecosystem approach is important. The more touchpoints a platform controls, the more data it can leverage, and the more seamless and personalized the consumer journey becomes. By positioning itself as a one-stop hub, Amazon offers advertisers not just customer reach but also the ability to track, target, and convert audiences at every stage of engagement.

Live Streaming Wars Continue

In 2025, live events are becoming the next battleground in the streaming wars. Sports remain the anchor, and every major streamer is making moves to secure live rights and test new formats. Parks Associates research finds 43% of consumers in US internet households report watching live sports or sports programs and highlights. Sports, whether live or highlights, is a core part of the viewing experience, particularly for men and those age 25 – 44.

Platforms are also investing in exclusive streams of major concerts (e.g., Taylor Swift and Beyoncé tours), political debates, and other milestone events designed to spark real-time engagement and social media buzz. For advertisers, live events offer something on-demand content can’t always deliver: scale, urgency, and attention. The 2025 Super Bowl saw 30-second ad slots hit a record $8 million each, proving that these unscripted live moments still have massive audience appeal.

However, delivering live content at scale still presents challenges for streaming services, especially those new to the format. Netflix’s early experience with live programming triggered issues like buffering, latency, and poorer video quality. As more viewers migrate from traditional broadcast to internet-based streaming, they expect a quality experience that matches or supersedes those delivered by traditional broadcasting networks. The pressure is on streaming platforms to fine tune their infrastructures and deliver live streaming experiences with as little friction as possible.

In the Quantified Consumer study Ad-Based Streaming: Consumer Demand & Engagement, Parks Associates quantifies the rise of ad-based streaming including both FAST and AVOD services. It analyzes why ad-based services are experiencing a surge in popularity, which services are the most popular, and household sentiment towards the ad-based experience.

Jennifer Kent is VP of Research at Parks Associates, where she manages the research department and Parks Associates' process for producing high-quality, relevant, and meaningful research. Jennifer also leads and advises on syndicated and custom research projects across all connected consumer verticals and guides questionnaire development for Parks Associates’ extensive consumer analytics survey program. Jennifer is a certified focus group moderator, with training from the Burke Institute.

Tam Williams is a contributing analyst at Parks Associates and serves as a resource primarily to the Marketing and Research Teams, contributing to press releases, content marketing, event speaker logistics, marketing research, and many other projects.

Parks Associates is a market research and consulting company and has extensive consumer and industry research on broadband, pay tv, streaming and connected home markets.

Industry Voices are opinion columns written by outside contributors—often industry experts or analysts—who are invited to the conversation by StreamTV Insider staff. They do not necessarily represent the opinions of StreamTV Insider.