Recent reports from Mediaocean and PwC paint a picture of continued growth for US connected TV advertising, where marketers are beginning to see it as more of a full-funnel channel that can drive performance - although findings suggest challenges around measurement and fragmentation persist.

In addition, recently released surveys, including from IAB, show marketers and ad buyers are not only exploring but adopting the use of genAI for building ad creatives.

Continued advertising growth for CTV

Mediaocean last week released its 2025 H2 Market Report, surveying 464 marketers and agencies about trends and projected media investments.

Among respondents, 58% expect to increase media spend in CTV in the second half of 2025. That figure is slightly more than the 55% who said they planned to up CTV investment in the firm’s November 2024 survey. It’s also higher than the percentage that plan to increase spend across any other channel, including social video (for which 55% intend to do so).

With more than half planning to boost CTV investment, study author Karsten Weide, principal and chief analyst for W Media Research, wrote that “this reflects CTV’s unique ability to blend the emotional resonance of traditional TV with the precision of digital, making it a cornerstone for both brand building and performance-driven campaigns.”

And 32% of marketers expect to maintain current levels of ad spend on CTV, while only 10% plan to decrease. That compares to national TV, where more than half said they expect to maintain ad spend levels but 29% plan to decrease investment.

Separately, on Thursday, PwC released its 2025-2029 Global Entertainment, Media and Telecom Outlook, which shows US CTV in-stream advertising market grew by a whopping 29.3% year-on-year in 2024 to reach $17.6 billion – helped by events like the Olympics and Presidential election.

PwC forecasts CTV in-stream advertising to grow at a 5-year compound annual growth rate (CAGR) of 11.3% and hit $30 billion in 2029. That includes growth in 2025, with the firm projecting CTV in-stream advertising to reach $20.5 billion this year.

Social video currently leads the US video advertising market, but PwC noted growth for CTV, although it’s a more fractured space.

Unlike social video that’s largely comprised of a few major players like Meta, YouTube and TikTok, PwC noted the CTV space includes competition among online natives, big tech, premium TV and video providers as well as connected and smart TV-makers like Samsung, Roku and Vizio, among others - all vying for consumer attention and ad spend and contributing to market complexity for advertisers.

Marketers start to see CTV as full-funnel

Although fragmented, given CTV’s digital capabilities alongside the advent of new technologies, interactive ad formats, and retail media integrations, marketers are starting to see it as not only a top-funnel channel for brand awareness and reach but also a performance or full-funnel vehicle.

“With players like Amazon and Walmart becoming increasingly involved in the space, and the emergence of shoppable ad formats, the medium is starting to move further down the funnel from brand awareness to delivering outcomes,” wrote PwC in its more than 60-page report.

Samsung is one example of a CTV hardware-maker seeking to turn the channel into a driver of mid-funnel results for advertisers, including through its GameBreaks effort that offers branded, interactive mini-game ad formats.

Signs that marketers are seeking more from CTV were also evident in Mediaocean’s survey.

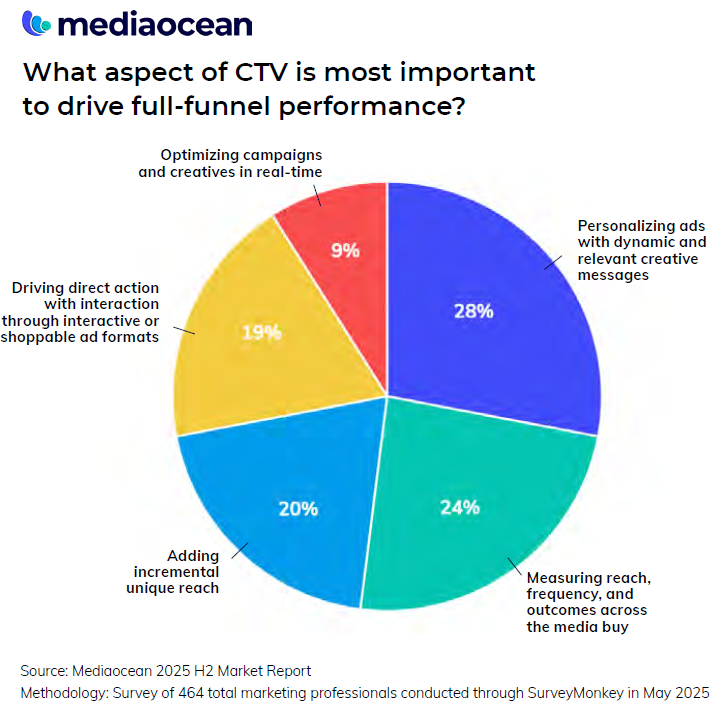

Asked what factors were most important to drive the next phase of CTV, dynamic ad personalization was marketers’ top-cited (28%) driver of CTV’s full-funnel performance, while measuring reach, frequency and outcomes remained key pillars (24%). And 19% cited direct action driven by engagement with interactive or shoppable ad formats as the key driver for full-funnel CTV performance.

Per Mediaocean, the emphasis on measurement and accountability aligns with metrics marketers value most in CTV and live sports campaigns, including conversions (45%) and reach (44%), followed closely by engagement time (39%) and impressions (38%).

“These results reflect a growing emphasis on achieving both performance outcomes and brand impact” from CTV, the report noted.

Fragmentation, measurement challenges persist

Still, while CTV holds promise to provide more and marketers keen to reap the benefits, challenges around measurement and CTV’s fragmented nature persist.

“Fragmentation is a key pain point, with more than half of marketers citing limited cross-channel visibility, fragmented measurement and data silos as persistent hurdles,” wrote MediaOcean study author Weide.

Similarly, PwC called out the need for improved outcomes measurement to support increased ad investment amid the siloed CTV and entertainment space.

“Fixing outcome measurement is essential to unlocking the full value of CTV advertising,” wrote PwC. “Prioritizing outcomes over impressions offers a way to address inconsistent measurement across the CTV space, where metrics and methodologies often vary between media providers. This is a critical piece of the puzzle that must be solved before advertisers can confidently go ‘all-in’ on CTV.”

The second half of IAB’s 2025 Digital Video Ad Spend & Strategy report also supports the need for CTV to focus on improved measurement and outcomes. It found that the No. 1 reason ad buyers reduce spend with a specific streaming partner is poor business outcome delivery.

Per IAB’s survey, campaign and placement-level KPIs are the most important data that digital video ad buyers need from ad sellers for measurement (cited by 55%), followed by basic data about content adjacent to ads (47%).

Marketers move beyond AI exploration for ad creatives

Another trend, likely unsurprisingly, top of mind and driving changes in both the CTV and advertising space is AI – particularly around ad creatives.

“Advances in GenAI are also opening up opportunities for the technology to be applied in the creation of video advertising, including CTV,” stated PwC’s report. “The hope is that this—combined with self-serve, programmatic buying platforms—will expand access to CTV by lowering production costs.”

Mediaocean and IAB’s reports, meanwhile, each indicate marketers and ad buyers are starting to mature a bit in terms of strategy and adoption of genAI.

Per Mediaocean, generative AI “has undeniably claimed the spotlight” – ranked as the top consumer trend for 72% of respondents, marking a clean sweep across all industry verticals and a 15% jump from late 2024.

While advertisers and marketers have been exploring AI use cases, MediaOcean said they’re now moving beyond to embed it into core functions, as data analysis (47%) and market research (46%) remained the main applications.

But creative use cases are also gaining traction, including for image generation and creative versioning (ie, generating multiple versions of the same ad based on different factors).

Asked how they’re using genAI in marketing, the answer of creative versioning made its debut in Mediaocean’s latest survey, at 27%. Image generation, meanwhile, ticked upward with a quarter of respondents now saying they’re using genAI for that use case.

MediaOcean’s report said shifts in how marketers are employing the technology signal that AI’s influence is steadily extending from back-end processes to front-end experiences.

The increased use of AI for ad creative also showed up in IAB’s report, which found 51% of ad buyers are currently using genAI for digital video ad creation (either built from scratch or enhanced). Another 34% plan to use it.

As for the ads themselves, IAB respondents said 30% of digital video ads are already being built with genAI. Buyers expect that figure to jump to just under 40% in 2026.

And complementing Mediaocean’s findings on the emergence of genAI for ad creative versioning, IAB found 42% of buyers using genAI to build multiple versions of video ads are doing so to create options for different audiences.

With the reason cited by over 40% of digital video ad buyers, “it’s clear that it's most important for them to get the right message to the right audience—likely because it offers the highest potential return,” wrote IAB. “It's also likely to be easier to measure, and thus demonstrate the value of the audience segmentation,” the report added.

The impact of genAI on ad creatives will continue to play out over the next year, but some expect more dramatic disruption than others.

When asked about the impact of AI on creative optimization over the next 12 months, 52% of Mediaocean’s respondents expect gradual change while 31% anticipate major disruption.

A previous version of this story incorrectly titled PwC's report "2024-2029 Global TMT Outlook". The report referenced is the firm's 2025-2029 Global Entertainment, Media & Telcom Outlook. This story has been updated to reflect that correction.